GBT: Pfizer Acquisition Signals Increasing M/A Deals

Pixelimage GBT

Price is what you pay. Value is what you get. – Warren Buffett

When you invest in biotech, it’s exciting to see your company getting acquired. After all, the acquisition price is usually at a premium to the market valuation. That being said, there were a good number of stocks that I have covered over the years that got bought out. Don’t nail me at the stake here. I’m not bragging. Instead, I want to show you that investing in high-quality fundamental stocks usually rewards you via either a merger and acquisition (i.e., M/A) or an organic share price appreciation in the long run.

In this article, I’ll feature a fundamental analysis on the recent Global Blood Therapeutics, Inc. (NASDAQ:GBT) acquisition by Pfizer (PFE). I hope that you’ll pick out nuggets in this article to assist you in forecasting other upcoming deals.

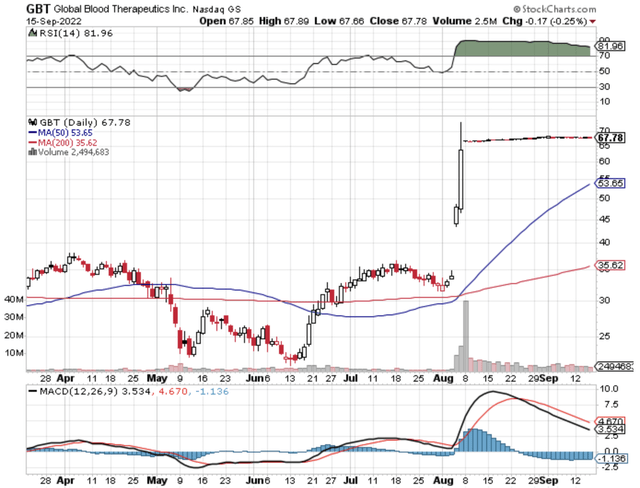

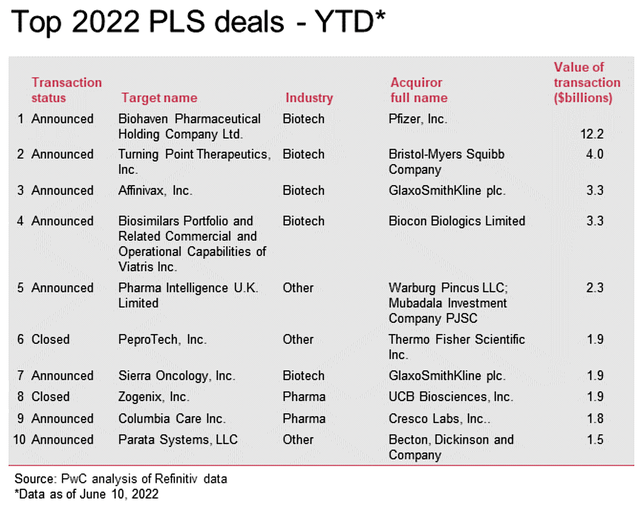

Figure 1: GBT chart

StockCharts

About The Company

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior article:

Operating out of San Francisco, California, GBT is focused on the development and commercialization of novel medicines to serve the unmet needs of the debilitating blood disorder coined sickle cell disease (« SCD »). Notably, GBT already launched Oxbryta in the U.S. for adults and kids (age 4-11) suffering from SCD. In February 2022, GBT also received Oxbryta’s marketing authorization in the European Union (i.e., EU) for kids in the same age group.

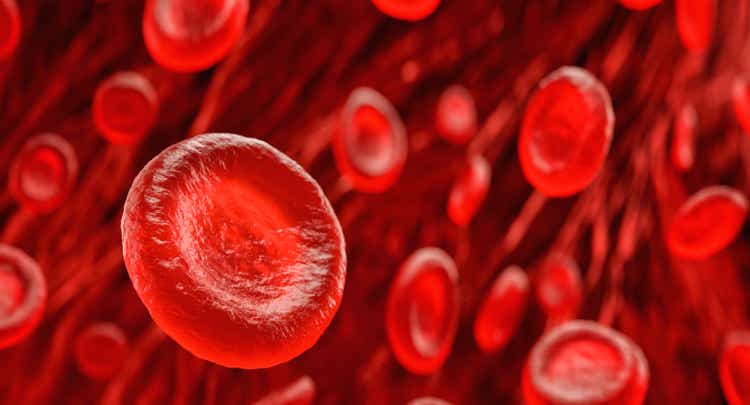

Figure 2: Therapeutic pipeline

GBT

Tracking GBT Investment Thesis

As you know, it’s important to place your stocks into their appropriate investment categories. That way, you can better track their development and progress. On this note, I classified GBT as a « growth biotech » that is still in its aggressive growth phase. As the crown jewel of the pipeline, Oxbryta was launched in the past few years. Being a prudent growth company, GBT continues to expand Oxbryta’s label as well as penetrating into additional markets. Of note, the most recent advancement is the label expansion to serve kids.

To track GBT’s growth story, you want to follow the sales growth to see if the company can continue to ramp up Oxbryta sales. That aside, you want to follow on other pipeline drugs (i.e., inclacumab and GBT601) to ascertain that they are catered for related conditions, i.e., blood disorders. Here, you should look for additional regulatory approvals and more market penetration for those assets. So long as that story remains the same, you can hold GBT indefinitely for multiple-fold gains. The other « exit situation » is when the company can get bought out. As you know, that is the main focus on this article.

Mergers & Acquisition

On August 08, Pfizer announced that the company would acquire GBT for $5.4B (i.e. at $68.50 per share). The move is to enhance Pfizer’s presence in rare hematology. That is to say, Pfizer is poised to strengthen its rare blood diseases portfolio. Accordingly, Pfizer estimated that GBT’s portfolio along with other pipeline assets would garner another $3B in annual sales. As Pfizer is a global powerhouse with its vast sales/marketing team, you can project that the firm would fully unlock the value of GBT’s drugs.

Metric #1: Favorable M/A Environment

Now, let us analyze the factors conducive to this acquisition. That way, we can employ similar metrics to size up other potential buyouts. The first criteria that I look at is a favorable market environment. As you can see, the biotech market (and the stock market in general) have been in steep decline for the past two years.

Keep in mind that despite the recent biotech resurgence, many bio-equities are still trading at a deep bargain to their intrinsic value. The fact that many potential acquisition targets are trading far below their true worth should entice more acquisitions. If you put yourself in the shoes of the acquirer, would you prefer to pick up the same company at a steep discount? I know I would.

Viewing the current M/A environment, you are likely to see more deals going toward yearend as well as next year. As you can see, my sentiment resonates with the Big Four accounting firm (i.e., PwC). Specifically, PwC stated that M/A biotech deals are expected to pick up robustly in 2H2022. According to a PwC research report,

All of the stars are aligned for there to be a flurry of deals activity across all areas of the sector despite the slow start to the year so far. Many large pharma players are flush with cash (particularly those that have COVID-19 treatments in their arsenal), biotech valuations have been normalizing after years of a boom market and the 2025 patent cliff is rapidly approaching, all making for a strong deal environment.

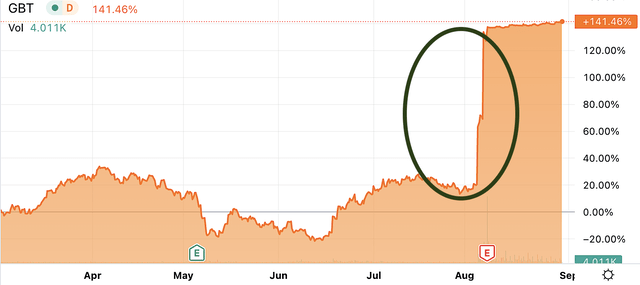

Figure 3: Notable 2022 biotech deals

PwC

Metric #2: Premium Acquisition Price

Asides from the acquirer (i.e., Pfizer), you have to view the aforesaid deal in the eyes of the buyout target (i.e., GBT). For the Board of Directors to agree to sell the company, they demand a premium price. At $5.4B (i.e., at $68.50 per share), Pfizer bought GBT at over 40% premium to the stock’s pre-deal valuation.

Figure 4: Premium acquisition price

Seeking Alpha

As you can imagine, it makes sense for GBT to request for a premium acquisition valuation. After all, the Board and shareholders won’t approve the deal if the price is not right. As you recall, Pfizer estimated that the GBT should deliver roughly $3B in annual sales.

If you put $3B in sales against the $5.4B in buyout price, you’re looking at the projected price/sales ratio of 1.8. At that valuation metric, Pfizer is getting a great deal. Nevertheless, I believe that the +40% premium and the ability of Pfizer to fully unlock the value of Oxbryta/other GBT’s assets justifies the acquisition.

Metric #3: Portfolio Additive And/Or Synergy

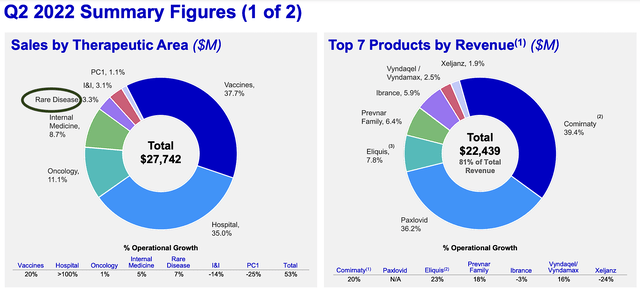

While most buyout situations are proposed to deliver pipeline synergy, the actual results tend to be value added (i.e., additive). In other words, creating synergy is extremely difficult. Therefore, a company typically gets additive value. From the figure below, you can appreciate that Pfizer is focused on rare diseases. Of those orphan conditions, Pfizer is dedicated to the innovation and commercialization of drugs to manage SCD.

Figure 5: Pfizer’s focus on rare diseases

Pfizer

Given that GBT is a powerhouse innovator of therapeutics for SCD, there is at least value added (if not, synergy) with this union. Of the $27.7B in quarterly revenues that Pfizer procured in rare diseases, that account for the total of 3% of Pfizer’s sales. As the company ramps up Oxbryta sales (as well as future launch for GBT601 and inclacumab), I believe that its rare disease portfolio would jump to at least 5% of total sales. Commenting on the M/A, the Chairman and CEO of Pfizer (Albert Bourla) enthused:

… We are excited to welcome GBT colleagues into Pfizer and to work together to transform the lives of patients, as we have long sought to address the needs of this underserved community (i.e., SCD). The deep market knowledge and scientific and clinical capabilities we have built over three decades in rare hematology will enable us to accelerate innovation for the sickle cell disease community and bring these treatments to patients as quickly as possible.

Figure 6: Pfizer’s rare disease product sales

Pfizer

Notably, Oxbryta is already generating $195M for Fiscal 2021. By having access to Pfizer’s powerful sales/marketing teams, GBT can now promptly send Oxbryta to many more patients afflicted by SCD. Consequently, you can expect Oxbryta revenue to hit around $500M annually in a year or two from now. Aside from Oxbryta’s added value to Pfizer, you know that GBT601 (the oral, once-daily next-generation drug) is currently in a Phase 2/3 clinical study. On that front, the available data supports strong future clinical outcomes and thereby approval.

Additionally, GBT has the P-selectin inhibitor (i.e., inclacumab) that is being assessed in a Phase 3 study. Since both inclacumab and GBT601 are « orphan drugs, » they command a premium reimbursement to reward the lengthy and costly innovation process. Ultimately, that would enhance the profit margin for Pfizer while delivering hopes to patients on a much larger scale.

Metric #4: Differentiating Characteristics

As you can appreciate, the aforementioned metrics are important for an acquisition. Nevertheless, the most crucial one is the differentiating characteristics of GBT’s medicines. In a nutshell, there has to be something unique about the target’s medicine to entice an acquisition. The more different the drug, the more attractive it is to the acquirer.

Interestingly, Oxbryta is the first and only of its kind (i.e., an oxygen binding affinity modulator), which differentiated it from competing drugs. The fact that it delivers stellar efficacy and safety while garnering robust year-over-year (YOY) sales is a strong indication of its blockbuster potential. Aside from Oxbryta, you know that GBT is also brewing two differentiated medicines: the next-generation drug (i.e., GBT601) and inclacumab. Putting all that together, it’s a no-brainer for Pfizer to move forward with this deal.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check up on the financial health of your stock. For instance, your health is affected by « blood flow » as your stock’s viability is dependent on the « cash flow. » With that in mind, I’ll analyze the 2Q2022 earnings report for the period that concluded on June 30.

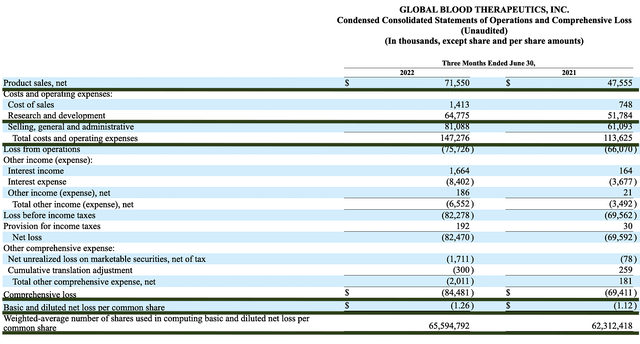

As follows, GBT procured $71.5M compared to $47.5M for the same period a year prior. On a YOY basis, the topline grew by the remarkable 50.5% clip. That aside, the research and development (R&D) for the respective registered at $64.7M and $51.7M. I viewed the 25.1% R&D increase positively because the capital invested today can generate blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $84.4M ($1.26 per share) net losses compared to $69.4 ($1.12 per share) net declines for the same comparison. On a per-share basis, the bottom line is improved by 12.5%. As Oxbryta sales continue to increase, the company would leverage the economy of scale to generate net profits.

Figure 7: Key financial metrics

GBT

About the balance sheet, there was $687.1M in cash and equivalents. On top of the $71.5M quarterly revenue (and against the $147.2M quarterly OpEx), there should be adequate capital to fund operations into 3Q2024 (i.e., 9 more quarters). Simply put, the cash position is quite robust.

Valuation Analysis

It’s important that you appraise GBT to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage a combination of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. Qualitatively, I rely heavily on my intuition and forecasting experience over the years.

Figure 8: Valuation analysis

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 64.4M shares outstanding and 10 P/E |

« PT of the part » after appropriate discount |

|

Oxbryta for SCD |

$1.5B (estimated based on the $5.5B SCD market, growing at a 14.3% CAGR) |

$375M | $58.22 | $52.39 (only 10% discount because it’s gaining strong sales traction) |

| GBT601 for SCD | $1B (estimated based on the $5.5B SCD market, growing at 14.3% CAGR) | $250M | $38.81 | $19.40 (50% discount because it’s still in early stage). |

|

Inclacumab for SCD |

$1B (estimated based on the $5.5B SCD market, growing at 14.3% CAGR) | $250M | $38.81 | $19.40 (50% discount because it’s still in early stage). |

| Younger pipeline assets | Will appraise with more development in the future | NA | NA | NA |

|

The Sum of The Parts |

$91.19 |

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are « growth-cycle dependent. » At this point in its life cycle, the most important concern for GBT is if the acquisition would be consummated. That aside, the risk for Pfizer is whether Oxbryta sales growth can be galvanized rapidly. The other risk is if the other pipeline assets (i.e., GBT601 and inclacumab) would generate positive data.

Conclusion

In all, I maintain my buy recommendation on Global Blood Therapeutics with the 5/5 stars (i.e., raised from 4.8) rating. Global Blood Therapeutics is a story of investment success. As a stellar medicine, Oxbryta triumphed against market doubts and thereby gained approval to deliver hopes to patients afflicted by SCD. In early commercialization, Oxbryta demonstrated that it can deliver strong sales traction at the 41% YOY growth rate. As the Pfizer acquisition is consummated, you can expect that Oxbryta sales to quickly ramp up due to the robust sales/marketing of Pfizer. Looking ahead, GBT601 and inclacumab would deliver strong data and thus gain approval. After this deal, you can expect more M/A activities to pick up for the remainder of the year.