The Week On Wall Street (SPY): The « BEAR » Is In Control

undefined undefined/iStock via Getty Images

« Common sense is not so common. » – Voltaire

The US economy is stable and saddled with high inflation, supply chain issues, and facing tighter monetary policy. With this stock market continuing in « correction » mode, many analysts are searching for answers. They are looking for a dialogue to share with their clients that explains how this situation can be turned around.

Essentially many have come up with a list that says the economy has to stabilize and start to experience lower inflation, supply chain stability, and a more dovish monetary policy. If your financial advisor has rattled off that list as their « answer » please look for another advisor.

We all like « wish » lists and in my view, we all realize what needs to be done to turn this situation around. Plenty of analysts and economists are forecasting for inflation and supply chain pressures to ease in the coming months. That will then have the potential to « slow’ down the FED’s express ride to higher rates. However, THAT IS A BIG QUESTION MARK.

So what is the data showing now? First, the economy: April’s update on conditions across the economy in the form of the Federal Reserve’s Beige Book showed a much more upbeat assessment than the last several reports. The negative Q1 GDP print caught everyone off guard and tossed some cold water on that outlook, adding more uncertainty.

Supply chains remain top of mind with significant headwinds expected through the rest of the year per recent reports from manufacturers like Tesla (TSLA) and Volvo Trucks. Improvements in this scene have been minimal. China’s lockdowns won’t last forever, but they continue to stall progress on this front.

Given the repeated messages from virtually every member of the FOMC indicating inflation is their sole focus at the moment, the question about what happens with Federal Reserve rate hikes is entirely dependent on what happens with inflation. Because of all the ‘moving parts » that go into « inflation », any forecast on this issue is a « guess ». Therefore any discussion on the Fed’s path is sheer speculation.

Bottom Line; IF the market sees the trend on these « issues » start to change for the positive, then sentiment will follow. If there is little to no shift in the trends in place, I believe sentiment remains in the tank. That leaves us to follow what has worked for us during the entire BULL market, we DO NOT FIGHT THE FED.

What have we heard for the duration of this Secular BULL market? Don’t fight the Fed. Since the FED is changing course from easy monetary policy to a tightening cycle it might be wise to listen and not fight their efforts to kill inflation. That means don’t fight the market’s reaction to higher interest rates that are the result of the fight to tame « inflation ».

NEW ERA INVESTMENT SCENE

During the easy money days, investors simply could NOT be ULTRA Bearish. For the group that was very bearish (and there were plenty that voiced their opinions here), they had a difficult time surviving. Now the opposite is true, an investor can’t be ULTRA Bullish. How an investor navigates this scene is very important, and when and where to invest now is a challenge. Sell everything, go net short and watch a 125-point S&P gain that could be the start of a « rip your face off » rally, OR but that dip only to see a 150-point S&P decline? These are now « ONE-day » events that will destroy the average investor. It does a pretty odd job on a seasoned investor as well. That of course is a seasoned investor that isn’t watching the « technical » picture. For it is that part of the investment scene that is in control now.

We all are aware of what is taking place with the Fed and interest rates. While it’s a big deal for the markets in the short term, the change in the MACRO picture is the one that should start to concern us. So a combination of these issues along with a global central banking shift from quantitative easing (QE) to quantitative tightening (QT) will require a successful transition from liquidity to earnings to drive renewed equity market gains.

There are enough unknowns that leave the situation « uncertain » enough for me to stay with my NEW ERA strategy. A plan for the next few months that continues a focus on the change in the MACRO scene.

The Week On Wall Street

Coming into trading this week, the backdrop simply couldn’t be much worse. It’s never a good feeling when equities close out the week at their lows, but with the close on Friday, April 29th, that made it back-to-back occurrences. Furthermore, the S&P 500 declined at least 1% for four straight weeks while the Nasdaq has been down at least 2.5% for four straight weeks as trading opened on Monday.

The week started off confusing the bulk of investors. For only the 25th time in S&P history, the index opened green, traded down as much as 1.5%, and finished the day with gains. That was just enough for the BULLs to step back up and defend the closing lows set in February/March.

The last time the S&P posted back-to-back UP days was April 1-2. Tuesday’s modest 20-point gain, followed by a strong 125-point upside move extended the gains to three consecutive days. It sure looked like it was full steam ahead for the BULLS. After all the FED meeting was over, the S&P rallied 5.8% off the lows in just 3 days. What could go wrong?

Investors found out that plenty could go wrong. Reality set back in overnight and the resulting ONE-day equity index losses were staggering;

S&P -3.6%

DJIA -3.2%

DJ Transports -3%

NASDAQ -5%

Russell 2000 – 4%

The week ended with more choppy price action on Friday. Despite the wild ride, the S&P closed with a small loss for the week. However, that made it 5 weeks in a row with losses, its longest losing streak in 11 years. The NASDAQ is also sporting a 5-week losing streak while the DJIA has now dropped for 6 consecutive weeks.

THE FED

The last half-point interest rate increase was in 2020 until today. As expected the fed Funds rate was increased by 50 basis points. However, the FED’s other actions and remarks were taken as « dovish ». Chair Powell stated the committee is “not actively considering” 75 bps rate moves. In addition, the Fed’s balance sheet reduction program won’t begin until June 1 and it will be about one-half of what was originally outlined.

After Chair Powell laid out his thoughts on how the Fed plans to fight inflation and bring the economy down to a soft landing on Wednesday, reality set in with the release of the Q1 productivity report. This report showed U.S. nonfarm productivity contracted at a 7.5% pace much worse than projected. Here is the data point that reminded market participants that inflation is cemented in place as a CORE problem now. Unit labor costs climbed 11.6%, one of the highest on record. Spiraling wage costs are a real issue in the fight against inflation.

POLITICAL SCENE

There is plenty of talk about what is going to happen with the mid-term elections. The « consensus » view has the Republicans taking control of the house and possibly the Senate as well. I’m not going to get into politics here, but either way, probabilities favor political gridlock and that will also come as the Fed is in a tightening cycle.

The last time the Fed embarked on a tightening cycle was the 2017-2018 time period. Stocks managed to rally through the first 12 months. How so? First, the Fed tightened policy at a pretty gentle rate, and second, the prior administration delivered big tax cuts that directly boosted after-tax corporate profits, giving a nice offset to the cost of capital being pushed higher.

No such relief is likely to be offered this time around. The Fed’s tightening cycle will be more aggressive than in 2017-18, as rate hikes are expected at all policymaking meetings this year and balance sheet trimming will run at twice the previous pace (Twin Tightening). Unless there is a complete change of administration policy (doubtful) that will be beneficial to Corporate America (low probability), this time around companies will not get an offsetting fiscal benefit. If Democrats lose control of Congress, fiscal supports are unlikely to materialize, and even if they did, ANY spending will fuel inflation.

Therefore, Corporate America and the U.S. economy could soon be subject to a “triple tightening”. That adds up to more equity volatility that could be MORE violent than what we have experienced thus far in 2022. It also could wind up causing a deeper correction similar to the 19% peak to trough decline during the fourth quarter of 2018.

There is no way the Fed solves this problem alone and there doesn’t appear to be any form of assistance in the deck of cards they are dealing with.

The Economy

The JOB SCENE remains a « bright » spot.

The nonfarm payrolls increased 428k in April after gains of 428k in March and 714k in February. The unemployment rate remained at 3.6% for a second straight month. Average weekly earnings increased 0.3% after a 0.5% prior gain, and that saw the 12-month pace slow marginally to 5.5% year over year. The labor force participation rate dipped to 62.2% from 62.4% and was as high as 63.4% in January 2020, just before the pandemic.

A sign that the job market is strong and that the « options » for all that are looking for employment are abundant. With so many job openings and such high quit rates, data on median wage growth illustrates just who is winning in the current labor market. To start with, the YoY change in median wages was in the 99.5th percentile since 1983 during March; while the data has some gaps, the overall message is clear that wage growth is extremely strong.

On the one hand that is a positive for consumers. However, it continues the spiral of high wage growth, leading to continued inflation, which spurs high wage growth and the cycle continues. Another data point that points to inflation hanging on a lot longer than many want to believe.

The JOLTS report showed several new records. Job openings rose 205k to 11,549k in March, making a new all-time high. The job openings rate improved to 7.1% from 7.0% in January and February and is back at the record peak of 7.1% in December. Quitters climbed 152k to 4,536k and compares to the record high of 4,510k in November.

MANUFACTURING

The Manufacturing And Services data reports this week were « mixed ».

Construction spending undershot estimates with a lean 0.1% headline gain in March after upward revisions. Analysts have seen boosts for construction in 15 of the last 17 reports. Construction spending looks poised for an 11% growth pace in Q2, after rates of 20.9% in Q1, and 12.9% in Q4.

The ISM manufacturing index dropped 1.7 points to 55.4 in April, weaker than projected, after slipping 1.5 ticks to 57.1 in March. This ties August and September 2020 as the lowest print since July 2020. The index has been above the 50 expansion-contraction levels since June 2020. Declines were broad-based.

The S&P Global US Manufacturing Purchasing Managers’ Index went in the opposite direction by posting 59.2 in April, up from 58.8 in March. The rate of overall growth accelerated for the third month running and was the sharpest since last September.

ISM-NMI services index fell to 57.1 from 58.3 in March, leaving the measure above the 1-year low of 56.5 in February but well below the 68.4 record high last November.

The Global Scene

A mixed bag of reports for the EU. Manufacturing down, Services up.

The S&P Global Eurozone Manufacturing PMI fell to a 15- month low of 55.5 in April, from 56.5 in March.

Global Eurozone PMI Composite Output Index rose to 55.8 in April, up from 54.9 in March.

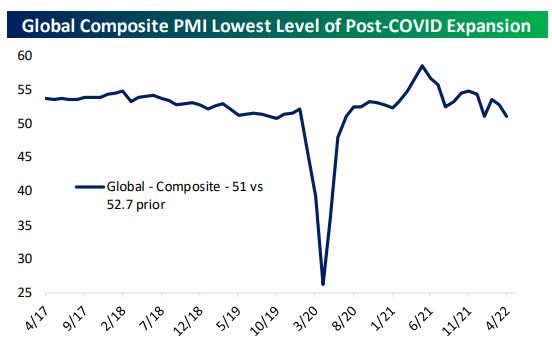

Summarizing all of the other global data reports shows a new post-COVID low in global economic activity in April.

Global economic data (www.bespokepremium.com)

The U.K.

S&P CIPS UK Manufacturing Purchasing Managers’ Index rose to 55.8 in April, up from 55.2 in March.

JAPAN

At 53.5 in April, the headline au Jibun Bank Japan Manufacturing Purchasing Managers’ Index dipped from 54.1 in March to 53.5. The second-weakest report in the past six months.

CANADA

The S&P Global Canada Manufacturing Purchasing Managers’ Index registered at 56.2 in April, down from March’s survey-record high of 58.9.

INDIA

India bucked the downward trend this month.

S&P Global India Manufacturing Purchasing Managers’ Index rose from 54.0 in March to 54.7 in April.

FOOD FOR THOUGHT

Federated Hermes Research noted that despite the issues plaguing the country, not much has changed in D.C.;

As lawmakers returned from break, we learned that Ukraine aid may get delayed over Covid aid, the best ideas for combating high gasoline prices are FTC investigations of oil collusion and a windfall profits tax, and the cure for inflation is higher corporate and capital gains taxes. A similar “cure” for high inflation in 1968 brought on a recession and no real impact on inflation. Talk of new tax hikes comes as federal tax revenues are higher than before the 2017 tax cut, and state tax revenues as a percentage of GDP are on track to set a second straight all-time high this year. »

So here we are deja vu all over again. The issues simply don’t go away by themselves, and adding gasoline to a fire doesn’t put it out.

The Daily chart of the S&P 500 (SPY)

The volatility is simply amazing, and confusing. A new low on Monday that undercut the February/March lows. That was followed by a 5.8% 3-day rally before the S&P fell back to within 5 points of the Monday low, and slowly moved higher.

S&P 500 May 6th (www.FreeStockCharts.com)

The technical picture tells us the « BEAR » is in control, as the BULLS have left the scene for now.

INVESTMENT BACKDROP

It was a rough finish to April. Not only did the S&P 500 finish the month with an 8.78% decline month to date, the biggest one-month decline since March 2020, but the last trading day of the month was one for the record books. Since SPY began trading in 1993, the only bigger drop on the final trading day of the month was in August 1998. Back then it was a much larger 7.13% decline.

If you are wondering why it feels so bad, that’s because it is — The January to April results for the S&P 500 were the worst since 2008 and for the NASDAQ it was the worst on record. The first 5 trading days in May reminded everyone that volatility remains a big part of the scene. While the « weekly » losses were muted when compared to recent weeks, the ‘ride » made most investors feel sick.

During times of uncertainty investors usually turn to the fixed income side of the investment equation to « hideout ». That hasn’t worked this year. While the S&P is off 13%, bond funds have been crushed. The PIMCO Total Return Bond ETF (BOND) has lost 11+% this year. The average investor is faced with a dilemma where nothing is working.

Well, it’s been « nothing » for those that didn’t see the handwriting on the wall and move to overweight positioning in what is working. But that wasn’t the only move that was needed to navigate the New Era. Staying in a holding pattern in the stock/sectors that have broken down has also proven to be costly.

That brings us back to the « canaries ». The Financials, Transports, Semiconductors, and Small Caps. Despite what can only be called a frustrating week, believe it or not, there were some signs of life that I noted. Whether or not that breathes some fresh air into these groups remains to be seen. For instance, the Dow Transports have yet to violate the February/March lows. unlike the Financials and Small caps, the Semiconductors did not put in a lower low this week.

Anyone that has truly been involved in managing these short-term market gyrations, knows that it’s not just the canaries that are warning about the economy. Many more sectors/sub-sectors have been obliterated this year.

The 2022 Playbook Is Open For Business

Thank you for reading this analysis. If you enjoyed this article so far, this next section provides a quick taste of what members of my marketplace service receive in DAILY updates. If you find these weekly articles useful, you may want to join a community of SAVVY Investors that receive DETAILED analysis seven days a week.

SECTORS

CONSUMER DISCRETIONARY

A sector (XLY) that just moved into « BEAR » mode and is struggling to hold on just below the February/March lows. A good sign if the group can rally now, BUT a failure here, and it’s a long way down to the next support level. It may also « confirm » the BEAR market signal.

COMMUNICATIONS SERVICES

The XLC is another sector ETF broken down and in a BEAR market trend.

CONSUMER STAPLES

A group of stocks (XLP) that many have flocked to has created an overvalued situation in the sector. However, it is one of the few groups that remain in an uptrend.

UTILITIES

This sector (XLU) has the same look as the ‘staples ». A solid uptrend BUT overvalued.

ENERGY

While WTI found support in the mid to high 90s again, there was resistance at the $103 level, but that was quickly overtaken as oil closed at $110 this week. The Energy ETF (XLE) found support as well then rallied 10% this week and is at another new high.

Bottom line; I still like energy and energy stocks. My work shows that we are in the early days of the reversal of the Energy sector vs the S&P 500. It may have gotten extended in the short term, but there is still plenty of room to revert after more than a decade of Energy underperformance.

FINANCIALS

Coming into this week the Financials were clearly in the « not working » category. The Financial ETF (XLF) started to roll over as the March lows were breached and a new low was established.

COMMODITIES

Natural Resources” and Commodities got caught up in the negativity recently as they were not spared from the selling. Even the year-to-date winners were jettisoned, providing the kind of shakeout action that happens even during the strongest of long-term uptrends.

I’m not ready to ready to write off commodities as having topped already after several years of poor underperformance. Therefore, I will use any weakness in this pullback as just that — a pullback — and one that provides many the opportunity to jump on board the trend if they’ve missed out on it so far. As is often the case with strong trends, a lot of investors don’t want to buy until a pullback happens, but when such a buying opportunity finally comes, the falling prices can scare them out of doing so.

The S&P Global Natural Resources Fund (GNR) rallied by 4% and keeps the pristine uptrend in place. I also added some individual stocks in the sector that continue to post solid fundamentals. Lithium had a GREAT week.

HEALTHCARE

While the sector broke down with the general market selloff, it is coming off a new high on April 8th. Unlike so many other groups, the technical pattern looks sideways rather than a total breakdown and the long-term chart is decidedly BULLISH.

This does make sense to me in that this group is more immune to inflation and rising rates, but not immune to a general selloff.

TECHNOLOGY

No place to hide here. As mentioned in last week’s update the « generals » were taken out to the woodshed recently. While the pain subsided for some of the victims, it now comes down to whether or not the ‘lows » end here.

Semiconductors

Back to the breakdowns again and this time it’s the semiconductor ETF (SOXX). The February/March lows were violated, and the descending resistance trend line looks like it is going to cap prices until a bottom is in place. Since this group had one of the largest rallies in this BULL market it now has to be recognized it could easily be a group that suffers one of the largest setbacks.

A perfect example of how the « technical » picture rules as we have seen « fundamentals » hold, up VERY well, while the weakness persists.

INTERNATIONAL MARKETS

CHINA

While there are limited opportunities in the near term here in the U.S. For those that can look past the « morality » issues that China brings with it. Some opportunities could be taking shape.

China planning to ‘pause’ campaign against tech companies. (BABA), (PDD), (JD), (WB). China is preparing to « hit pause on its months-long campaign against technology companies, » Keith Zhai of Wall Street Journal reports, citing people familiar with the matter. The country’s top internet regulator is set to meet next week with China’s tech giants to discuss the regulatory campaign, sources told the Journal, who described the meeting as a sign that officials acknowledge the toll the regulations have had on the private sector, reports Zhai.

China regulators are planning to hold off on new rules that limit the time young people spend on mobile apps and are also considering pushing some of its biggest tech companies to offer 1% equity stakes to the state and give the government a direct role in corporate decisions, Zhai adds. Shares of Alibaba (BABA), Pinduoduo (PDD), JD.com (JD), and Weibo (WB) could be beneficiaries of this change.

Many things have to go right for this turnaround. The investment « climate » must continue to change, COVID has to dissipate, and the government has to start using some of the bullets they have left in their arsenal to boost the economy. For those that are interested, it’s time to pay attention to this situation. especially those that have a longer-term time horizon.

FINAL THOUGHTS

I noted some concerning issues that were taking root back in May 2021;

Letting « politics » pilot the ship is POLICY ERROR times 10. »

I do not believe this « interest rate » part of the stock market story is over. »

Don’t fall asleep on this issue. »

That commentary was in response to a picture that was brewing where the FED had to step back into the picture much sooner than many anticipated. One year later and that « view » is now a reality.

Fedspeak, « hard » landings, « soft » landings, I’m not paying that much attention to the rhetoric now. First of all, people are talking about « landing » when this plane has just taken off and the landing gear is being retracted. In my view, the Fasten seatbelt needs to remain « on » for a while.

I believe the NEW ERA strategy is playing out the way it was intended keeping clients and members of my service positioned correctly in the near term. The stocks/sectors that are working will continue to provide excellent returns on the upside rallies while keeping the downside days muted.

POSTSCRIPT

Please allow me to take a moment and remind all of the readers of an important issue. I provide investment advice to clients and members of my marketplace service. Each week I strive to provide an investment backdrop that helps investors make their own decisions. In these types of forums, readers bring a host of situations and variables to the table when visiting these articles. Therefore it is impossible to pinpoint what may be right for each situation.

In different circumstances, I can determine each client’s situation/requirements and discuss issues with them when needed. That is impossible with readers of these articles. Therefore I will attempt to help form an opinion without crossing the line into specific advice. Please keep that in mind when forming your investment strategy.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!