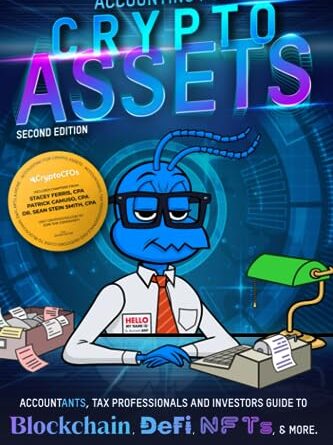

Accounting for Crypto Assets: Accountants, Tax Professionals and Investors Guide to Blockchain, DeFi, NFTs, & more.

Price: 23,29 €

(as of Apr 16, 2024 01:34:06 UTC – Details)

As the Web 3.0 era unfolds, owning digital assets is the new normal. This second edition of “Accounting for Crypto Assets” is your comprehensive guide to navigating this paradigm shift. This book provides the tools to understand and monetize this trillion-dollar asset class, equipping you with the knowledge to service this colossally underserved market as a professional or investor.

This updated second edition expands on previous insights and includes guest chapters from industry experts Stacey Ferris, CPA, Patrick Camuso, CPA, and Dr. Sean Stein Smith, CPA. Stay ahead of the curve with current regulations and learn to think critically about integrating digital assets into accounting practices.

Beyond the book, the CryptoCFOs community – www.CryptoCFOs.com – offers a wealth of resources, networking opportunities, and up-to-date trends in crypto, NFTs, Web3, and blockchain. Master the future of finance with “Accounting for Crypto Assets” and CryptoCFOs.

ASIN : B0CCZZYV22

Éditeur : Independently published (27 juillet 2023)

Langue : Anglais

Broché : 185 pages

ISBN-13 : 979-8853968943

Poids de l’article : 340 g

Dimensions : 15.24 x 1.07 x 22.86 cm