Meta Stock: Is Mark Zuckerberg The Next Warren Buffett? (NASDAQ:FB)

Kevin Dietsch/Getty Images News

Investment Thesis

Meta (FB) reported a mixed quarter, beating top-line revenue expectations but with weaker than expected earnings and an underwhelming 2022 guide. As a result, the stock traded down over $240B in market cap, the largest market cap decline in one day. The company grew quarterly revenues by 20% year-over-year but only guided for between 3-11% growth for the first quarter of 2022 which has set Meta’s stock down over 30% since its earnings call.

In the short term, Meta’s core business faces competition and challenges due to iOS impact, but in this note, I will illustrate why Meta, led by its visionary founder, is poised to overcome these headwinds. Meta’s Family of Apps division is still extremely strong, with over 3.5B monthly active users. Meta still has a walled garden moat around its social media platforms, while it’s significantly investing in AI as well as augmented/ virtual reality to ensure its platform remains an attractive outlet for advertisers.

Zuckerberg created Facebook and was vital in pioneering the most dominant social media platforms of the internet and then mobile phones. Meta, by the way of Facebook, What’s App, and Instagram, has the most extensive network of social media platforms across the globe. Facebook changed its name to Meta because Zuckerberg realizes the next chapter of the company will be in the metaverse, where it can have a more meaningful impact on society and continue to innovate how society communicates through new types of platforms. Facebook started by building different social media platforms on the internet, then bringing those platforms to mobile phones, and along the way, Meta’s evolved its apps to feature Stories and now Reels (short videos comparable to TikTok). The company’s investing its profits from this segment in AI and the metaverse to capitalize on the opportunity to leverage its massive user base as it looks to democratize communication platforms enabled by VR and AR, in the same way it did for the internet.

Meta’s Family of Apps Aren’t Going Away

Meta’s family of apps remains one of the largest advertising platforms on Earth with billions of users.

Meta Investor Relations

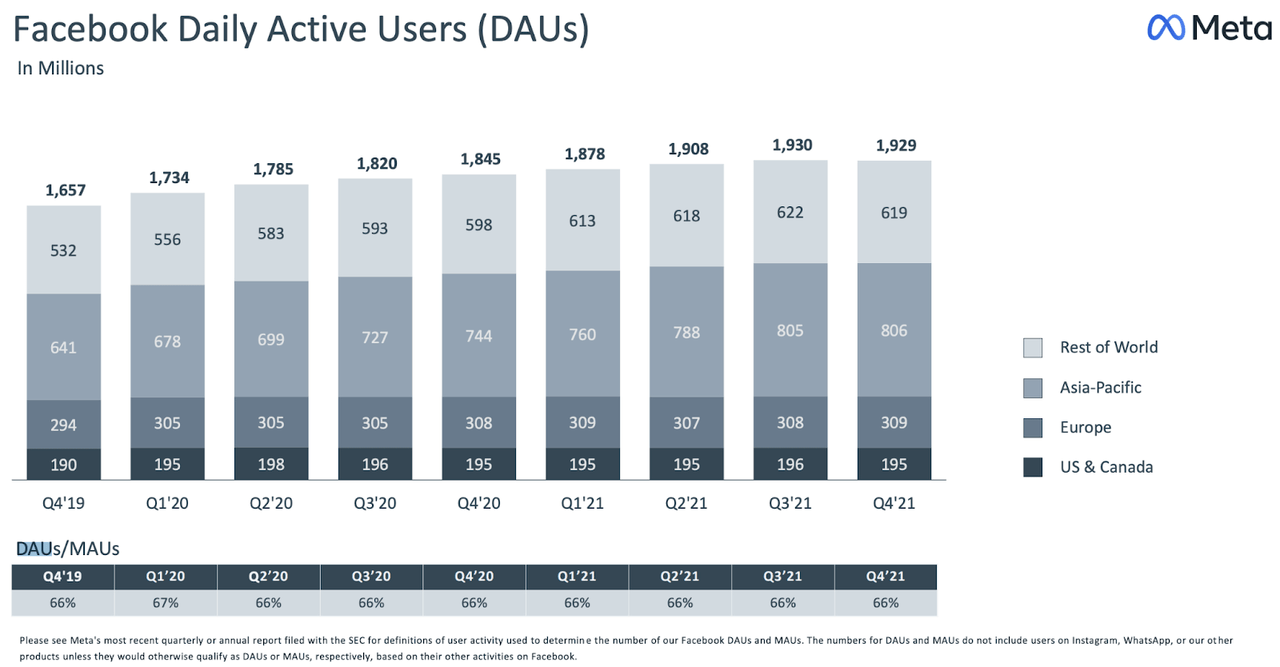

For the first time ever, Facebook reported that it saw a sequential decrease in daily active users. Facebook’s Daily and Monthly Active Users were up 5% and 4% respectively. Facebook is still a social media giant and user growth over the last decade is incredible when considering the platform’s global scale. Facebook still saw a slight increase in monthly active users while Family Daily and Monthly Active Users slightly were still up.

Meta Investor Relations Meta Investor Relations

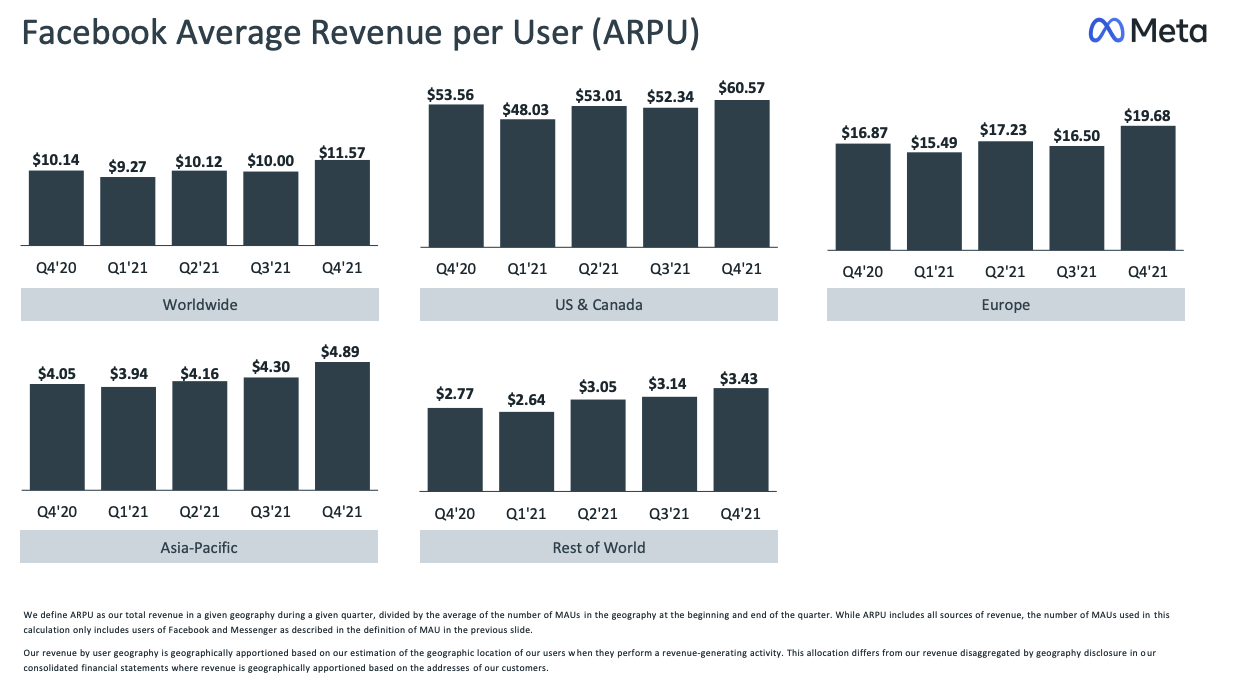

When removing the countries that are banned from Facebook, 53% of the internet users are daily Facebook users while ~80% are monthly users. Facebook, as well as Instagram and What’s App, are not going anywhere, while Meta continues to generate strong ARPU, especially in the U.S. and Canada.

Building For Web3.0

When it comes to Web3.0, it’s unclear how many of the converging technologies will blend together to result in new technology and innovation, but it’s clear that data will play a large role and the metaverse which will weave together many technologies to create superior methods of communicating and interacting with one and another. When it comes to data, Meta’s Family of Apps has a lot of users, which feed its machine learning and risk modeling engines.

In order to go and build an AI system that proactively identifies harmful content, it takes multiple years while Meta’s ramped up its investments in AI over the past five years. Meta tracks more than 20 types of harmful behaviors ranging from terrorism to child exploitation, to incitement of violence, which are difficult to identify and need specific systems in place to identify harmful content. Meta is uniquely positioned to develop an AI system because of its 2.82 billion daily active users, which feed Meta’s AI with valuable data which enable them to learn how to detect harmful content, as well as help advertisers.

In the past, Facebook developed an algorithm that enabled them to identify its users’ top personality traits which proved extremely valuable to advertisers. The new changes to Apple’s iOS and stricter regulation around privacy create headwinds for Meta as it’s challenged with creating new advertising « engines » that abide by the new iOS rules. Meta needs to update its « mousetrap », which was engineered to utilize the information available within the iOS operating system and make it easy for advertisers to target specific groups of users. The recent iOS update (which started with a release of iOS 14.5) now asks for users’ permission before an application can share data with other third-party applications. As a result, Meta needs to update and improve its advertising models to overcome the newly introduced barriers to using third-party data to drive personalized advertisements.

Meta is investing significantly in AI and machine learning to overcome the challenges of iOS changes, while Meta recognizes the need to overcome these engagement issues as TikTok is a growing competitor, albeit lacks the massive network effects and scale of Meta.

Below is management’s take from the earnings call on the transition to Reels and the mitigation to the new iOS.

The big similarity is that this is certainly not the first time that we’ve gone through a major format evolution. And what these transitions all had in common from Desktop Feed to Mobile Feed, Feed to Stories, and now to Reels in the beginning, our ad system and business are not as tuned for the new format.

So as the engagement of the new thing starts to replace some of the engagement and the old thing, it creates a near-term headwind for revenue, but it’s not that part – at this point now, is not that big of a concern for us. I mean it makes some of the stuff not as clear in the near term, but over the long-term, we’re pretty optimistic about that.

The dynamic that I think is actually a little bit different with Reels than what we’ve seen with Stories and Mobile Feed in the past. And with Reels, I would say that the teams are executing quite well, and the product is growing very, very quickly. The thing that is somewhat unique here is that TikTok is so big as a competitor already and also continues to grow at quite a faster rate off of a very large base. And so that – to the question that was asked before around are we like – that was asked before around, is there anything that’s going to make it so that we – it takes us longer to kind of get to where we want on this, is that even though we’re compounding extremely quickly, that’s – we also have a competitor that is compounding at a pretty quick rate, too.

But overall, back to the question, Reels, it’s extremely engaging. I think overall engagement will grow as a part of this. And that’s why we’re optimistic about the future, but there’s a lot of work to do here. » – Mark Zuckerberg

So when we talked about mitigation, we’ve said there are 2 key challenges from the iOS changes: targeting and measuring performance. On targeting, it’s very much a multiyear development journey to rebuild our ads optimization systems to drive performance while we’re using less data. And as part of this effort, we’re investing in automation to enable advertisers to leverage machine learning to find the right audience with less effort and reduce reliance on targeting. That’s going to be a longer-term effort.

On measurement, there were 2 key areas within measurement, which were impacted as a result of Apple’s iOS changes. And I talked about this on the call last quarter as you referenced. The first is the underreporting gap. And what’s happening here is that advertisers worry they’re not getting the ROI they’re actually getting. On this part, we’ve made real progress on that underreporting gap since last quarter, and we believe we’ll continue to make more progress in the years ahead. I do want to caution that it’s easier to address this with large campaigns and harder with small campaigns, which means that part will take longer, and it also means that Apple’s changes continue to hurt small businesses more.

The second area underneath the measurement challenge is really – are really data delays. As part of the iOS changes, we and many other ad platforms, we receive less granular conversion data on a delayed basis. And what advertisers shared with us that this makes real-time decision-making, especially difficult, and that’s particularly important during the holiday period, where people are often spending a lot and really monitoring their ads and adjusting spend not even on a daily basis, but often on an hourly basis. » – Sheryl Sandberg, Meta COO

The excerpt from Meta’s earnings call above speaks to both the threat of TikTok and the privacy changes within iOS. As Zuckerberg mentioned in the quote above, throughout Meta’s history, it’s been forced to pivot and evolve its platform whether to mobile devices or Stories. Meta’s advertising models aren’t as effective as the old models when it comes to Reels and the iOS changes, which is why Meta is essentially rejuvenating its advertising engine to cater to the new systems and protocols when it comes to third parties sharing data on mobile devices. As a result, Zuckerberg expects that Meta will overcome these headwinds as Meta’s ad system evolves to accommodate the data available within the new system. In the past, it took Meta years to ultimately develop the ideal ad system for large and small businesses, while there’s no doubt that the company intends to develop a new « ad system » which offers the same value proposition advertisers have come to expect when marketing on Meta’s platforms. In the new paradigm, Meta will look to increase its monetization of search ads through search engines like Google which can access more third-party data.

The Buffett Analogy For Zuckerberg

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. » – Warren Buffett

Early on in Buffett’s investing career, he took the « cigar butt » approach where he would invest in any type of business, and instead would focus on investing in companies that were extremely attractive on a quantitative basis. Buffett mastered this approach, inspired by Benjamin Graham, and Buffett’s initial partnership generated over 29% annualized returns for its partners.

As Charlie Munger describes in the video above, he helped shape Buffett’s investment approach when it comes to identifying « better businesses ». Buffett had done so well with the « cigar butt » approach, but as Buffett’s funds grew in size, it became much more difficult to operate this style of investing at such a large scale. Buffett’s investment approach evolved to invest in branded companies that were making meaningful impacts on society whether a candy store, insurance companies, or the largest soft-drink manufacturer. Buffett pivoted to investing in high-quality businesses and wonderful companies that would profoundly impact society, while the investments he was making in the later years of the partnership were much larger than compared to when he had just started the partnership, therefore they were that much more valuable to society. Buffett recognized that his « cigar butt » approach wouldn’t last as his investments grew, which is why he made the pivot.

You may be asking how this relates to Mark Zuckerberg?

Zuckerberg pioneered social media and communication platforms for Web2.0. While Meta’s created a massive userbase between its Family of Apps and it’s built a massive supply of users on those platforms which are extremely valuable to advertisers for businesses of any size. However, social media platforms provide value to advertisers based on how active their members are and how many users they engage with daily. For social media platforms to keep their users engaged, they need to generate content that will lead to « clicks » and attract more attention. Zuckerberg’s approach is therefore similar to Buffett’s early « cigar butt » investment approach, as Meta’s core Family of Apps is a way for Meta to aggregate a massive supply of users which it then uses to appeal to advertisers, while Meta does this by gaining people’s attention and using critical topics act as a means to attract users to its platform. Zuckerberg’s mastered this approach over the last 20 years, but similarly to Buffett, there remains another chapter for Zuckerberg to improve the value of its services as Meta scales into the metaverse.

Through Facebook, Instagram, and What’s App, Meta has created some of the most influential communication platforms of Web2.0. Through AR and VR, Meta has an opportunity to capitalize on its Family of Apps as it looks to pioneer the metaverse. This is where Meta can now start to truly make a difference for its user bases within its social media platforms by enabling new methods of interacting and communicating through the metaverse (specifically VR and AR). Meta is uniquely positioned to capitalize on Web3.0 given its massive user base and through the opportunity to empower people through the innovations to the mediums society uses to communicate.

Meta represents Zuckerberg’s evolution to go from helping people communicate through platforms over the internet, while the pivot into the metaverse is investing that Zuckerberg investing in pioneering the next « executable » phase of Web3.0 compared to the « writable » phase of Web2.0. Zuckerberg and Meta are only in a position to do this because of the success and profitability of its Family of Apps, which now enables Meta to tackle much larger technological problems that will better enable society. This is similar to how Buffett pivoted to investing in wonderful companies at fair prices, once he had mastered the « cigar butt » approach.

More on our thesis for Meta’s Reality Labs division can be found here.

Meta’s Valuation

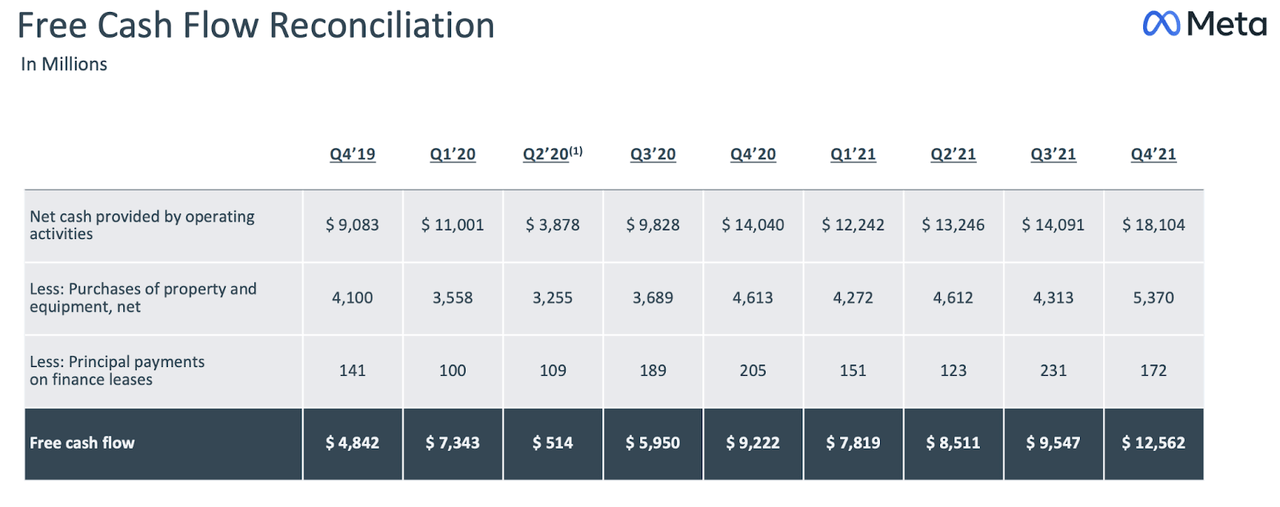

In Q4, Meta generated $12.56B of free cash flow, a record for the most it’s generated in a single quarter. Meta grew its quarterly revenues by 20% while annual revenue for 2021 was up by 37% to $117.9B. The market is concerned for drop-offs in Meta’s free cash flow margins while expecting Meta to suffer from a major revenue slowdown. When considering the strong 2021 in terms of top-line revenue growth, I think it’s safe to say that Meta’s core Family of Apps isn’t going anywhere. While Meta may see a slowdown in growth over the first half of 2022, I think revenues will still grow near 20% in 2022.

Meta Investor Relations

Meta’s CAPEX was $5.54B for the quarter and $19.24B for 2021, which is expected to be in the range of $29-34B for 2022. Meta is investing significantly in AI and the metaverse in order to overcome the iOS changes, which negatively affected margins for the quarter, while also investing heavily in the metaverse. Meta’s operating margin was 37% compared to a year ago when it was 46%. Management reported the iOS changes could result in a $10B headwind for 2022.

Meta also bought back $19B of common stock in the 4th quarter, bringing its total to $44.8B for the year. Meta still has ~$38B in authorized share repurchases to accumulate its stock at its depressed valuation.

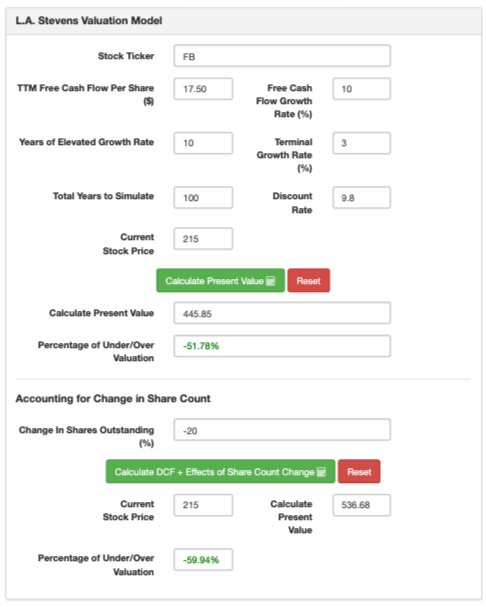

Meta’s growth story is far from over, as digital advertising remains one of the most powerful secular growth trends, as we highlighted here, while the metaverse represents Meta’s long-term growth engine. Trading at 15x Price to Free Cash Flow, Meta’s valuation is attractive, but with all this information in mind, let’s determine Facebook’s fair value. To do so, we will employ our proprietary valuation model. Here’s what it entails:

-

In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

-

In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

-

In step 3, we normalize valuation for future growth prospects at the end of the ten years. Then, using today’s share price and the projected share price at the end of ten years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

Assumptions:

|

Forward 12-month revenue [A] |

$140 billion |

|

Potential Free Cash Flow Margin [B] |

35% |

|

Average diluted shares outstanding [C] |

~2.808 billion |

|

Free cash flow per share [ D = (A * B) / C ] |

$17.50 |

|

Free cash flow per share growth rate |

10% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our « Next Best Alternative ») |

9.8% |

L.A. Stevens Valuation Model

Meta is extremely undervalued, especially when considering its present value when accounting for buybacks. The inputs used in the model were also very conservative, specifically the 10% free cash flow growth we used which is probably too conservative considering that Meta continues to buy back shares. Hence, if Meta were to grow revenues between 15-25% throughout the next, this model would prove too conservative, but this leaves us with a strong margin of safety.

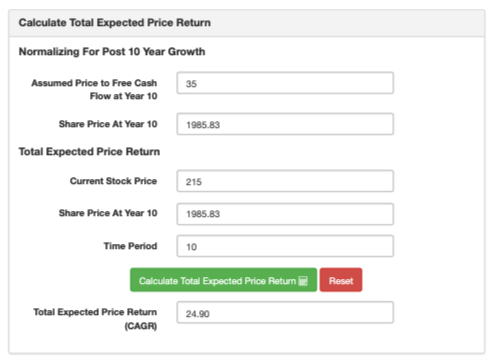

To calculate the total expected return, we simply grow the above free cash flow per share at our conservative growth rate, then assign a conservative multiple, i.e., 35x, to it for year-10. Thereby, we create a conservative intrinsic value projection by which we determine when and where to deploy our capital.

L.A. Stevens Valuation Model

According to our model, Meta has could grow at a ~25% CAGR over the next ten years. Given Meta’s expected returns are better than our 15% hurdle rate and the potential to see its share price 9X over the following decade, I rate Meta a strong buy.

Risks

TikTok

TikTok was mentioned numerous times on Meta’s earnings call and the short-form video platform with 1 billion active users. TikTok doesn’t pose an existential threat to neither Instagram nor Meta. Meta’s proprietary network of social media platforms is still massive, and Meta recognizes the threat from TikTok. If anything, the conference call indicates that Meta is taking the threat seriously and will use the threat from other platforms as a means to greatly improve and invest in Reels. Meta acknowledges that it needs to improve its ad targeting and specifically improve Reels to fight off the competition from other platforms, but given Meta’s history, it will weather the storm as it builds out its AI and improves Reels.

iOS Changes

While Meta is facing challenges from other platforms, it also is dealing with changes within iOS which make it more challenging for Meta to use data from third-party apps on its users’ mobile devices to feed its ad engines, to drive tailored advertisements. The ad-yields for Meta have decreased and this is highlighted by its lower operating margin, but as we highlighted earlier, we believe that Meta will adapt to these changes in iOS as it learns how to cater to advertisers in the new iOS.

Metaverse

Meta is investing aggressively in the metaverse, and the Reality Labs segment lost $10B for the year. While this segment isn’t profitable and is relatively small compared to Meta’s Family of Apps, there still remains a massive opportunity for growth.

We expect 2022 capital expenditures, including principal payments on finance leases, to be in the range of $29 billion to $34 billion, unchanged from our prior estimate. Our planned capital expenditures are primarily driven by investments in data centers, servers, network infrastructure, and office facilities. As we discussed previously, this range reflects a significant increase in our AI and machine learning investments, which will support a number of areas across our Family of Apps. While our Reality Labs products and services may require more infrastructure capacity in the future, they do not require substantial capacity today and, as a result, are not a significant driver of 2022 capital expenditures. » – David Wehner, Meta CFO

Meta is investing significantly in AI and machine learning while it won’t need to continue to spend aggressively on Reality Labs products or infrastructure. Given that Meta is already a leader in VR hardware with Oculus and has already pioneered the communication of the internet, Meta is uniquely positioned to pioneer the communication platforms within the metaverse. While the benefits of the metaverse may not be apparent today, Meta is well-positioned and this segment represents a long-term revenue driver for the company, but with elevated risks considering the challenges ahead as well as competition. However, Meta’s core business is still extremely profitable and will use this segment to fuel future growth.

Conclusion

Meta’s family of apps are the most dominant forms of communication over the internet with billions of users. Meta still remains one of the largest advertising platforms and is spending aggressively on AI/ engineering to overcome these challenges. As Meta faces competition from TikTok and headwinds due to the iOS changes, Meta’s navigated operating challenges in the past (when FB went to mobile, Instagram with stories). Meta’s evolution combined with our belief in Zuckerberg to ultimately have a large impact on the metaverse make Meta extremely attractive at this valuation, especially when considering the capital repurchase program.

Thanks for reading and happy investing!