Thousands of women will receive letters stating they are owed £13,500 over state pension scandal

Around 200,000 women will receive letters to say they are owed an average £13,500 windfall due to state pension admin blunders dating back nearly 30 years.

Budget documents yesterday revealed that the scandal will cost the Department for Work and Pensions an estimated £3billion to rectify.

The sum owed to women, who were collossally short-changed, has emerged after a joint investigation by This is Money pensions columnist Steve Webb and journalist Tanya Jefferies, following a reader question to Steve’s weekly column a year ago.

A dedicated team of 155 civil servants is working through hundreds of thousands of files to trace every woman affected and pay them any money owed. But the laborious task could take six years.

The scandal relates to the failure to pay automatic increases to the state pensions of wives, widows and the over-80s.

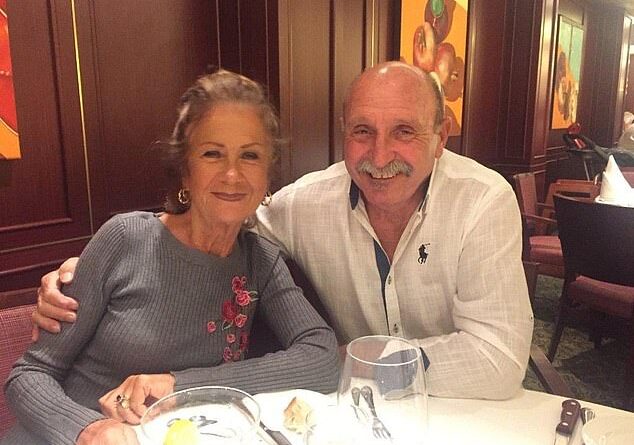

Great-grandmother Jean Hayes, 75, should have had her pension automatically increased from £60.72 a week to £77.45 when her husband Richard, 77, (pictured together) retired in 2008

Women who retired under the old state pension system before April 6, 2016, are entitled to claim a rate equivalent to 60 per cent of their husband’s basic state pension. The DWP was supposed to pay this automatically from March 2008.

Widows are also entitled to the same state pension their late husband received, and the over-80s should all be receiving at least a 60 per cent state pension.

The current basic state pension pay is £134.25 a week, so married women should be receiving at least £80.45 every week.

Around 200,000 women will receive letters to say they are owed an average £13,500 windfall due to state pension admin blunders dating back nearly 30 years. Budget documents yesterday revealed that the scandal will cost the Department for Work and Pensions (file image) an estimated £3billion to rectify

Lynda Hallaway, 74, had been receiving only £57 a week, despite her husband John, 73, reaching pension age in 2012. She now gets £80.45 and she has had a back payment of £9,160

Former pensions minister Sir Steve Webb last year estimated tens of thousands of women had missed out, but the true scale of the scandal emerged only last night.

A report from the Office for Budget Responsibility revealed the DWP would have to put aside £3billion over the next six years. It is understood around 200,000 women are owed £2.7billion in all – an average of £13,500 each.

The paper read: ‘DWP investigations between May and December 2020 uncovered a systematic underpayment of state pensions, meaning tens of thousands of married, divorced and widowed people may have been underpaid.’

It is understood the families of women who have since died will be paid what they were owed.

But arrears will not have any interest added. Sir Steve, now a partner at pensions consultancy Lane Clark & Peacock, said the scale of the scandal was ‘truly mind-numbing’.

He said: ‘When I first looked into this a year ago I had no idea it would explode into such a huge issue. It is truly shocking 200,000 women have been underpaid such huge sums.’ The first letters went out in January, and the DWP says it will contact all the women owed money.

One 96-year-old woman was deprived of £117k over 20 years while others such as Anne Psaros, 79, have been paid back more than £10,000 – around the average amount paid back to each woman by the DWP so far.

Great-grandmother Jean Hayes, 75, should have had her pension automatically increased from £60.72 a week to £77.45 when her husband Richard, 77, retired in 2008. It was only last year that the DWP admitted she had received a lower rate for 12 years and paid her £8,822.41 as a result.

Anne Psaros, 79, was handed £11,600 after realising that the DWP failed to upgrade her pension to the married woman’s rate when husband retired more than ten years ago

She said: ‘The Government has let down a generation of women with this issue.’

Lesley Pugh, 76, had her complaint against the DWP lodged with the ombudsman in December. She estimated she missed out on more than £20,000 because she did not know she could claim a pension based on her husband Tony’s record of National Insurance contributions.

The grandmother-of-two first collected a small state pension in 2006 before Tony, 78, was able to claim his in April 2007.

The couple, who have been married for 56 years and live near Folkestone, Kent, say they were never aware of the entitlement and do not remember seeing the claim forms.

Lesley said: ‘I got a pathetic amount of pension. It really riles me. It’s appalling. Obviously, if I had had a claim form like that, I would have acted on it.’

Lesley only realised she had been missing out when she heard Sir Steve talking about it on the radio in May. It then took six calls over two months to get her pension hiked from £41.46 to £85.32 a week.

Yet, while she missed out on a better pension for 13 years, the DWP could only backdate her claim a year, leaving her with £2,481.36.

Her husband Tony said: ‘It’s a victimisation against wives who raised their families and had no opportunity to go to work.’

Lesley says she escalated her complaint to the ombudsman because the DWP needs to make sure no other women miss out.

She says: ‘A lot of people of my age won’t be in a mental or physical state to do this and have the time and effort to get their complaint in. I do think the DWP are relying on time here, and hoping that we will all become so frail and out of energy that we won’t be able to do it.’

And she urged other women to fight back, adding: ‘I say: go for it. Do not get fobbed off. They aren’t going to do it for you.’

Meanwhile, Marion Stafford had her pension increased from around £49 a week to around £81 after reading the first story on the scandal in the Daily Mail in May. Yet she also fears she has lost out on more than £20,000 since her husband turned 65 in 2007.

Former pub landlady Marion, from Angmering, West Sussex, says many of her friends had heard nothing and missed out, too. She said: ‘I defy anyone in government to show where this information was readily available to the ordinary person.’

Her husband of 46 years, Ron, 76, adds: ‘If they had told us, we would have obviously claimed it.’

Ignored: Many wives may have missed out because the vital forms were sent to their husbands when it was time to claim (file image)

Malcolm Finnis, 81, is fighting for more than £5,000 after his wife found out that she could have had a better pension for 14 years.

Malcolm, from Eastbourne, has taken the case twice to tribunal but, in both cases, the judges ruled in the DWP’s favour.

He says: ‘We were prevented from claiming in 2004 because the DWP’s maladministration meant we did not get the forms.’

His wife, who does not want to be named, has only been able to claim back £782 for a year of missed payments.

Anne Psaros, 79, was delighted to be handed £11,600 after realising that the DWP had failed to upgrade her pension to the married woman’s rate when husband retired more than ten years ago.

Her pension has also gone up by £23.52 a week to £80.45.

Anne, of Poole, Dorset, contacted the DWP after husband Anthony, 76, read about the scandal in our report. ‘I am so chuffed that my husband read about it in the Mail. We could not get over our luck.’

Lynda Hallaway, 74, had been receiving only £57 a week — despite her husband John, 73, reaching pension age in 2012

The mother-of-two, from New Ellerby, near Hull, has seen her pension hiked to £80.45 and had a back payment of £9,160.

Lynda says: ‘I would encourage anyone who thinks her pension is being underpaid to get it checked.’

Jack Dromey, shadow minister for pensions, said: ‘The women concerned are the best of Britain. They deserve better than to be denied the money they worked so hard for all their lives to enjoy in retirement.’