What it will take to vaccinate the world against COVID-19

Within just a few months, pharmaceutical firms have produced hundreds of millions of doses of COVID-19 vaccine. But the world needs billions — and as fast as possible. Companies say they could make enough vaccines to immunize most of the world’s population by the end of 2021. But this doesn’t take into account political delays in distribution, such as countries imposing export controls — or that the overwhelming majority of doses are going to wealthier countries. This situation is fuelling a campaign to temporarily waive intellectual-property rights so that manufacturers in poorer countries can make the vaccines more quickly themselves.

How many vaccines can the world make this year?

The pharmaceutical industry, in common with many industrial sectors, does not reveal its production capacity, says Rasmus Bech Hansen, chief executive of Airfinity, a London-based analytics company that compiles data on the industry. But vaccine growth is likely to be “exponential” in the coming months, he predicts.

Some 413 million COVID-19 vaccine doses had been produced by the beginning of March, according to Airfinity data. The company projects that this will rise to 9.5 billion doses by the end of 2021. A larger figure was published last week in an analysis from the Global Health Innovation Center at Duke University in Durham, North Carolina. The centre’s researchers aggregated publicly announced forecasts from vaccine makers, which add up to around 12 billion doses by the end of the year.

However, Andrea Taylor, who led the research at Duke University, says these numbers are more likely to be reached by the end of 2022. “Supply chains could break down and countries could threaten to block vaccine exports,” she says — as is already happening with India and the European Union having announced restrictions on vaccine exports.

Vaccine production can require more than 200 individual components, which are often manufactured in different countries. These include glass vials, filters, resin, tubing and disposal bags. “If any critical item falls short, then it can disrupt the entire process,” said Richard Hatchett, chief executive of the Coalition for Epidemic Preparedness Innovations, a non-governmental organization headquartered in Oslo, speaking at a summit of manufacturers and policymakers earlier this month.

But Martin Friede, head of vaccine development at the World Health Organization (WHO) in Geneva, Switzerland, is more confident that at least one potential bottleneck can be avoided: the process of filling vials with the vaccine substance (known as ‘fill-and-finish’). Many companies that make injectable drugs can help out with filling vials. And Friede says that the WHO has drawn up a list of several hundred facilities worldwide that currently fill insulin, monoclonal antibodies or injectable antibiotics. The WHO is also launching a matchmaking service to link these producers to vaccine companies, Friede adds.

Can’t companies work together to make vaccines faster?

They already are. Firms that would usually be competing are working together at pace. In one tie-up, Merck, headquartered in Kenilworth, New Jersey, is manufacturing vaccines for its rival Johnson & Johnson in New Brunswick. In another, London-based GSK, and Novartis in Basel, Switzerland, are manufacturing 100 million and 250 million doses, respectively, of a vaccine for Curevac, based in Tübingen, Germany. Such a degree of collaboration between multinational corporations is unprecedented.

In addition, there are many fill-and-finish deals. For example, Sanofi, headquartered in Paris, has a contract with BioNTech of Mainz in Germany to do late-stage manufacturing of 125 million doses of the Pfizer–BioNTech vaccine. Sanofi also has a contract to fill and pack millions of doses of this vaccine.

But the biggest manufacturing deals have been negotiated by AstraZeneca, based in Cambridge, UK, which has contracted manufacturing capacity for 2.9 billion doses to 25 firms in 15 countries. The company’s largest partnership deal is with Serum Institute of India in Pune, which agreed in June 2020 to produce one billion doses of the AstraZeneca vaccine. Serum Institute, the world’s largest manufacturer of vaccine components, also agreed last August to make at least one billion doses of a vaccine developed by Novavax in Gaithersburg, Maryland.

Manufacturers that are signed up to make vaccines also include South Africa’s Aspen Pharmaceuticals in Durban, which will formulate, as well as fill and finish, Johnson & Johnson’s vaccine.

Why isn’t the world making more vaccines?

There are three main types of COVID-19 vaccine: viral vector; whole virus; and messenger RNA (mRNA). mRNA vaccines are made from strands of genetic material that code for a protein on the virus that elicits an immune response. Around 179 million doses had been produced as of early March, representing 43% of the total. By contrast, 35% of vaccines were whole virus, and 22% viral vector, according to Airfinity data.

Could other companies pitch in to manufacture more? Making mRNA vaccines has a simplicity about it, but scaling up is tricky, says Zoltán Kis, a chemical engineer at the Future Vaccine Manufacturing Hub at Imperial College London (see ‛Messenger RNA: the science of speed’). Because it’s never been done before, the newness of the process means there’s a shortage of trained personnel. “It’s very hard to find these people who are trained and also good at it,” he says.

But the key bottleneck in mRNA-vaccine manufacture is a worldwide shortage of essential components, especially nucleotides, enzymes and lipids. This is because relatively few companies make these products, and not in sufficient numbers for global supply. Moreover, these companies are proving slow to license their manufacturing so that others could do this.

For example, every RNA strand requires a ‘cap’ that prevents the human body from rejecting it as foreign material. It’s the most expensive component, says Kis, and the intellectual-property rights for a popular cap design are held by one company — TriLink Biotechnologies, based in San Diego, California. Similarly, a small number of companies hold the intellectual-property rights for one of the four lipid nanoparticles that form the cage around the RNA, Kis adds.

That said, manufacturers of component parts are now expanding their production. TriLink, for example, has built new facilities in California. And Merck, based in Darmstadt, Germany, is expanding its supply of lipids to BioNTech, Pfizer’s collaborator.

Early in the pandemic, there was swift investment in vaccine research and development, but scale-up of components was given less attention, says Drew Weissman, an RNA biologist at the University of Pennsylvania in Philadelphia. Weissman’s research laid the groundwork for the mRNA vaccines developed by both Pfizer–BioNTech and Moderna, based in Cambridge, Massachusetts1 .

“Last February [2020], Pfizer and Moderna were already thinking about how to make more. They started buying GMP [good manufacturing practice] companies,” Weissman says, referring to firms that already fulfil the numerous rigorous requirements for producing safe food, drugs or medical equipment. “They [also] started leasing other companies, but they had no control on the raw materials. Maybe governments could have used their authority to make chemical companies produce more raw materials, but that’s a lot to ask for when the drug hasn’t even been approved,” he adds.

To what extent is intellectual-property protection slowing access to COVID-19 vaccines?

Some 11 billion doses are required to vaccinate 70% of the world’s population — assuming two doses are given per person. This is the proportion that might be needed to reach population-level, or herd immunity.

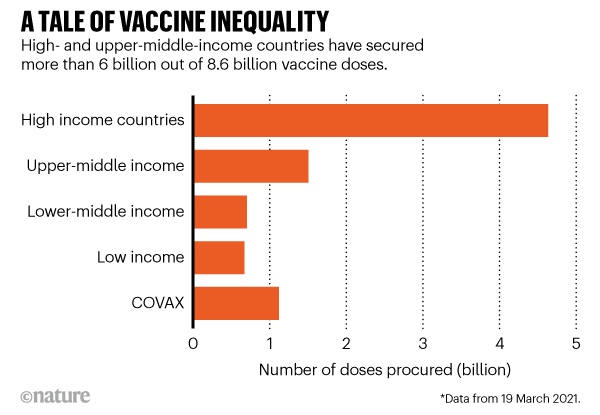

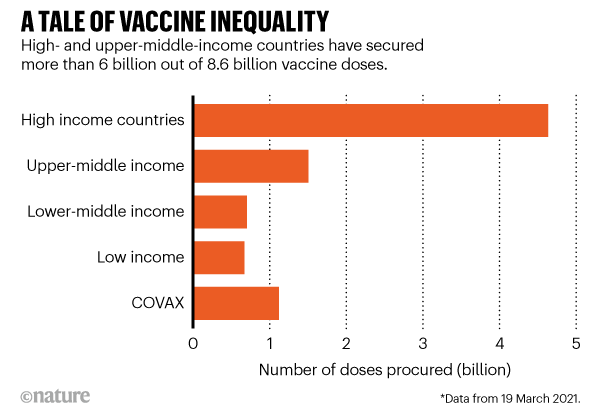

According to researchers at Duke’s Global Health Innovation Center, high- and upper-middle-income countries, representing one-fifth of the world’s population, have bought around 6 billion doses; but low- and lower-middle-income countries, representing four-fifths of the population, have secured only around 2.6 billion. This includes 1.1 billion doses for COVAX, a scheme in which international funders have pledged to vaccinate one-fifth of the world’s population. By this measure, the researchers say, it could take two or more years for people in the lowest-income groups to be vaccinated.

That’s why India and South Africa are among the countries in a campaign for COVID-19-related intellectual-property rights to be temporarily waived. This, the campaign’s proponents argue, will unleash a cascade of production.

Last October, the two countries asked the World Trade Organization (WTO) for certain intellectual-property rights on COVID-19 medical tools and technologies to be temporarily suspended until herd immunity has been reached. The proposal has been gathering support, and is now backed by around 100 countries, and a diverse coalition of organizations called the People’s Vaccine Alliance, which includes the United Nations’ HIV/AIDS agency, UNAIDS, and Amnesty International. It was discussed at a WTO meeting on 10 and 11 March, and talks are due to resume next month.

Proponents argue that the waiver will enable governments and manufacturers to jointly organize a ramping up of vaccine supply. Without a temporary waiver on intellectual-property rights, they say that poorer countries will remain dependent on the charity of richer countries and their pharmaceutical industries.

John Nkengasong, a virologist who heads the Africa Centres for Disease Control and Prevention in Addis Ababa, says the waiver campaign also comes from the experience of the AIDS epidemic. In the 1990s, he says, drugs to treat HIV had been developed and were available in high-income nations, even though most HIV cases and deaths were in Africa. Then, as now, it took many years for AIDS drugs to get to Africa, he says.

“We cannot repeat the painful lessons from the early years of the AIDS response, when people in wealthier countries got back to health, while millions of people in developing countries were left behind,” Winnie Byanyima, executive director of UNAIDS, said earlier this month.

But the India–South Africa proposal is being opposed by the European Union, the United States, the United Kingdom and most of the larger pharma companies. They argue that intellectual-property-rights waivers are unnecessary, and even undesirable, for COVID-19 vaccines.

Jerome Kim, director-general of the International Vaccine Institute in Seoul, says: “The thing about vaccines is that, unlike a drug, you can’t just [follow instructions] and assume that you’ve got a vaccine. This is a complex biological process that has multiple quality-control steps.” For RNA technology, he says, “it’s really not that robust yet”.

Furthermore, for mRNA vaccines, at least, intellectual-property rights are scattered among many companies. Negotiating with everyone in the intellectual-property-rights chain would probably take a year, says Kim. “Would it actually get us vaccine faster? Or would you just be asking a company to give up something that in the end wouldn’t have an impact on global health?”

Instead, Kim proposes that companies license their intellectual-property rights to third parties. Such ‘technology transfer’ will speed up the manufacturing process because more companies will be making things. This is already happening, he points out. “Technology transfer has been one of the remarkable features, I think, of this particular pandemic,” Kim says.

Friede agrees. “We’ve seen partnerships where, if you’d asked me six months ago, ‘do you think those two could ever play together?’, I’d have said, ‘absolutely not, they are violent competitors’,” he says.

What other types of tech transfer could speed up vaccine production?

The WHO is advocating what it calls “coordinated technology transfer”, in which universities and manufacturers license their vaccines to other companies through a global mechanism coordinated by the WHO, which would also facilitate the training of staff at the recipient companies, and coordinate investments in infrastructure. It says this approach is more coherent and transparent than one-off tech-transfer deals such as that between AstraZeneca and Serum Institute.

In another approach, the University of Pennsylvania, which owns sufficient intellectual-property rights relating to mRNA vaccines to strike out on its own, is helping Chulalongkorn University in Bangkok to develop a vaccine-making facility.

“If you look at vaccine roll-out right now, it’s going to be two years before Thailand and other lower-income countries get vaccine,” says Weissman, who is collaborating on the project. The country’s government wasn’t willing to wait, he says. “They were willing to put up the money … so that they’ll be ready to treat their people by the end of this year.”

In the long term, argues Friede, every region needs a facility that fully owns the production know-how and can produce vaccines. The gap is most egregious in Africa, a continent that imports 99% of its vaccines, says Nkengasong. It has only three big vaccine manufacturers.

“Can a continent of 1.2 billion — projected to be 2.4 billion in 30 years, where one in four people in the world will be African — continue to import 99% of its vaccines?” Nkengasong asks.