Wall Street Futures slid on hawkish Fed jawboning

On late Thursday and early Friday, Wall Street Futures slid, USD surged and oil slumped amid hawkish Fed jawboning, slowing China (amid an impending drought despite targeted stimulus and commitment of coming out from zero COVID policy), surging inflation in Europe, and synchronized global stagflation. Also lower than expected U.S. jobless claims dragged Wall Street as it will keep Fed on a faster tightening course for the rest of 2022. Earlier Wall Street got some boost on less hawkish FOMC minutes for July.

On Thursday, the SF Fed’s President Daly said:

· Core services inflation is still rising

· We don’t want unforced error; need to balance doing enough with not doing too much

· We do not want to overdo policy and find we’ve tightened the economy more than necessary

· The slower-growing global economy will push down on US growth

· If you look at how consumers are spending and getting jobs in large numbers, I don’t think we are in a self-fulfilling prophecy mode for a recession

· Some cooling of the labor market would be welcome

· The markets have a lack of understanding, but consumers do understand that rates will not fall right after they rise.

· The Fed may need to go higher than that, it depends on the data

· A hump-shaped path for rates is not what’s on my mind

· The raise and hold strategy does pay off

· We must bridle the economy a bit and slow the pace of inflation

· When we get closer to the meeting, we will make a decision on the September rate hike

· 50 or 75 BPS is reasonable for September

· We need to get a little above 3% by the year-end

· Food and energy prices are rising high, and housing is as well, there is a lot of work to do on inflation

· It is way too early to declare victory on inflation

· The worst thing you can have as a business or a consumer is to have rates go up and then come rapidly down— it just causes a lot of caution and uncertainty

· I do think we want to not have this idea that we’ll have this large hump-shaped rate path where we’ll ratchet up really rapidly this year and then cut aggressively next year – that’s not what’s on my mind

On Thursday, the Kanas City Fed President George said:

· Falling productivity makes the Fed’s task on inflation more difficult

· The rationale for rising interest rates remains compelling, but the timing will remain a point of debate

· I believe that economic growth will slow down

· The Fed will have to address the issue of demand

· Productivity levels are currently appalling

· There has been little relief in the labor market, with firms indicating that they are still under pressure to raise wages in order to hire

· There are some encouraging signs in terms of supply, with shipping rates dropping and delivery times improving

· Expectations for inflation appear to be very well anchored

· The United States still has a quite large mismatch between demand and supply

· So far, the relief in core inflation is hardly comforting

· Although inflation is high, it may be moderating

· Last month’s inflation figure was encouraging, but it’s not time to celebrate

· The easing of financial conditions may have been based on optimism that Fed would slow down, but does not reflect how Fed is thinking about policy

· The pace of rate change can have implications for households and businesses, policy has lags that must be watched

· Inflation expectations seem to be pretty well anchored

· No relief has yet been seen in the job market, with businesses reporting they are still under pressure to raise wages to hire

· Does not expect much further help on inflation from improvements in supply

· It is unclear where the Fed will stop raising interest rates, but the Fed will need to be fully convinced that inflation is declining

· To know where that stopping point is— we are going to have to be completely convinced that the inflation number is coming down

· The drop in inflation registered in July, while good news, did not evidence the underlying problem was fixed

· Much of the decline was related to energy costs, while prices for a broad set of other services and goods continued to increase-That is hardly comforting

· Recent abysmal productivity numbers, which imply that workers are producing less for each dollar they are paid, could make controlling inflation that much harder

On Thursday, the St. Louis Fed President Bullard said:

· I am leaning toward a 75 bps rate hike in September

· A 75 basis point rate hike next month could be a reasonable reaction to inflation and employment data

· Inflation is too high and it is too soon to declare that the inflationary rise has peaked

· It is premature to be concerned about the economy entering a slump

· It’s too soon to speculate about Fed rate cuts

· Growth in the second half of 2022 will be higher than in the first half

· It’s unclear whether financial conditions have improved

· The Fed still has to raise its target rate to 3.75%-4% by the end of the year

· Front-loading rate increases this year provide the Fed with options in 2023

· The Fed can reduce inflation over an 18-month period

· The Fed should not prolong the process of raising interest rates

· The job market is solid, and the outlook is promising

· The Fed has a long way to go before reining in inflation

· It is possible that unemployment will continue to fall

· Its possible unemployment may tick down a touch further from the 3.5% reading seen in the July data

· We should continue to move expeditiously to a level of the policy rate that will put significant downward pressure on inflation

· I don’t really see why you want to drag out interest rate increases into next year

On Thursday, Minneapolis Fed President Kashkari said:

· I’m not sure if the Fed can reduce inflation without causing a recession

· The economic fundamentals are sound

· I’m not sure if we can avoid a recession

· The Fed understands how to control inflation, but the question is whether we can do so without a recession

· The supply side is assisting us with inflation

· Domestic factors, especially fiscal policy, are likely to account for 1/3 of inflation

· Labor supply potential is now more or less fixed and we must reduce demand

· We must reduce inflation immediately

· The yield-curve control becomes quite complicated

· The real yield curve has not reversed

· The Fed has considered yield-curve control, but the benefits do not appear to exceed the drawbacks

· The economy’s overall supply potential is considerably smaller than we imagined

· The question right now is, can we bring inflation down without triggering a recession?—And my answer to that question is, I don’t know

On Friday, the Richmond Fed President Barkin said:

· The Fed will need to raise interest rates to restrictive levels but will rely on signals from the economy to determine how high those levels should be

· I anticipate that poor productivity results will improve as GDP and job creation are revised

· At this point, underlying demand appears to be stronger than it was at the previous Fed meeting

· There is still a lot of time before deciding on the extent of the September rate increase

· The recent drop in core inflation was largely due to volatile items

· The Fed is currently weighing the need to get rates where they need to go with uncertainty about the impact on the economy

· The July inflation report was better, we have some hope that it will continue to come down

· Recent data on the economy has been strong and the job market seems healthy as do core retail sales and industrial production

· The amount of money in overnight RRP means the Fed is nowhere near the edge of a balance sheet low point

· The Fed will do what it takes to return inflation to target, but it will not happen immediately

· There is a recession risk on the path to 2% inflation

· Returning to normalcy does not necessitate a calamitous decline in economic activity

· I expect inflation to fall, but it may bounce around

· We are beginning to see some precautionary softening in business investment

· The underlying activity metrics— look stronger than three weeks ago

· Though recent inflation readings showed some slowing in the pace of price increases, changes in prices for cars and apparel were very bouncy

· It’s all a balance between how much underlying strength is there still in the economy, and therefore pressure on prices, and how much of that pressure on prices is easing because of other changes in supply or commodity markets

· On the margin, I tilt toward getting there faster, by moving rates to the restrictive level that will be needed to cool demand and control prices

· But there’s still some question in my mind about how you balance that urge with the uncertainty about the underlying health of the economy in a world where our moves operate with a lag

On Thursday and Friday, Wall Street stumbled, USD surged, and Gold tumbled on hawkish Fed jawboning as contrary to earlier market perception, Fed will not pause at all in September, November and December; Fed will continue to hike @75 or 50 bps subject to inflation data.

On Thursday, all focus was also on U.S. jobless claims, which serves as a proxy for the unemployment trend/overall labor market conditions.

The U.S DOL flash data shows the number of Americans filing initial claims for unemployment benefits (UI-under insurance) fell to 250K in the week ending 13th August from 252K in the previous week, below market expectations of 265K.

The 4-week moving average of initial jobless claims, a better indicator to measure underlying data, as it removes week-to-week volatility, decreased to 246.75K on the week ended 13th August from 249.500K in the previous week.

The continuing jobless claims in the U.S., which measure unemployed people who have been receiving unemployment benefits for more than a week or filed unemployment benefits at least two weeks ago under UI, increased to 1437K in the week ending 6th August, from 1430K in the previous week, and below market expectations 1438K. The continuing jobless claim is also a proxy for the total number of people receiving payments from state unemployment programs; i.e. overall trend of unemployed persons.

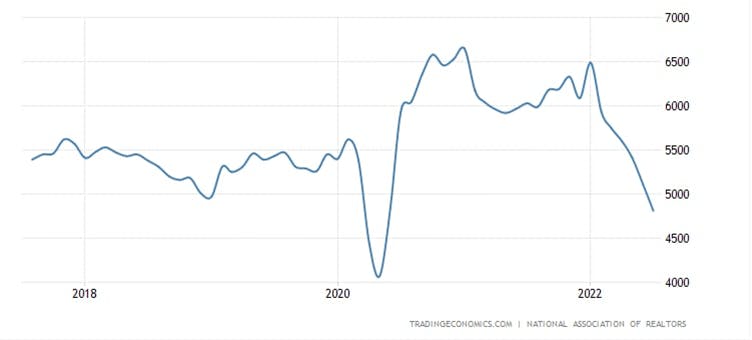

On Thursday, NAR (National Association of Realtors) data shows existing home sales in the U.S. declined 5.9% to a seasonally adjusted annual rate of 4.81 million in July, the lowest since May’20 and below market expectations of 4.89 million. Sales declined for a sixth consecutive month, reflecting the impact of the mortgage rate peak of 6% in early June. The median existing-home price for all housing types was $403,800, up 10.8% (y/y) from July’21, and total housing inventory increased 4.8% to 1,310,000 units. Single-family home sales declined 5.5% to 4.31 million and co-ops were down 9.1% to 500,000 units.

The NAR said:

« The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June. Home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers. We’re witnessing a housing recession in terms of declining home sales and home building. However, it’s not a recession in home prices. Inventory remains tight and prices continue to rise nationally with nearly 40% of homes still commanding the full list price.”

Conclusions:

Overall, July FOMC minutes and various Fed comments revealed that Fed is still quite concerned about elevated inflation, still substantially over Fed’s 2% target, but quite upbeat about U.S. economic activity and robust labor market despite some slowdown; i.e. Fed is still confident about a softish landing. Fed is also not ready to acknowledge even a technical recession of consecutive two-quarters of contraction. Fed is relying on a possible large positive revision for Q2CY22 GDP data. Thus Fed will continue with the faster tightening mode.

Fed also thinks that it’s not behind the inflation curve amid strong forward guidance in the past along with a current spate of faster tightening, the overall economy is slowing gradually, which will ultimately help to remove the present imbalance between elevated demand and constrained supply.

Looking ahead, Fed will continue to hike for the rest of 2022 (September, November, and December), but maybe with a slower pace @ +0.50% instead +0.75% (subject to actual inflation reading)-if inflation does not surprise the upside. From September, Fed will also increase the pace of QT, which will cause further tightening in financial conditions (higher bond yields/borrowing costs). Fed also acknowledged trajectory of inflation is dependent on non-monetary conditions such as Russia-Ukraine/NATO war/geopolitical tensions and subsequent economic sanctions, causing supply chain disruptions and higher inflations.

Ahead of Nov’22 U.S. mid-term election, expect cooler inflation and hotter employment data for a ‘Golden Recession’ narrative by the White House. Fed, on its part, will jawbone the market for a +75 bps hike in September to not only control inflation expectations but also to ensure a pre-election rally in Wall Street as Fed may eventually hike by +50 bps after jawboning for +75 bps, which will be seen as a less hawkish hike.