Polar Capital Technology – Exciting times

Exciting times

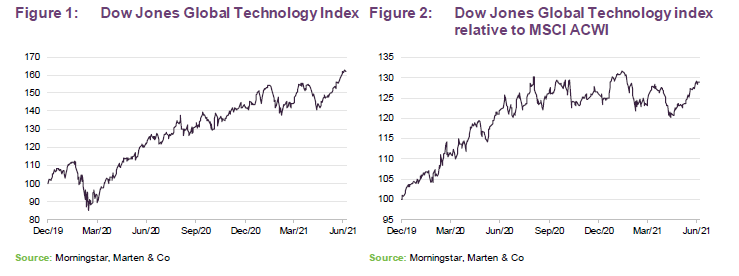

In the short term, the technology sector has given back some of its considerable long-term outperformance of the wider market. Ben Rogoff, manager of Polar Capital Technology Trust (PCT), is unfazed by this. He says that the pandemic has accelerated many societal shifts that he believes will be permanent. Ben notes that areas such as e-commerce, cloud computing, video conferencing, digital entertainment and telemedicine have benefitted. At the same time, he believes that advances in sectors such as electric vehicles (EVs) and artificial intelligence (AI) will revolutionise a swathe of industries.

Ahead of the recent sell-off, Ben saw pockets of overvaluation in the sector but no new technology bubble. The long-term potential that he sees for PCT’s portfolio sits alongside a 7.9% discount.

Global growth from tech portfolio

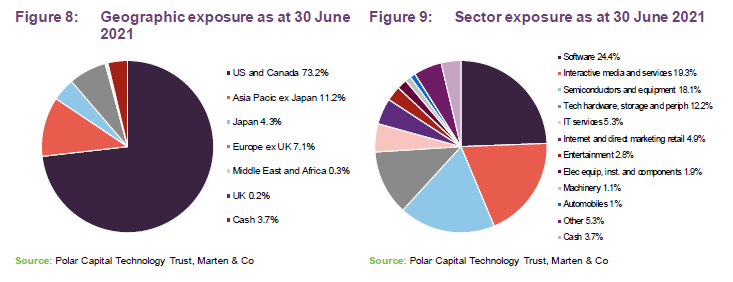

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors within the overall investment objective to reduce investment risk.

Fund profile

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors. PCT launched in December 1996 as Henderson Technology Trust and, following a change of manager, became Polar Capital Technology Trust in April 2001.

Management arrangements

PCT’s AIFM is Polar Capital LLP and the lead manager assigned to the trust is Ben Rogoff, a partner in Polar Capital LLP. He is supported by a team of nine technology specialists, including another partner, Nick Evans. Polar believes that this is one of the best-resourced teams dedicated to this sector within Europe. In addition to PCT, the team also manages two open-ended funds, Polar Capital Global Technology Fund and the Automation & Artificial Intelligence Fund. Collectively, these funds had AUM of $14.7bn at 30 April 2021.

Ben joined the team from Aberdeen in 2003, having started his career in the years running up to the technology boom. The events surrounding the collapse of the tech bubble have influenced the way in which he manages money. Ben says that one important lesson is that there is no permanence in the technology sector; it is forever engaged in a process of creative disruption. He feels that change in the sector is a non-linear process; once-great companies can disappear and minnows can become giants.

Nick Evans joined the team from Framlington in 2007. Nick has a more bottom-up approach to selecting stocks, whereas Ben has a bias to a top-down stance.

Pause for breath

Ben says that he was pleasantly surprised by the speed with which vaccines were developed and tested. He believes that the vaccines are an unequivocal positive for the global economy, but since November’s news, some sectors have benefitted disproportionately. Investors appeared to take profits from growth stocks and more cyclical stocks have recovered. Rising long-term rates – likely a response to increasing concern about inflation – also seem to have knocked long-duration assets such as technology stocks. Some investors question whether behaviours that originated in the lockdowns and benefitted the sector will persist, the degree to which sales have been pulled forward and the sustainability of margin expansion.

Ben acknowledges that financial markets – for example the S&P500 – look expensive. However, whilst he sees the potential for further market volatility around inflation numbers, he is not expecting that inflation will be a persistent problem. The pace of technological advance is one of a number of factors that should continue to act as a long-term dampener. He did not believe that the tech market was in bubble-bursting territory ahead of the recent falls. However, he says that there were, and in some cases still are, pockets of valuation excess, for example around SPACs.

Ben thinks that the new global minimum corporate tax of 15% proposed by the G7 should not prove unduly burdensome for the sector, and removes one element of uncertainty.

Growth accelerated by lockdowns

Ben is a thematic investor and says that the lockdowns associated with the COVID-19 pandemic have accelerated the adoption of many new products and services that are represented in PCT’s portfolio.

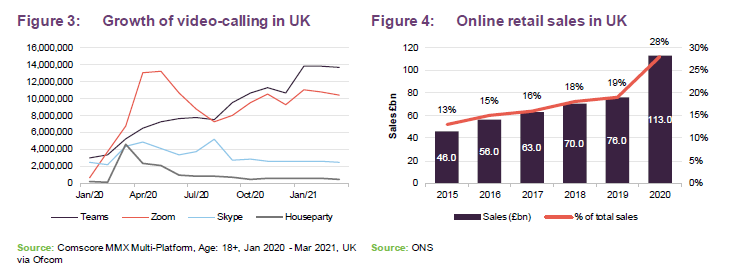

In the UK, Ofcom recently released its Online Nation 2021 report. It shows that over 2020 and within the UK, we spent more time online – watching streamed content, learning, gaming, video-calling, consuming online health services, using fitness apps and shopping – than in 2019. The video-calling data in Figure 3 may be interesting in that it illustrates that there were winners and losers even with a fast-growing area such as this.

According to the data, the amount of time spent online has increased, but numbers dropped back towards pre-pandemic levels when lockdowns were lifted in August 2020. The report notes that digital advertising grew in 2020 (by 4.3%) despite an overall decline in advertising revenues (fall of 8.0% according to AA/WARC Expenditure Report).

The significant growth in online sales in the UK appeared to be driven largely by increases in food, drink and groceries. Apps such as Just Eat, UberEats and Deliveroo saw a significant increase in deliveries (collectively 19.2m in December 2020, up 54% on January 2020).

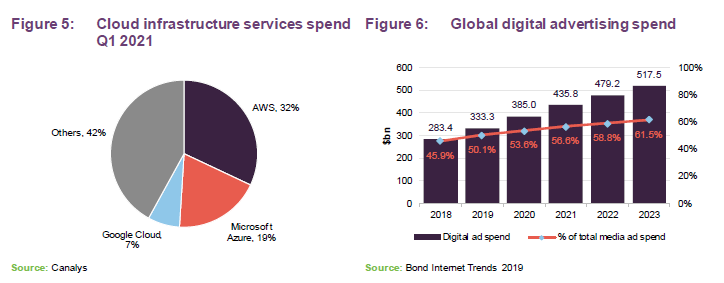

More globally, Ben says that the growth of cloud computing continues to transform the way in which we use software and store data. Cloud infrastructure services spending grew by an annualised 35% to $41.8bn in the first quarter of 2021. Amazon’s AWS dominates, but it is growing more slowly than its two closest competitors, according to Canalys.

Hybrid office/home-working model

One potential lasting effect of the pandemic may be a fundamental shift in the way we work. Whilst some managers are keen to force staff back into the office, many recognise that home-working was much less problematic than feared. An opportunity may now present itself to improve staff morale and cut office space by adopting a more flexible working model. This could provide strong benefits to workflow sharing software and cloud storage companies. However, Ben feels that some of the companies that enabled this shift, such as Zoom, will not be able to sustain last year’s growth rates (he has reduced PCT’s exposure to Zoom).

In addition, Ben notes that, historically, 40% of global travel has been intracompany. The cost and sustainability issues associated with this could mean that much of this will be replaced with virtual alternatives. This might also put a question mark on the $1trn global physical event market.

Rising house prices away from cities could also speak to a trend of de-urbanisation facilitated by remote working. A shift to greater home-working could have knock-on effects on the demand for transport, with less commuting, but this might also offer the potential for a mini productivity boom. Ben also points out that the shift could improve female participation in the workplace – without a commute, working around school hours is much easier – and it is easier for disabled people to work too.

Disruption is everywhere

The growth of online shopping has been well-documented. In PCT’s portfolio, Ben highlights online fashion business, Zalando, which is based in Germany but operates across Europe. Its volumes have been compounding at over 26% per year over the past seven years.

Online payments companies were a clear beneficiary of the lockdown as volumes rose sharply. PayPal was PCT’s largest overweight position relative to the benchmark at the end of April 2021 (see Figure 11). Visa and Mastercard also feature prominently within the portfolio.

As grocery shopping became more inconvenient, the shift to online shopping even appeared to introduce technological disruption into the food sector. One stock that Ben bought for the portfolio was Hello Fresh, where customers order ingredients for meals that they then cook themselves.

Ben thinks that the growth of direct to consumer sales has the potential to undermine brand power/dominance. He suggests that launching a new product is much easier without the need to persuade a retailer to stock it, and a much wider audience can be accessed online.

The growth of telemedicine in the pandemic was another notable trend. There are obvious benefits to holding many initial consultations and follow-up appointments over telephone and video. Not only can medical professionals be more productive, but also patients can reduce time spent mixing with other potentially infectious people in cramped waiting rooms.

Capturing technological change

We explored Ben’s thinking behind his approach to stock selection in our initiation note, but to recap:

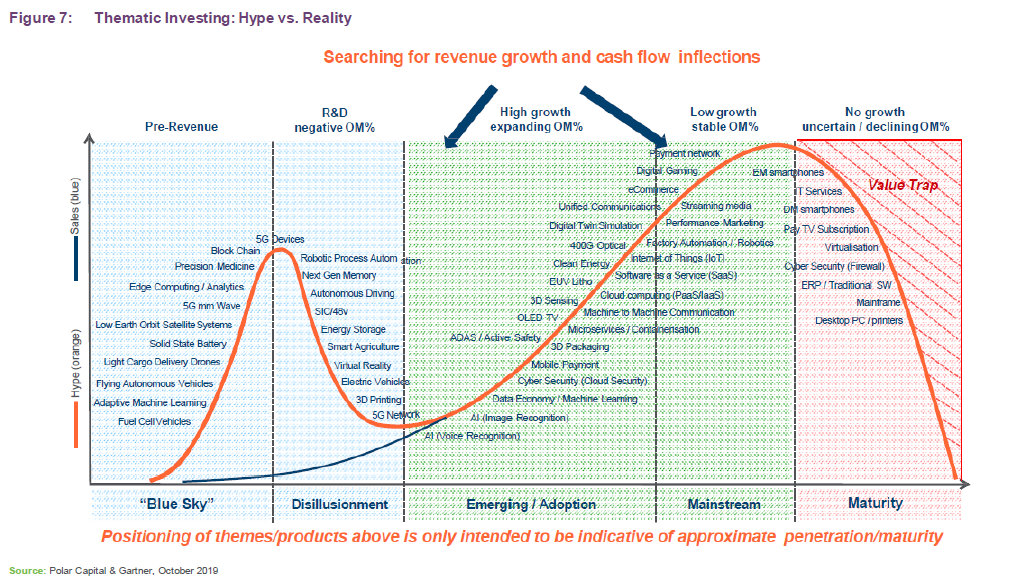

The sector can offer fantastic rewards and can also be unforgiving when you get it wrong. Avoiding the riskiest stocks and the savage adverse swings in sentiment that accompany missed profit or revenue expectations can make a big difference to long-term returns. For investment managers, it is as much about damage limitation as spotting the next big thing.

Technologies go through cycles, like any other product. New entrants tend to displace yesterday’s winners. Sometimes these big companies can reinvent themselves, but usually not.

The best returns can be made as a product or service moves from the early adoption phase to the mass adoption phase. The manager believes that sell-side analysts find it hard to model the near-exponential growth that businesses can achieve as penetration of a product or service shifts from around 5% to around 30%, and…

… this presents an opportunity for active managers. It is also important to exit companies reliant on mature, mainstream technologies. Products and services can see a dramatic collapse in sales and profitability – the technology market is unforgiving.

PCT avoids blue-sky and venture-capital-type investments. It also does not invest in businesses that are reliant on securing additional capital – there are points in the cycle when it is much harder for companies to attract funding.

Figure 7 provides an illustration of this. It is a couple of years old and some of the technologies have moved along the curve since (electric vehicles being a good example, as we discuss below). PCT’s sweet spot is the area shaded in green.

One area that Ben thinks is undergoing rapid and exciting change is the field of artificial intelligence, AI. As advances are made here, this has significant implications for a number of industries. Ben highlights the progress made in natural language processing and the advances that this is leading to in areas such as translation, smart assistants (Alexa and Siri, for example) and automated voice calls.

Investment process

The management team behind PCT is described on page 18. The team carries out many hundreds of meetings a year, not just with portfolio companies, but also their competitors and suppliers. The team uses surveys and speaks to domain experts to cross-reference what customers think of products, where appropriate.

The manager selects from a universe of more than 4,000 stocks and looks to construct a diversified portfolio with about 100 stocks in aggregate. The intention is that these should represent the best opportunities within the investment themes that the manager has identified, and should come at the right price. The team looks at the value chain and identifies areas where it believes it is possible to generate super-normal profits (where companies have an unfair advantage) and recurring revenue.

On average, the stocks that are selected for the portfolio should be capable, in the manager’s view, of generating 30%–50% higher growth than the average stock in the benchmark index and the manager is prepared to pay up for this growth – roughly 20%–30% more than the benchmark, on average.

There is little merit in first screening for value, in the manager’s opinion. It is better to think about which companies PCT should have exposure to, and only then about what is the price he is prepared to pay. The team is much more likely to screen for improving business fundamentals or stocks it may have missed at the periphery of PCT’s investment universe that may not be perceived as tech stocks today, but might be in the future. They say that an important part of this process is to think about the potential downside in a stock – how much will be lost if the investment case is wrong. For many of these stocks, missing an earnings forecast can be devastating to their rating.

PCT may miss out on the odd stock as a result, but the manager believes that this is an acceptable price to pay for avoiding the worst of the downside.

Sell discipline

Ben thinks that it is important to run your winners (do not sell just because an investment has done well), but do sell when you realise that you have made a mistake. Fair value is a moveable target and the potential upside and downside from any position needs to be reassessed regularly. The team has a bull, bear and base case for each stock, with a weighted probability to each of these scenarios.

Holdings will be trimmed as they approach the team’s target price. Sometimes Ben will hold onto a small position in a stock that he feels it is important to stay in touch with. PCT’s portfolio has a tail of 20 small positions – some of these are binary opportunities. In total, these account for about 3% of the portfolio. The ability to have exposure to this type of opportunity is a benefit of PCT’s closed-end structure.

Portfolio construction

PCT is managed very much with an eye to risk. It is designed to deliver 3%+ annual outperformance versus its benchmark after fees on a consistent basis, with typical active share of 40–50%. It rarely makes outsized stock-level bets, preferring to add value by avoiding losers (often mature, or blue-sky companies) and correctly identifying the most important secular themes (and allocating between them where value is perceived to be most compelling). This means that PCT ends up holding 100+ stocks. Whilst this means that other, less risk-aware funds may perform better over shorter periods, this risk-adjusted/diversified approach has contributed to PCT delivering first quartile/first decile performance over almost every medium/longer timeframe.

From time to time, a handful of stocks can dominate the benchmark index. The board allows the manager to take a neutral position in any stock that accounts for more than 10% of the index (up to a maximum of 20% of the portfolio) but PCT cannot have an overweight exposure to these companies.

PCT is emphatically not a closet-tracking fund. If the manager does not like a company, PCT will have no exposure to it, regardless of its weight within the benchmark. This is currently true of Intel, Cisco and Broadcom, for example (see Figure 12).

Typically, the maximum exposure to a stock will be a 3.0%-3.5% active weighting. The portfolio’s active share has ranged from about 30% to just over 50% max.

Investment in emerging markets is permitted but this is capped at 25% of gross assets. The board has also given the following indicative ranges for PCT’s asset allocation:

- North America up to 85%;

- Europe up to 40%;

- Japan and Asia up to 55%; and

- Rest of the world up to 10%.

and has set specific upper exposure limits for certain countries where it believes there may be an elevated risk.

The remit allows investment in unquoted companies (subject to prior board approval and capped at 10% of gross assets) but in practice, this has not been used.

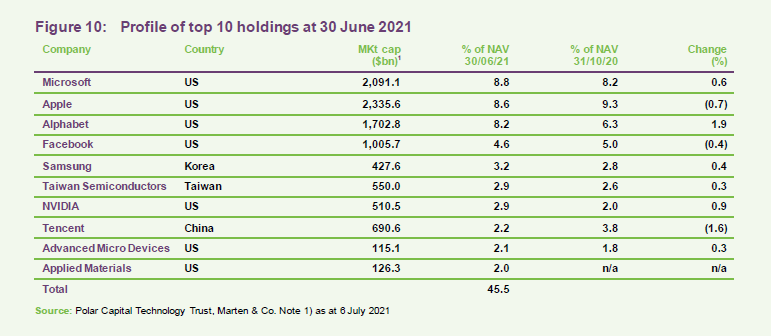

Asset allocation

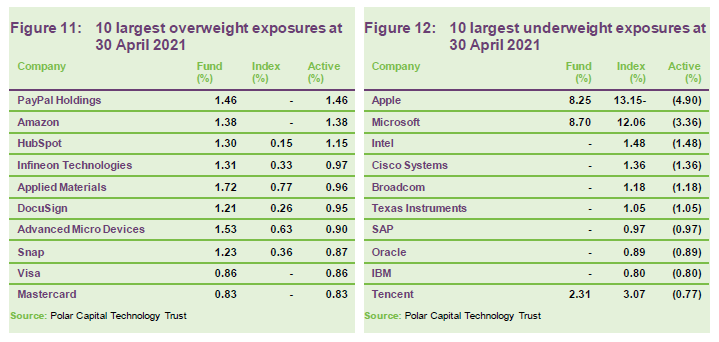

At the end of May 2021, there were 108 stocks in PCT’s portfolio. The portfolio remains benchmark-aware – at the end of April 2021 the active share was in the 40s. Ben feels that, because of their strong cash flow generation, PCT should own some Apple and Microsoft for the moment. Nevertheless, at the end of April, these two stocks were still PCT’s largest underweights (see Figure 12) and when Ben feels the time is right, PCT may not own either. The portfolio may be managed in a benchmark-aware style but he is happy to have zero weightings in large stocks when he feels that their growth prospects do not merit their inclusion within the portfolio.

Cash and equivalents, which includes puts on the Nasdaq, amounted to 3.7% of the portfolio at the end of June. This reflects Ben’s caution on valuations.

Ben does not try to add value through geographic asset allocation. PCT’s exposure to Asia has fallen to the benefit of the US since we last published (using data as at the end of October 2020). In Figure 9, the most significant change is a reduction in exposure to internet and direct marketing retail.

10 largest quoted holdings

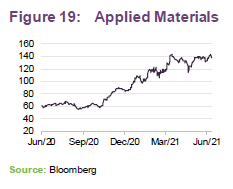

There has been very little change to the constituents of the top 10 list – NVIDIA and Advanced Micro Devices and Applied Materials have moved up into the list to replace Adobe Systems (now ranked 11th), Alibaba (12th) and Amazon. The weight in both of the two Chinese tech giants has fallen (as was reflected in Figure 8).

Figures 11 and 12 show PCT’s largest overweight and underweight exposures relative to the Dow Jones Global Technology Index at 30 April 2021.

The rationale for PCT’s overweight exposure to online payments companies was discussed on page 6.

Ben was reducing PCT’s position in Amazon on concerns about slowing growth within its AWS cloud computing business. Amazon’s share price began to drift off in February. This followed the announcement that Jeff Bezos was stepping down as CEO but also coincided with rising market chatter about inflation. Ben thinks the pandemic may have intensified the competitive threat to Amazon, as it accelerated the business plans of a number of competitors. Nevertheless, he is slowly rebuilding PCT’s position on weakness. He notes that the bid for MGM, while significant to its Prime streaming business, will absorb only a small part of its cash flow.

Microsoft’s Teams operation seems to be outperforming Zoom now, as we showed in Figure 3. Its Azure business is also doing well. Ben feels that Apple, trading on a P/E in the high 20s, is not excessively priced given its dominance in areas such as smartphones. Sales have been strong recently, possibly as US consumers have been spending their stimulus cheques. However, questions have been raised around the future of the app store in Apple’s ongoing court case against Epic Games and a shortage of chips is holding back production of iPads and Mac computers.

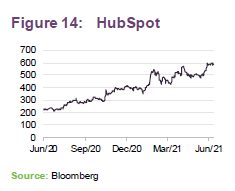

Ben highlights the strong performance that HubSpot has delivered, more than doubling over the past 12 months. This has boosted the size of this position within the portfolio. HubSpot operates a cloud-based customer relationship management platform. Q1 revenue was up 41% year-on-year and the vast bulk of this was subscription revenue.

The underweight exposure to Intel reflects Ben’s feeling that it cannot catch Taiwan Semiconductors (TSMC), which continues to out-innovate it, helped by the reinvestment of its significant cash flows. In April, TSMC announced plans to spend $100bn on R&D over the next three years. That compares to $20bn committed by Intel on two new chipmaking factories. Security of supply for semiconductors has become a focus for the US government and Intel may be its national champion in that regard. Ben says he would buy back the stock if he thought it would work.

Eight core themes

PCT’s portfolio is positioned towards stocks that will benefit from eight core themes:

- Software as a service (SaaS);

- Industry 4.0/automation;

- Cloud infrastructure/security;

- Digital entertainment;

- Mobility/Connectivity/5G;

- Payments/Fintech;

- Data economy/artificial intelligence; and

- Online advertising/ecommerce.

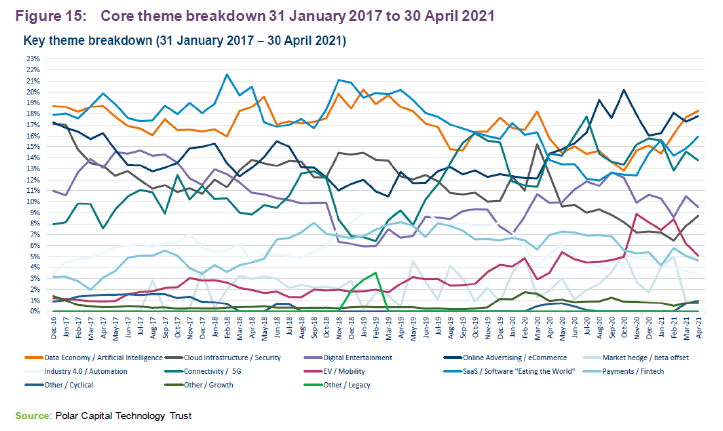

Figure 15 updates a chart that we have used in previous notes, which shows how the composition of the portfolio by theme has changed over time.

Highlighting some of these:

Online advertising/ecommerce

Ben thinks that the dominant players in the online advertising market – Facebook and Google – have strong market positions and considerable pricing power. COVID accelerated the decline of print media and the increasing shift to subscription entertainment undermines terrestrial TV.

Digital entertainment

The phenomenal growth experienced by services such as Netflix and Spotify during the early stages of the pandemic could make year-on-year comparisons look relatively poor and Ben has reduced PCT’s exposure. He notes that Disney has also been experiencing good subscriber growth. Tencent Music’s share price has been weak but PCT did not own it. Generally, he is avoiding second-tier Chinese stocks; for example, PCT no longer owns delivery company Meituan.

Video gaming companies have been reporting strong numbers; for example, companies such as Activision and Nintendo. Ben has reduced exposure to this area slightly, booking profits.

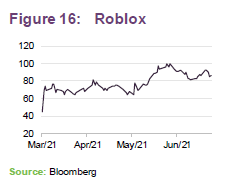

Ben bought Roblox, a competitor to Minecraft, at IPO in March 2021. This was a clear beneficiary of the pandemic and has performed well since.

Cloud infrastructure/security

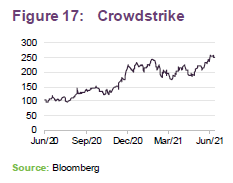

Towards the end of 2020, the discovery of the SolarWinds cyberattack highlighted the threat and the need to spend money on data security. Ben notes the importance being placed on this theme by many investors, and the prices that they are prepared to pay for these businesses. For example, private equity firm Thoma Bravo bought Proofpoint, a constituent of PCT’s portfolio, for 9.5x forward sales, despite what Ben considered to be modest growth prospects for that business.

Within PCT’s portfolio are stocks such as Crowdstrike, Tenable and CyberArk. Crowdstrike’s annual recurring revenue grew by 74% for Q1 2021 over Q1 2020. The equivalent figure for Tenable was 20% and for CyberArk over 40%.

EV/Mobility

While, in the short term, a semiconductor shortage has had a real impact on the automakers, Ben thinks that the EV market may be at an inflexion point where it goes from being a niche product to mass-adoption relatively quickly. Estimates for EV sales growth vary wildly. The IEA offers two scenarios. In the first, based on stated policy objectives, EVs go from 4% of total vehicle sales in 2020 to 10% in 2025 and 16% in 2030. It also models what might be needed to achieve net zero emissions by 2070. Here it suggests that EV sales might be 17% of all sales by 2025 and 34% by 2030. By contrast, UBS believes that EVs will be 40% of new car sales by 2030 and that this may be an underestimate.

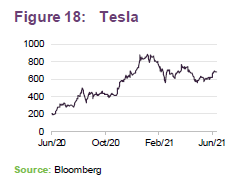

Even against this backdrop, Ben felt that Tesla had become overvalued, and sold it when the price was in the high 700s. He notes that the company seems to have a public relations problem in China. Orders dropped sharply in May.

Ben bought some Volkswagen following its battery day on 15 March 2021, where it set out a roadmap for its batteries and charging operations up to 2030. It plans to build six factories in Europe capable of producing 240GWh of cells, and operate 18,000 fast charging points across Europe by 2025. VW also plans that EVs will be 70% of its sales in Europe by 2030 and 50% in China and the US.

PCT also has a position in Chinese EV-maker, BYD. Whilst COVID-19 and reduced subsidies had an impact on EV production and sales in China last year, volumes picked up towards the end of 2020.

BYD makes a range of passenger and commercial vehicles, including buses and urban rail transit. It has an R&D joint venture with Toyota Motor Corporation and is working with Huawei on automotive intelligent networking and intelligent driving. BYD also has a handset component and assembly business and a presence in batteries and photovoltaics.

SaaS/Software “eating the world”

In the software-as-a-service (SaaS) area, Ben has been rebuilding PCT’s exposure, having cut it as valuations soared in this area. Ben highlights the Snowflake IPO as an example of these high valuations. Snowflake’s IPO broke records for a software company IPO in the US and then its share price rose rapidly – its market cap exceeded $115bn in December. The stock has fallen back since, but still trades on about 75x its forecast revenue for 2022. It was a 0.4% position in PCT’s portfolio at the end of April 2021.

Ben used to say that he wouldn’t own a company trading on more than 10x EV/sales, but has relaxed this rule. He feels that Microsoft’s recent agreed bid for Nuance Communications (PCT has a small position) on a multiple of over 14x sales might suggest that these valuations are underwritten by potential M&A activity.

More cyclical exposure

Ben added some exposure to more cyclical stocks in anticipation of a recovery in economic activity after COVID. For example, PCT had a 0.5% position in Dolby Laboratories at the end of April. He also added to PCT’s semiconductor exposure, building positions in stocks such as Applied Materials and Micron. Ben thinks that the semiconductor shortage – which was exacerbated in March by a fire at Renesas’s factory in Japan – and the associated firm pricing for semiconductors could persist for some while.

Performance

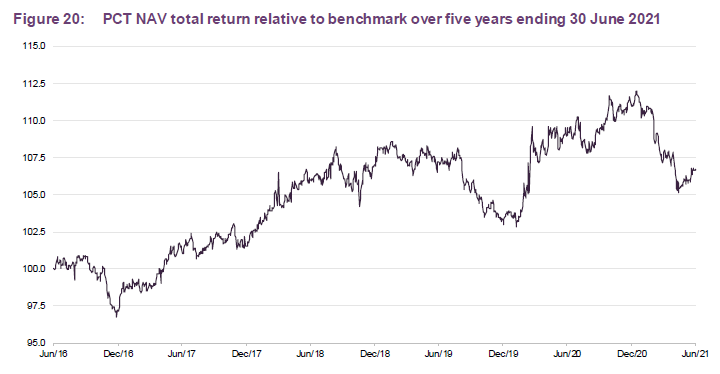

PCT’s strong run of outperformance relative to its Dow Jones Global Technology benchmark over the past five years moderated a little earlier this year, but PCT is now outperforming again.

PCT’s short-term underperformance of its benchmark came at a time when PCT’s two largest underweight exposures – Apple and Microsoft – held up reasonably well against a falling technology sector.

After a brief period of profit-taking, the technology sector appears to be outperforming the wider market once again, as Figure 21 shows.

Dividend

PCT is not designed to produce a dividend. Over the years, its running expenses have exceeded its revenue. The board would declare a dividend if this was needed to maintain the company’s status as an investment trust. However, PCT would first need to eliminate its brought forward revenue reserve deficit (£99.6m at 30 April 2020).

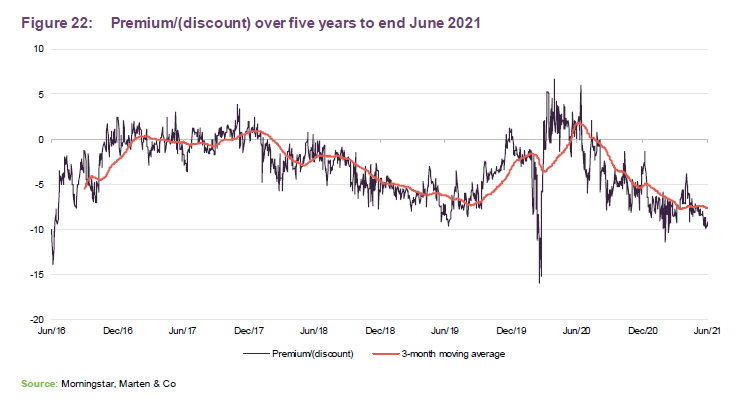

Premium/discount

Over the 12 months to 30 June 2021, PCT traded between a discount of 11.4% and a premium of 6.1%. The average discount over this period was 5.5%. At 6 July 2021, PCT’s shares were trading at a discount of 7.9%.

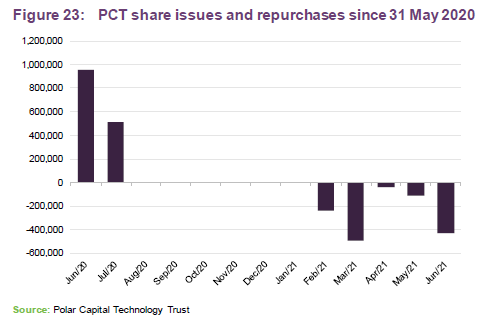

PCT issues and repurchases shares with the aim of ensuring that the shares do not trade at excessive premiums or discounts. Shareholders are asked at each AGM to approve the issuance of up to 10% of PCT’s issued share capital and the repurchase of up to 14.99% of its issued share capital. Shares are only issued at a premium to NAV. Shares repurchased may be held in treasury and reissued.

Fees and costs

The fee payable to the manager is tiered. PCT pays 1.0% on the first £800m of net assets, 0.85% on the next £800m, 0.80% on the next £400m and 0.7% on amounts above £2bn.

A performance fee of 10% of the fund’s outperformance of the benchmark is payable. The performance fee is subject to a high watermark and a cap of 1% of net assets. No fee is payable if the NAV fails to exceed the high watermark, but outperformance in such years is carried forward to subsequent years.

The ongoing charges ratio is 0.93%, which has been falling as the fund has expanded. Note: this ongoing charges ratio excludes performance fees. At 31 October 2020, reflecting the strong outperformance of the fund at that date, the NAV included a provision for a performance fee of £10,969,000.

Capital structure

PCT has 136,006,232 ordinary shares in issue and admitted to trading plus a further 1,308,768 shares held in treasury. There are no other classes of share capital.

PCT’s financial year end is 30 April and AGMs are usually held in September. PCT has an unlimited life, but at last year’s AGM, shareholders were asked whether they want the fund to continue. Shareholders backed the proposal overwhelmingly (99.8% of those voting). The same question will be put to shareholders in 2025 and every five years thereafter.

The use of gearing and derivative instruments is permitted and overseen by the board.

Derivative instruments such as financial futures, options, contracts-for-difference and currency hedges would be used for the purpose of efficient portfolio management. Any leverage resulting from the use of such derivatives will be subject to the restrictions on borrowings.

PCT has no long-term borrowings and, at present, no short-term borrowings either. It does have two facilities provided by ING Bank NV which expire on 30 September 2022:

- a JPY 3,800,000,000, two-year fixed rate term loan at an interest rate of 0.90% pa., and

- a USD 36,000,000, two-year fixed rate term loan at an interest rate of 1.3350% pa.

Management team

Ben Rogoff

Ben is the lead manager of Polar Capital Technology Trust and is a fund manager of the Polar Capital Global Technology Fund and Polar Capital Automation and Artificial Intelligence Fund.

Ben has been a technology specialist for 25 years. Prior to joining Polar Capital, he began his career in fund management at CMI, as a global technology analyst. He moved to Aberdeen Fund Managers in 1998, where he spent four years as a senior technology manager. Ben graduated from St Catherine’s College, Oxford in 1995.

Nick Evans

Nick Evans joined Polar Capital in 2007. He has 23 years’ experience as a technology specialist and has been lead manager of the Polar Capital Global Technology Fund since January 2008. He is also a fund manager on the Polar Capital Technology Trust and Polar Capital Automation and Artificial Intelligence Fund.

Prior to joining Polar, Nick was head of technology at AXA Framlington and lead manager of the AXA Framlington Global Technology Fund and the AXA World Fund (AWF) – Global Technology from 2001 to 2007 (both rated five stars by S&P). He also spent three years as a Pan-European investment manager and technology analyst at Hill Samuel Asset Management. Nick has a degree in Economics and Business Economics from Hull University, has completed all levels of the ASIP, and is a member of the CFA Institute.

Xuesong Zhao

Xuesong joined Polar Capital in 2012. He has 14 years’ investment experience and is a lead manager of the Polar Capital Automation and Artificial Intelligence Fund. He is a fund manager on the Polar Capital Technology Trust and Polar Capital Global Technology Fund.

Prior to joining Polar Capital, Xuesong spent four years working as an investment analyst within the emerging markets & Asia team at Aviva Investors, where he was responsible for the technology, media and telecom sectors. Previously, he worked as a quantitative analyst and risk manager for the emerging market debt team at Pictet Asset Management and started his career as a financial engineer at Algorithmics, now owned by IBM, in 2005. Xuesong holds an MSc in Finance from Imperial College of Science & Technology, a BA in Economics from Peking University and is also a CFA Charterholder.

Fatima Iu

Fatima joined Polar Capital in 2006. She has 15 years’ investment experience and is a fund manager on the Polar Capital Technology Fund, Polar Capital Technology Trust and Polar Capital Automation and Artificial Intelligence Fund. Fatima is responsible for the coverage of European Technology, Global Security, Networking, Clean Energy and Medical Technology.

Prior to joining Polar, Fatima spent 18 months working at Citigroup Asset Management with a focus on consumer products and pharmaceuticals. She holds an MSc in Chemistry with Medicinal Chemistry from Imperial College of Science & Technology in London. Fatima is also a CFA Charterholder.

Alastair Unwin

Alastair joined Polar Capital in June 2019 as a fund manager and senior analyst. Prior to joining Polar Capital, he co-managed the Arbrook American Equities Fund. Between 2014 and 2018 Alastair launched and then managed the Neptune Global Technology Fund, and managed the Neptune US Opportunities Fund. Prior to Neptune, he was a technology analyst at Herald Investment Management. Alastair has a BA (1st Class Hons) in history from Trinity College, Cambridge and is a CFA Charterholder.

Chris Wittstock

Chris joined Polar Capital in 2017 as a senior technology analyst based in the US. Prior to this, he led the international research sales effort at Pacific Crest, a technology investment bank that was ultimately acquired by KeyBanc Capital in 2014.

Before joining Pacific Crest in 2004, Chris led the international sales effort at Schwab SoundView, the successor company to Soundview Technology Group, where he was from 1996.

Chris spent significant time in Europe as a derivative products specialist in the late ‘80s and ‘90s, latterly with Morgan Stanley International. He is a graduate of the University of Toronto, Faculty of Engineering (Industrial).

Brad Reynolds

Brad joined Polar Capital in 2011 as an analyst and trader working within the European Market Neutral team with a focus on media and internet. In 2014, he joined the Technology team as an investment analyst.

Prior to joining Polar, Brad worked at Ratio Asset Management as an analyst and trader, and from 2007 to 2011 he worked at F&C as a hedge fund analyst. He started his career in 2001 at Gartmore Investment Management working within the hedge fund team. Brad graduated from the University of Hertfordshire with a degree in Business Studies.

Paul Johnson

Paul joined Polar Capital in 2012. Prior to this, he helped manage a private investment fund between 2010 and 2012.

Paul holds a BA in History and Politics and a Masters in History from Keele University. He has successfully passed all three levels of the CFA programme.

Nick Williams

Nick joined Polar Capital in June 2019 as an analyst on the Polar Capital Technology team. Prior to joining Polar Capital, he worked at Neptune Investment Management as the assistant fund manager on its US Opportunities growth fund. Previously, he worked in academia at the University of Oxford. Nick holds an MChem Chemistry from the University of Oxford.

Patrick Stuff

After graduating in July 2016 from the University of Warwick with a BSc in Economics, Patrick joined Polar Capital as an operations executive, where he provided operational support to all fund management teams at Polar, including the technology team. During this time Patrick successfully passed all three levels of the CFA program first time, and subsequently, after a successful eight months seconded to the Technology team, he joined on a full-time basis in May 2021 as an investment analyst with a focus on small- and mid-cap companies.

Board

PCT’s board is comprised of five non-executive directors, all of whom are independent of the manager and who do not sit together on other boards. As part of its regular programme of refreshing the board, PCT has announced that Sarah Bates will retire as chair following the AGM in 2022. Each of the directors stands for re-election at each AGM.

Sarah Bates

Sarah Bates is a past chair of the Association of Investment Companies and has been involved in the UK savings and investment industry in different roles for over 30 years.

Sarah is chair of Merian Global Investors Limited (formerly Old Mutual Global Investors), senior independent director of Alliance Trust Plc, and is a non-executive director of Worldwide Healthcare Trust Plc. She is also chair of the Diversity Project Charity, a member of the investment committees of the BBC Pension Scheme and of the University Superannuation Scheme. Previously, Sarah was chair of St James’ Place Plc, JPMorgan American Investment Trust Plc, Witan Pacific Investment Trust Plc and was also chair of the audit committees of New India Investment Trust Plc and of U and I Group Plc. She is a Fellow of CFA UK.

Tim Cruttenden

Tim is currently chief executive officer of VenCap International Plc, having been with that company in various positions since 1994. VenCap invests in venture capital funds in the US, Asia and Europe, with a primary focus on early-stage technology companies.

Tim is a non-executive director of Merian Chrysalis Investment Company Limited.

Charlotta Ginman

Charlotta Ginman qualified as a Chartered Accountant at Ernst & Young before spending a career in investment banking and commercial organisations, principally in technology-related businesses. She held senior roles with UBS, Deutsche Bank, JP Morgan and the Nokia Corporation.

Charlotta is a non-executive director and chairs the audit committees of Pacific Assets Trust Plc and Keywords Studios Plc. She is also a non-executive director of Unicorn AIM VCT Plc, Gamma Communications Plc and Boku Inc.

Charles Park

Charles Park has over 25 years of specialist investment experience and is a co-founder of Findlay Park Partners, an investment firm specialising in quoted American equity investments. Prior to this, he was a US fund manager at Hill Samuel Asset Management.

Charles is a non-executive director of North American Income Trust Plc and Evenlode Investments. He is also a member of Salters’ Management Company Ltd.

Stephen White

Stephen White qualified as a Chartered Accountant at PwC before starting a career in investment management. He has more than 35 years’ investment experience, most notably as head of European Equities at Foreign & Colonial Investment Management, where he was manager of F&C Eurotrust Plc and deputy manager of The F&C Investment Trust Plc. Currently, he is head of European and US Equities at British Steel Pension Fund.

Stephen is a non-executive director and chairman of the audit committees of Blackrock Frontiers Investment Trust Plc and Aberdeen New India Investment Trust Plc and a non-executive director of JPMorgan European Smaller Companies Trust Plc and Brown Advisory US Smaller Companies Plc, where he is the chairman-designate.

Previous publications

Readers interested in further information about PCT may wish to read our earlier notes (details are provided in Figure 24 below). You can read the notes by clicking on the links below or by visiting our website.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Technology Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

210707 PCT annual overview IN