Pfizer’s Partnership With Beam Aimed At mRNA/Gene Therapy

Chan2545/iStock via Getty Images

Investment Thesis

While a lack of deal-making activity at the JPMorgan Healthcare Conference – one of the biggest events of the year in the sector – disturbed many biotech market watchers, it was good news at least to see Pfizer (PFE) agreeing to partnerships that appear to suggest the big pharma is looking to become a leader in messenger-RNA technology and medicines.

Of course, Pfizer’s success with its mRNA COVID vaccine, Comirnaty, developed in partnership with Germany-based BioNTech (BNTX), which earned ~$36bn in revenue for the two companies to share last year, has been well documented and has helped Pfizer stock appreciate in value by 47% across the past 12 months, despite a prevailing bear market for the biotech sector.

Pfizer also has developed Paxlovid – a COVID antiviral that has demonstrated it can reduce the rate of hospitalization for high-risk patients by ~90% – far superior to Merck’s (MRK) Molnupiravir, which achieved a 30% reduction in a similar trial but has still been granted Emergency Use Authorisation (« EUA »), as Paxlovid has, in the US and other countries.

Thanks to Paxlovid, Molnupiravir may not become the >$5bn per annum asset analysts believed it could be, but Paxlovid itself can become one of, if not the world’s biggest selling drug in 2022, perhaps earning >$20bn, and taking the crown from Comirnaty – 2021’s best-seller, with its $36bn of sales.

These are huge numbers even for a pharma like Pfizer – the company’s revenues may challenge the $100bn mark in 2022, it’s believed, and for context, Johnson & Johnson (JNJ), whose market cap of $442bn is 43% larger than Pfizer’s $308bn, earned just $82.5bn in 2020.

In other words, based on sales – which had been flat for Pfizer for several years prior to its development of Comirnaty, will nearly double in 2021, with management forecasting for $81bn – $82bn, and profitability – the pharma earns a net income margin that’s typically over 20%, and potential for share price accretion – despite the company’s outstanding share count of 5.6bn, its shares still feel undervalued – Pfizer stock looks a solid bet for ~15%-30% upside in 2022.

Pfizer Is Addressing Past Shortcomings In Portfolio With Push Into mRNA

One reason Pfizer’s share price may not hit the heights of, say, >$70, is the lack of really stellar growth outside of its COVID product portfolio. Ex-Comirnaty, revenues for Pfizer are forecast by management to be $45-$46bn, with EPS of $2.6 – $2.65, or a forward PE of ~21x.

That’s solid, rather than spectacular – a bit like Pfizer’s non-COVID portfolio of leading drugs, which are divided into Internal Medicines – which accounted for 21.5% of the company’s revenues in 2020, and is led by blood thinner Eliquis, jointly developed with Bristol Myers Squibb (BMY), Oncology, which accounted for 26% of total revenues and is led by ~$5bn per annum selling breast cancer therapy Ibrance, Hospitals, which accounts for ~19%, Vaccines, 16%, Inflammation and Immunology, 11%, and Rare Disease, 7%.

A number of Pfizer’s leading drugs, including both Eliquis and Ibrance – are set to lose their patent exclusivity in the coming years, and will be generating ~77% less revenue, analysts believe, by 2030, so the key question is whether Pfizer stock – riding high on the back of Comirnaty and Paxlovid – could crash if the pandemic were to end rapidly in 2022, reducing the requirement for either medication?

Building a sustainable long-term pipeline of drugs that can challenge for standard of care, and best in class efficacy and safety status is the long-term goal of any pharma, and therefore it makes complete sense that Pfizer is strategically investing in the science and technology behind its most successful ever product, Comirnaty.

Pfizer appears to be pushing for leadership in developing messenger-RNA technology to cure diseases, starting with infectious diseases, but ultimately looking toward « one and done » gene therapies for rare diseases, and vaccines to treat blood and solid tumor cancers.

I wrote a couple of weeks back about how Pfizer’s newly inked partnership with Codex DNA (DNAY), a $270m market cap biotech that specializes in “writing” high-quality synthetic DNA and mRNA, to co-develop Codex’ platforms and make « products of interest » to Pfizer, could be a sign that Pfizer is attempting to develop its own full-service mRNA drug development pipeline, starting with the building blocks.

Of course, Pfizer could have continued its partnership with BioNTech in the mRNA space – after all, the two companies’ first collaboration resulted in the development of Comirnaty – and perhaps it still might, since BioNTech, alongside Moderna (MRNA), is a global leader in mRNA science – but Pfizer also may want to license technology from an earlier stage partner and build up its IP portfolio perhaps with some M&A activity.

Partnership With Beam Further Signals Intent to Build From Ground Up

In the midst of all this comes the news that Pfizer has signed an agreement with Beam Therapeutics (BEAM), a gene-editing specialist that has access to an advanced form of CRISPR/Cas9 based editing, that relies upon erasing and replacing « point mutations » – one of the four bases found in DNA which are adenine (« A »), cytosine (« C »), guanine (« G »), or thymine (« T ») – and rewriting a different letter in its place.

It’s a technique known as « base editing » and it was developed in a Massachusetts Institute of Technology (« MIT ») lab run by Dr. David Liu, a decorated Harvard scientist and one of the cofounders of Beam, alongside Feng Zhang, PhD, and Keith Joung, MD, PhD, respectively of Massachusetts General Hospital and Harvard Medical School.

The agreement with Pfizer will last for four years, and it will be focused on in vivo base editing programs for three targets for rare genetic diseases of the liver, muscle and central nervous system. Beam can provide the mRNA technology and lipid nanoparticle (« LNP ») delivery technology that Pfizer needs to produce Comirnaty, but also other vaccines targeting other infectious diseases, from influenza to Respiratory Syncytial Virus (« RSV ») – down the line.

Beam has received a $300m upfront payment from Pfizer, and if Pfizer proceeds into the clinic and late-stage trials with all three targets, a potential $1.3bn in milestone payments is on the table, plus royalties on net sales, if any drugs are approved, plus the option to co-develop 1 target, splitting revenues 35/65 with Pfizer.

Why Beam?

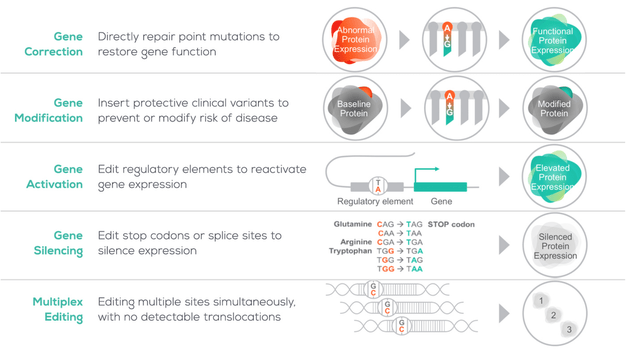

beam’s approach to gene editing

Beam website

As we can see above, Beam’s core focus is the gene-editing process while drug delivery is another strength, with electroporation and AAV vector delivery systems in development as well as LNPs.

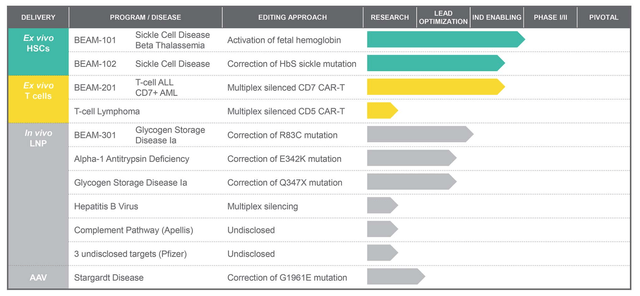

Beam Therapeutics drug development pipeline

Beam Website

Only one of the company’s assets has reached the Investigational New Drug (« IND ») application stage, as shown above. Beam-101 – an ex-vivo therapy for treating Sickle Cell Disease (« SCD ») – was approved for clinical trials in November last year and Beam hopes to proceed into a Phase 1/2 trial, according to its Q321 earnings press release.

The biotech has a second candidate targeting SCD, although it should be noted that this is a field in which CRISPR Therapeutics (CRSP) and Vertex (VRTX) are developing a gene therapy that has delivered positive data in a Phase 1/2 trial already, showing signs of « functionally curing » patients, and could be in line for an approval before 2023.

Its other ex vivo assets are types of cell therapies targeting cancer, an important field that is intensely competitive, but, with last year’s approvals of Bristol Myers Squibb’s Abecma and Breyanzi, as well as Gilead’s Tecartus, all targeting hematological cancer, a major space to watch for the next few years.

Nevertheless, it could be Beam’s in-vivo portfolio that’s interesting Pfizer the most, and may be where we see the true value of Beam’s technology unlocked in the long term.

Intellia Therapeutics (NTLA) made a major breakthrough in this field last year, generating positive results from three patients with Transthyretin (ATTR) Amyloidosis, who saw a reduction in serum levels of a faulty TTR gene comparable to current standards of care (« SoCs »). Intellia’s shares rose >100% after the data were published, given that unlike SoCs, Intellia’s therapy is a one-and-done treatment.

Beam Is A Cash Rich Brain Trust At The Crossroads of mRNA Tech and Gene Therapy

The extra funds that the Pfizer deal has brought in this year have likely taken Beam’s cash reserves beyond the $1bn mark, which is important for a company that lost $328m in the first six months of 2021 alone.

Beam will likely be grateful for the further funds it can raise from its Pfizer deal, but the company is not short of admirers and influencers in its ranks – besides its celebrated co-founders mentioned above, President and Chief Scientific Officer is Giuseppe Ciaramella, formerly of Moderna, where he was CSO of infectious diseases, developing mRNA vaccines, AstraZeneca (AZN), Boehringer Ingelheim, Pfizer and Merck. Chief Medical Officer, Amy Simon M.D. joined Beam from Alnylam, where she helped guide Givlaari through the FDA approval process.

Pfizer itself is cash-rich beyond its wildest dreams thanks to the success of Comirnaty, and with its cash reserves likely to increase further as Paxlovid is rolled out – the US government has already purchased 20m pills at a potential cost of ~$10bn – can afford to do deals with almost any company in biotech – it’s notable that the pharma selected Beam.

Pfizer’s issue with BioNTech may be around intellectual property, and profit-sharing with its partner – despite the incredible success the two firms have had together, the pharma may have realized that in order to develop its own end-to-end mRNA solutions and own as much of the process as possible, and hold the intellectual property rights, it would be better off partnering with a firm that is hungry for success, and less well resourced, as opposed to one that already has its own pipeline in the clinic.

BioNTech has assets in development for most indications that Pfizer would doubtless like to explore – largely focused on infectious diseases that can be vaccinated against, and oncology.

Beam has no such and also marries two of the most cutting-edge fields in science – mRNA technology and gene editing technology – a pretty intoxicating mix of possibilities.

Conclusion – With Biotech, Bear Market Could Drive Beam Stock Down This Year – But Validation Is Worth Holding On For

As mentioned above, it’s hard to see how Pfizer has a poor year in 2022 – its Comirnaty and Paxolvid revenues combined ought to be greater than the $36bn the Pharma earned from Comirnaty last year, and based on an average pharma industry price to sales ratio of ~5.5x, I can see the Pharma’s market cap pushing $375bn by the year end, or a share price of ~$65 – $70, to get closer to a P/S of 4x, which would still be industry leading.

That progress won’t necessarily last however unless Pfizer begins to revamp a drug development pipeline that has traditionally had a high clinical success rate but has not churned out many blockbusters outside of COVID in some years.

mRNA science, therefore, seems to be a perfect field for Pfizer to invest heavily in, beginning by building relationships with the firms of the future, using its financial clout to ensure it is involved in every stage of the process, rather than linking up with a partner that has its own pipeline technology and experienced staff already in place, as it did with BioNTech.

That will allow Pfizer – as it has done with Beam – to structure deals where it earns the lion’s share of the revenues as opposed to splitting them equally, and it also allows the firm to shape Beam’s discovery and development platform, perhaps pushing it more toward the in vivo side of things.

Beam is by no means a small biotech, having raised $180m at $17 per share in its IPO in February last year. Its valuation is falling, however – from a brief high of $133 per share in July last year, to just $62 per share at the time of writing, and there are few internal near-term catalysts to look forward to, with interim data even from its SCD therapies perhaps unlikely to be available this year.

That’s why the Pfizer deal may prove critical for Beam – a company that wants to validate its technology sooner rather than later in order to keep pace with a plethora of other CRISPR/gene-editing and mRNA/RNA specialists.

Looking at Beam I can’t help but make comparisons with Arrowhead Pharmaceuticals (ARWR), a cutting-edge biotech developing a portfolio of RNA-interference assets. Arrowhead has been working with its own partners – Johnson & Johnson drug development subsidiary Janssen, and US Pharma Amgen (AMGN), on assets targeting Hepatitis B and cardiovascular disease, whilst its own asset indicated for Hypertriglyceridemia has entered a pivotal late-stage trial.

Progress has been slow as Arrowhead has itself struggled with drug delivery mechanisms, safety and efficacy, but the biotech has an almost cult-like investor following and based on its promise, deserves its current market valuation of $5.7bn.

Beam’s market cap of $4.2bn is lower than Arrowhead’s, and even though its assets are much further back development wise, I wouldn’t bet against Beam beating Arrowhead to the punch in fields such as liver disease, Hep B and glycogen storage disease.

It would not be the first time that Pfizer and a partner emerged victorious against JNJ and its partners in a drug development race – just look at the two companies COVID vaccines – and that type of potential success and market leadership might even persuade Pfizer to buyout Beam, to position itself as an mRNA/cell therapy/gene therapy powerhouse all rolled into one.

Given that Gilead Sciences (GILD) paid ~$12bn for Kite Pharmaceuticals in 2017, a company that has since secured just two approvals for CAR-T cell therapies in nearly five years, Pfizer making a move for Beam at say, a 75% premium to current price does not seem beyond the realms of possibility.

In summary, although Pfizer already had a great partner for mRNA, BioNTech, in place thanks to Comirnaty, if the pharma is looking to reinvent itself as a leader in mRNA and perhaps even gene therapy, its deals with Beam, and Codex DNA, ought to be closely watched, and many investors will feel excited about the prospects of Pfizer rolling out another vaccine, liver disease therapy or in vivo gene therapy within the next couple of years, and what that may do for its partners share prices.