FTSE 100 perks up but Wall Street seen mixed after strong jobs report

Everyone’s looking forward to the US non-farm payrolls report later, as the big market-moving event

- FTSE 100 up five points

- US jobs numbers beat expectations

- Wall Street heading for mixed start

The FTSE 100, having traded today in an extremely confined range, spiked slightly after US jobs numbers came in higher than expected.

Non-farm payrolls increased 943,000 in July, compared to the 870,000 consensus estimate from economists on Wall Street.

US unemployment also fell to 5.4% last month from 5.9% in June.

“The payroll number has beaten the drum a bit harder again and today we have a clear warning sign that excessive loose monetary policy is going to leave the town soon,” says market analyst Naeem Aslam at AvaTrade.

“The US NFP number has pushed the gold price sharply lower as traders believe that the fed will not maintain its current monetary stance—change is coming.”

Market reactions so far include a small spike for the US dollar index. The pound is down 0.2% against the greenback at 1.3900, which is a boost for the Footsie, which is up five points at 7125.

12.13pm: Mixed start predicted for US stocks

London’s blue-chip index is remaining less than one point in the green at 7,120.74, though a gain of just 3 points is anything but bullish, and this tentative position is mirrored across the Pond, where Wall Street futures are pointing to a similarly edgy start.

The Dow Jones and S&P 500 are set to open an uninpressive 0.07% and 0.04% higher, while the tech-powered Nasdaq is seen reversing 0.1%.

With the big US jobs report due shortly, most traders are understandably unwilling to make a big bet either way.

Reflecting the excitement among market analysts, Marshall Gittler at BDSwiss begins: “OK, gang – it’s NFP day! The markets are likely to be holding their collective breaths today until the fabled US nonfarm payrolls hit the wires.”

And although the NFP is the big number that everyone watches, he points out that the Federal Reserve when determining policy has “nearly limitless data available” about the US labour market, having said it wants to see “substantial further progress” toward their goal of “maximum employment” before they begin tapering down their bond purchases.

Gittler continues: “The NFP is far from the only number they would use to evaluate labor conditions. Nonetheless, it does seem to sum everything up for the market: is the number of jobs increasing, and if so, at how rapid a pace?”

The median of forecasts on Bloomberg is currently for payrolls to be up 858K, but with forecasts ranging from 350K to 1200K, he says the consensus would be “a good number but still a little disappointing” as it would show little improvement from June and would still be below the +916k added in March.

Over at ThinkMarkets, analyst Fawad Razaqzada suggests that if the NFP number trounces expectations, “we would favour looking for long dollar trades against low-yielding currencies such as the euro. But we would be cautious on stocks in the event of a big beat because it would increase the odds of an early taper of QE, something which the markets may not like – especially growth stocks.”

If it comes in line with the expectations, “we would look to trade long indices and other risk-sensitive currency pairs such as GBP/JPY on the long side” and if it NFP badly disappoints, “selling the dollar against the pound would make sense in this potential scenario. Looking for long setups in gold and silver would also be favoured by us”.

11.13am: Tiny gain

Nobody move, the FTSE has crept into a precarious positive position and we’re not 100% sure why.

It could be financial sector stocks leading the rebound, with life insurers Prudential PLC, Legal & General Group PLC and Aviva PLC near the top of the leaderboard, and the presence of debt-laden utilities BT Group PLC and Vodafone PLC implies this might be something to do with bond yields.

Several of these names have results out next week, as do Flutter Entertainment PLC and Entain PLC, which are also on the leaderboard.

There is an extra boost for these bookmaker groups with speculation re-emerging about bid interest from the US, with Entain, the owner of bookmakers Ladbroker and Coral, having rejected an US$11bn (£7.9bn) offer from MGM Resorts earlier this year.

The US casino giant, which partners Entain with an i-gaming joint venture Stateside, has raised $4.4bn of extra cash after selling a stake in a real estate company.

Talking of real estate, UK house prices as measured by Halifax rose a 0.4% month-on-month in July, which offers a more bullish contrast with the fall in Nationwide’s index.

It « offers some tentative, early, evidence that the housing market has not been seriously impeded by the tapering of the stamp duty holiday in June », says economist Martin Beck at the EY ITEM Club.

Annual growth slowed to a four-month low of 7.6%, but Beck said this partly reflected the strength of price growth last summer, as the market began to recover from the first lockdown.

« The full end of the stamp duty holiday in September will give a better idea of how important the tax concession has been in supporting the market. But demand for properties and house price growth may not tail off much. The economic consequences of the pandemic appear to have prompted an upward shift in house prices. Some of those consequences, such as government support to households and ultra-low interest rates, will fade. But others, such as increased demand for larger properties in a world of more home working, could prove long lasting.

« The outlook for prices faces some headwinds. On some metrics, affordability is looking increasingly stretched. And higher inflation and the risk of a rise in unemployment when the furlough scheme ends mean the outlook for growth in household incomes is not all positive. But the odds of a significant correction in the housing market anytime soon look small. »

9.57am: FTSE slips further

The big focus today is going to be the US jobs data later, but even though that’s all that market analysts are talking about, before then we have to find some other news.

In London, before everyone wakes Stateside, the Footsie is creeping lower, down 16 points to below 7105.

The FTSE 250 initially rose to a new all-time high of 23,526.78 but is now down 98 points or 0.4% to 23,408.

Bottom of the mid-cap fallers list are financial sector companies (Ashmore Group PLC, Network International Holdings, () Holdings PLC and ()), travel and leisure related names (SSP Group plc, (), easyJet PLC, () and ()).

Yesterday the leisure sector was one of the best performing after the government lifted some of the travel restrictions, including those against the extra quarantine requirements for travellers from France, which had lifted IAG, Whitbread and ().

“US non-farm payroll figures could put a bit of life in the markets later today, » said Russ Mould at AJ Bell, noting the consensus forecast is for 925,000 jobs to have been added in July and unemployment at 5.6%.

“A worse than expected figure might trigger a positive market reaction as it would suggest the economy is not overheating. Conversely a better-than-expected figure might trouble investors if it suggests the economy is racing ahead, which would stoke fears of interest rate hikes happening sooner than currently guided by the US Federal Reserve. »

With the markets now entering the summer lull, Mould said investors will be taking stock of their year-to-date performance and creating a game plan for the autumn, with US stocks continuing to be the place where a lot of UK investors are making money.

“Joe Biden’s $1 trillion infrastructure plan will provide impetus, together with the fact that businesses and consumers are busy spending, all creating a tailwind for economic growth. Equally there is also a headwind in the form of inflationary pressures which is starting to eat into corporate profit margins. For now, investors seem happy to stick with the US market in the search for investment returns, » Mould said.

He said UK shares have done remarkably well relative to the performance in the past decade, with the FTSE 250 the star performer, up 14.1% so far this year, helped by a swathe of takeover activity, while the FTSE 100 has lagged its smaller sibling but still delivered an 8.2% gain that is slightly better than the historical annual returns seen from the market.

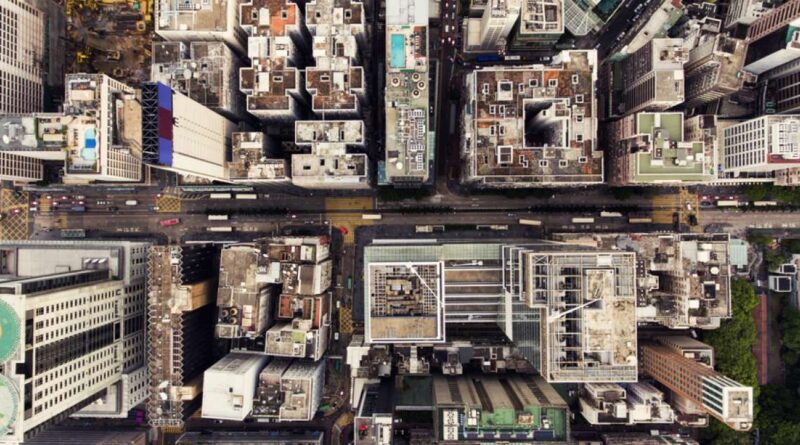

“Asia has been the laggard, with a regulatory clampdown in China putting investors off the region. Hong Kong’s Hang Seng index has fallen 4.6% so far this year, and China’s SSE index is down 1.3%, » he added.

“Japan’s Nikkei 225 index has bucked the negative trend in Asia with a 2.1% gain since the start of January, but hardly a reason to celebrate. The IMF recently downgraded its 2021 economic forecast for Japan as it struggles to deal with Covid. It now expects 2.8% growth this year, the weakest of all the advanced economies.”

8.38: Lower start

The FTSE 100 has continued in the same vein for the second day in a row by starting marginally lower on Friday.

However, London’s main share index has dropped just under nine points to 7112, extending its incremental losses having finished yesterday three points down.

Commodities stocks are the main weight on its neck, led by precious metals miner () falling more than 2% as gold struggles under pressure from the recent rebound in the US 10-year yield.

With more detail on the yellow metal is Alexey Kirienko of fintech Exante, who says: “Gold has consistently run into resistance each time it has attempted a breakout. Traders seem happy to keep fading the rips in gold because of a stronger dollar and lack of demand for safety as global indices continue to trade at all-time highs.

“Soon, stocks will correct themselves and we may see increased haven flows into gold and silver as a result. For now, low bond yields are helping to keep precious metals’ downside risks contained. Gold bulls will be hoping to see some soft numbers from the jobs sector, later.”

Leisure and retail shares are also prominent in the blue chip fallers, including British Airways owner IAG, Kingfisher, Next and JS Sports.

Top of the leaderboard is () after an upbeat set of half-year results, including good news on cost-cutting efforts from its acquisition of Refinitiv.

6.40am: FTSE wait-and-see

To the surprise of few people, traders are in wait and see mode ahead of this afternoon July US jobs report.

The FTSE 100 is expected to open practically unchanged.

“There has been plenty of speculation about the importance of today’s jobs report in terms of the timing of a possible tapering of asset purchases, as well as when to expect a possible rate hike, whether it be early 2023, or late 2022,” said CMC’s Michael Hewson, setting the scene.

“The reality is, whatever today’s number is, the picture is unlikely to be any clearer after the numbers drop, than it is now, which means this month’s Jackson Hole symposium probably won’t offer investors the steer on monetary policy they hope it will.

“This is because no one on the FOMC really has any idea what the US economy will look like a month from now, let alone a year from now,” he suggested.

Economists have pencilled in a figure of 870,000 after the US economy added 850,000 jobs in June, with the unemployment rate expected to ease to 5.7% from 5.9%.

US markets had a good session yesterday with the Dow Jones jumping 272 points to 35,064 and the S&P 500 advancing 26 points to 4,429.

Asian markets this morning have been more equivocal; Tokyo’s Nikkei 225 is up 77 points at 27,805 but Hong Kong’s Hang Seng index is off 11 points at 26,193.

In the UK, results from the () are expected to be the main event early doors.

After a strong time for new listings in the past year, the initial public offerings pipeline is continuing to channel new companies onto the market in 2021, while the Refintiv addition has strengthened the group’s revenue streams into data, trading tools, analytics and risk management across financial markets.

“The shares remain a show-me story as we think it will take some time for the market to give the company credit for the acquisition-related earnings growth and cash flow generation in the coming three-five years,” said UBS.

Around the markets

- Sterling: US$1.3922, down 0.05 cents

- Gilt: US$0.528%, up 94 basis points

- Gold: US$1,802.20 an ounce, down US$6.70

- Brent crude: US$71.38 a barrel, up 9 cents

- Bitcoin: US$40,285, down US$623

6.50am: Early Markets – Asia / Australia

Stocks in the Asia-Pacific region were mixed on Friday as the Reserve Bank of India (RBI) kept interest rates unchanged, a decision that was largely in line with expectations of economists in a Reuters poll.

The repo rate, the key lending rate at which the RBI lends to commercial banks, remains unchanged at 4%.

The Shanghai Composite in China fell 0.36% while Hong Kong’s Hang Seng index gained 0.04%

In Japan, the Nikkei 225 rose 0.33% but South Korea’s Kospi dipped 0.20%.

Shares in Australia lifted, with the S&P/ASX 200 trading 0.36% higher.