Lex in depth: a solid case for the next generation of batteries

Batteries, said Elon Musk, are the key to the future. They have powered the tech revolution that has brought the world smartphones, tablets and, as consumers are encouraged to turn away from fossil fuels, electric cars. Yet the science behind the lithium-ion batteries that drive the modern world has remained largely unchanged for more than three decades.

The lithium-ion batteries used in electric vehicles amplify the dirty secret that haunts the industry. They contain hundreds of kilogrammes of metals, especially graphite, cobalt and high-purity nickel, that can — during the mining and refining process — cause significant pollution and increase CO2 emissions. Safety is another concern: these batteries are prone to fires and explosions.

Such drawbacks make the excitement around solid-state batteries — a much-touted technology that promises to resolve many of these environmental and safety concerns — understandable. The next generation power source, so-called for the thin layer of solid electrolytes that replace the flammable liquid solution in current lithium-ion batteries, can store energy far more densely. The electrolytes also double as the battery’s separator, a key component in a lithium-ion battery, reducing the fire risk and the amount of raw materials needed.

Musk, the chief executive of electric vehicle maker Tesla, has stayed uncharacteristically quiet on the topic of solid-state batteries, which have rarely featured in his public pronouncements, including his “Battery Day” event last September.

The quest for shorter charging times and longer mileage without increasing the cost of battery packs and the risk of fires has reached a technical ceiling. Solving these limitations is key to making the electric car revolution really take off. Solid state batteries offer a partial solution, but at the potential expense of Tesla’s position as the undisputed market leader by cars sold.

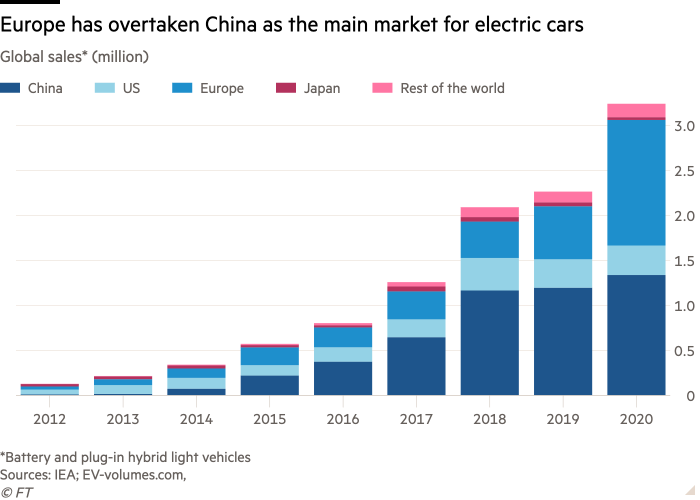

Adding urgency to the need for a change in battery technology are twin trends: the growing shift to electric cars in Europe and China and a global surge in demand for industrial metals which is likely to dent long-term supply.

Sales of electric cars in Europe more than doubled last year as tougher new emissions targets for new cars were phased in. An increasing number of countries — from the UK to Germany — have committed to a ban on new petrol and diesel cars from 2030. While green technologies are now seen by governments as a way to boost slowing economic growth.

In China, a record 1.3m electric cars were sold last year. “It’s not even about subsidies any more, they are now a negligible part of the total car price, at just about a tenth,” says Mark Mao, a research analyst at JPMorgan Asset Management. “Sales are only going to go up.”

Such optimism is partly fuelled by battery makers lowering the cost of production. For a lithium-ion battery pack — the most expensive component of an electric car — prices of its cells have fallen nearly 90 per cent in the past decade to around $110 per kilowatt-hour last year, according to consultancy Benchmark Mineral Intelligence.

On average, electric cars remain 30 per cent more expensive than conventional petrol vehicles. But that gap is closing and, say analysts at UBS, price parity is now just three years away. From there, demand for EVs should further accelerate, which means greater demand for batteries.

Natural limits

Yet, the limits to battery technology pose problems that could slow the mass adoption of electric cars.

The highly flammable liquid solution in batteries is not just combustible, it also makes recycling difficult, hitting resale values. Pricing is another factor. Improvements to safety and energy density without increasing the cost of battery packs, which are around $12,000 per car, have reached technical limits which means there is an inbuilt floor to the price for longer range cars using lithium-ion batteries. The entry-level Tesla Model 3 for instance starts at $37,990, the Hyundai Ioniq at $33,245.

As well as expensive and volatile, the batteries are also bulky and heavy — over 540kg for the Tesla Model S. Their size cuts into legroom and imposes other design constraints. This added weight makes electric vehicles much heavier than petrol cars and so they require more power to cover the same mileage, especially in cold weather. Add to that long charging times of around 50 minutes on average and an inadequate charging infrastructure and there is room for improvement.

“Fast charging does not pair well with liquid electrolytes. The heat generated in the process can damage batteries and absolutely raises the risk of fires,” says Brian Sheldon, professor of engineering at Brown University. “Solid state batteries could solve that risk.”

Advocates of electric cars seem to accept these limitations and employ workarounds like turning off the heater in the winter and staying off the accelerator to extend driving range.

Yet most problems, especially safety, cannot be addressed as easily. Traditionally batteries have had equal amounts of nickel, cobalt and manganese. But a more recent industry trend has been to increase the proportion of nickel in the battery to more than 80 per cent of the cathode — one of the main components. This helps increase mileage and has the added benefit of using less cobalt — which costs twice as much as nickel — lowering production costs.

Unfortunately, that new combination of metals also makes batteries more volatile. In China, which first began commercialising such batteries, three cars equipped with these battery cells have caught fire since May. Other combinations of metals, like lithium and iron, have proved safer, but have a lower energy density.

Raw materials: demand vs supply

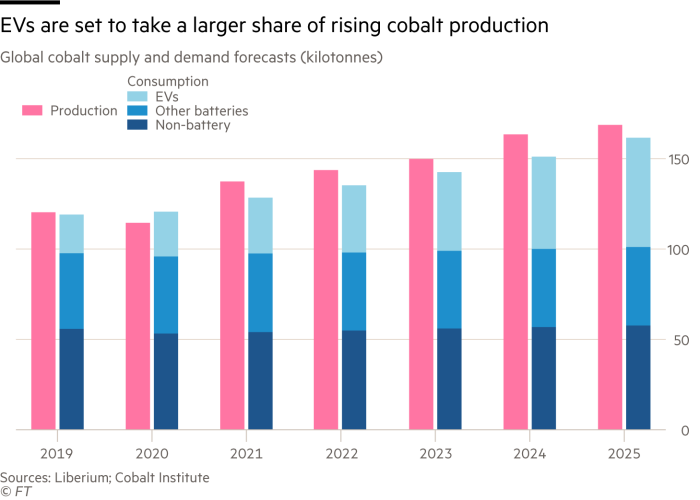

An additional problem, for everyone from carmakers to smartphone developers, is that as batteries become a critical component for so many technologies, demand for the raw materials has risen. This has pushed prices of everything from nickel to graphite, lithium, cobalt and copper ever higher in the past year. When coupled with a weaker US dollar, which most commodities are traded in, prices could rise further.

On average, an electric passenger car needs around 20kg of nickel in

its battery (a Tesla Model 3 needs 30kg), up to 20kg of cobalt in the cathode plus roughly 60kg of lithium compounds. Of the metals used, nickel is crucial as it helps batteries store more energy and cuts down on the need for the more expensive cobalt.

Tesla accounted for more than half of all the nickel used in the European electric car industry last year and Musk has singled out its supply as a concern. It plans to produce batteries storing 3 terawatt-hours by 2030, which would exhaust most of the world’s nickel production at current levels, says Jefferies, the US investment bank. Boosting production is difficult. Less than half of the nickel supplied is suitable for use in batteries. New nickel deposits are rare discoveries. A shortage cannot be ruled out.

Lithium supply is limited for different reasons. It is an abundant resource but the ability of companies to refine it for battery manufacturing is limited. Substitutes are scarce. Building new lithium mining facilities can take up to 10 years. Such is the demand from electric car makers that analysts expect a shortfall in supply to start by the end of this year. Cobalt faces a similar fate. Demand is expected to continue to outpace supply for the next decade, says UBS.

Structural forces are also at play. A new commodities supercycle — a decades-long uptrend in base material prices — has just started, says Goldman Sachs. That should accelerate substitution, of both materials and the underlying technology, in electric car batteries.

Next-generation technology

Frank Blome, head of Volkswagen’s battery cells centre, describes solid-state batteries as the “end game” for their lithium-ion equivalents.

Solid state batteries are safer, cheaper and can be used for longer without a decline in performance, requiring fewer raw materials. Battery cells can be stacked, like bricks in a wall, making them easier to fit into different car designs. They are lighter, reach a full charge in around 10 minutes and have higher energy density — providing double or more range. Less copper and aluminium will be needed. Graphite and cobalt could be eliminated altogether. Recycling solid-state batteries is a much simpler and safer process.

“Historically, next generation technologies — for everything from car exhaust systems to refrigerators — have brought with them a dramatic reduction in the usage of raw materials. It should be no different for solid state batteries”, says Donghwan Kim, chief executive of Hana Ventures, a Seoul-based venture capital firm with investments in technology and industrials.

Prototypes suggest that solid state batteries could store up to 80 per cent more energy than lithium-ion units of the same weight and volume. Lithium metal, which has a higher energy density, could take the place of graphite, helping to reduce battery weight and volume.

For those wishing to improve the performance of lithium-ion batteries, installing one with a weight in excess of 500kg on a moving vehicle — without compromising range and safety — is the onerous challenge. That has led to some scepticism among analysts over Tesla’s stated ambition to mass produce and boost the energy density of its conventional lithium-ion batteries by 50 per cent to increase driving range, over the next three years.

“A 50 per cent increase from today’s upper limit would . . . mean a much bigger size battery than what we have now as more materials would need to go into the cathode,” says Sheldon at Brown University. “Fitting those into cars would be a significant challenge.”

Energy density of conventional batteries has risen about 4 per cent a year over the past two decades to about 700 watt-hour a litre (Wh/L), which translates to a driving range of about 500km in a passenger car. Further increases have been difficult to achieve due to the volume that cells and liquid electrolytes take up.

Solid state batteries offer a step change. Not only would they push the energy density of battery cells beyond 1,000 Wh/L — for a driving range of 800km — but they can also handle more charging cycles before starting to degrade. They would also hold more energy throughout their longer lifespan, allowing for the possibility of a 1m-mile life battery. That would dramatically change lifetime ownership costs and cut the use of raw materials.

Patents boom

The manufacture of solid state batteries still faces a host of practical difficulties.

While working prototypes have been developed, each long-range electric car would need at least 20 times the number of battery cells that have so far been tested in a laboratory. Factories would struggle to make them in bulk and currently each battery would cost about $100,000 to manufacture.

Mass production is years away. But companies are getting closer. “The big difference now is that solid state battery technology has advanced so that the problems that have held back commercialisation have been identified,” says Sheldon. “That is reason enough to be optimistic.”

The company receiving the most attention is QuantumScape, a Silicon Valley start-up backed by Volkswagen and Bill Gates. It is aiming to achieve commercial production in 2024. After listing via a special purpose acquisition company, its shares rose more than 1,000 per cent last year, at one stage valuing the company at nearly $50bn — more than General Motors.

Solid Power, a Colorado-based start-up, is producing small-scale batches of 22-layer lithium-metal cells — which would already offer more mileage than current long-range batteries. It plans to produce larger cells within a year and have them in cars by 2025.

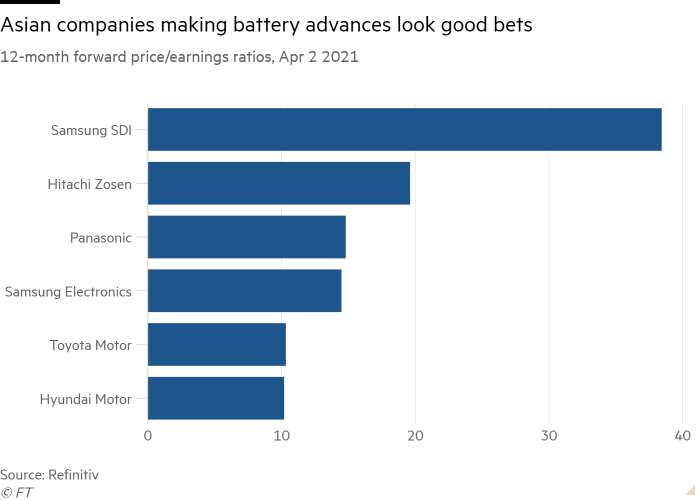

Yet for investors searching for a Tesla disrupter, start-ups like these may not be the best bet. They lack manufacturing capabilities to make critical components from scratch. Companies that currently dominate conventional battery, auto and machinery sectors are better suited to produce large volumes of parts with existing access to machinery and materials.

For those reasons, a number of Asian companies look best placed to make solid state batteries a reality. Toyota is set to unveil a prototype this year, which would take just 10 minutes to charge for 500km of range. Its Lexus LF-30 concept model, with a compact solid-state battery, was unveiled two years ago and it now has 1,000 registered patents involving solid-state battery technology.

An alternative from Samsung would offer 800km of mileage on a single charge. It would be half the size of conventional batteries. “The technology serves as the basis for a revolution in increasing the mileage of electric cars,” says lead researcher Dongmin Im. Its lifecycle of more than 1,000 charges compares favourably with existing batteries that have shown capacity loss after just 60 fast charges.

For these companies, and their investors, solid state batteries are a lucrative bet. Each incremental improvement in such technology has generated windfalls for the first movers. Samsung, which is set to roll out a fifth generation lithium-ion electric vehicle battery, has already signed several contracts, including one with BMW worth $3.5bn to supply battery cells for the next decade.

For Tesla, the developments pose a threat. Its hold on the electric vehicle market has as much to do with the longer range and fast charging times of its models as its innovative software and disruptive marketing. Yet its network of superchargers around the world would give little competitive advantage if cars could be charged as quickly at home.

Patents offer a clue as to how close makers are to commercialisation. The number of new global patent applications for batteries and electricity storage equipment has grown four times faster than the average of all other technology fields, according to data from the European Patent Office going back to 2005. And patents related to solid-state batteries have shown the biggest rate of growth, hinting at a faster-than-expected timeframe for their introduction to the market.

“How soon we get to mass production is simply a function of how much is invested,” says Kim at Hana Ventures. “In chip making, for example, most limitations — including those once said to be technologically impossible — have been overcome by increasing funding. The recent growth in the size of the electric car market means that much more capital can now be allocated to bringing solid state batteries to market.”