Xi Jinping of China Calls for Openness Amid Strained Ties With U.S.: Live Updates

Xi Jinping, China’s top leader, called for cooperation and openness to an audience of business and financial leaders on Tuesday. He also had some warnings, presumably for the United States.

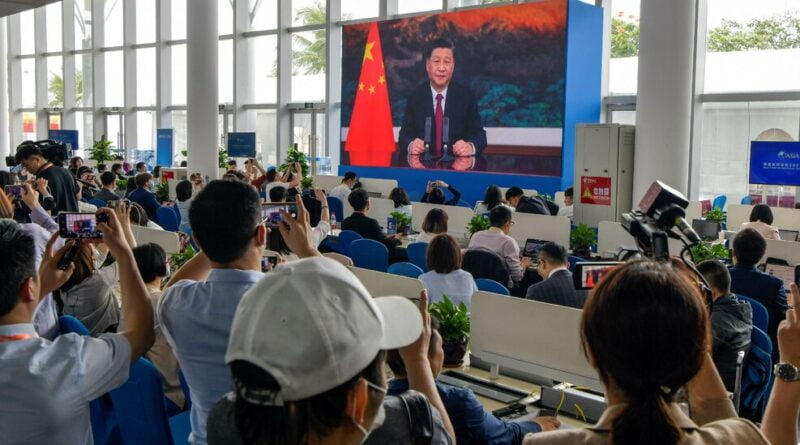

Speaking electronically to a largely virtual audience at China’s annual Boao Forum, Mr. Xi warned that the world should not allow “unilateralism pursued by certain countries to set the pace for the whole world.”

The audience included American business leaders including Tim Cook of Apple and Elon Musk of Tesla, as well as two Wall Street financiers, Ray Dalio and Stephen Schwarzman. Long a platform for China to show off its economic prowess and leadership, the Boao Forum is held annually on the southern Chinese island of Hainan. (Last year’s was canceled amid the pandemic.)

In recent years, Mr. Xi has used the forum to portray himself as an advocate of free trade and globalization, calling for openness even as many in the global business community have become increasingly vocal about growing restrictions in China’s own domestic market.

On Tuesday, he also reiterated his earlier message opposing efforts by countries to weaken their economic interdependence with China.

“Attempts to ‘erect walls’ or ‘decouple’” would “hurt others’ interests without benefiting oneself,” Mr. Xi said, in what appeared to be a reference to the United States and the Biden administration’s plans to support domestic high-tech manufacturing in the United States.

The White House held a meeting with business executives last week to discuss a global chip shortage and plan for semiconductor “supply chain resilience.” Speaking to executives from Google, Intel and Samsung, Mr. Biden said “China and the rest of the world is not waiting, and there’s no reason why Americans should wait.”

China is pursuing its own program for self-sufficiency in chip manufacturing.

Mr. Xi also pledged to continue to open the Chinese economy for foreign businesses, a promise that big Wall Street banks like Goldman Sachs and Morgan Stanley have clung to even as foreign executives complain that the broader business landscape has become more challenging.

Dogecoin, a cryptocurrency started as a joke, now has a market value that can’t be laughed at: more than $50 billion. On Tuesday, traders of Dogecoin were trying to push up the price to coincide with 4/20, or April 20, a date associated with smoking cannabis.

On Twitter, the hashtags #DogeDay and #Doge420 were trending. Dogecoin’s price, which has surged lately, fluctuated between gains and losses on Tuesday, trading at about 40 cents, according to Coindesk. A month ago, it was about 5 cents.

The ripple effects of the boom in crypto markets are being felt far and wide. Coinbase, the cryptocurrencies exchange that went public last week and is helping force the industry into the mainstream, has a market value of $66 billion. Central banks have ramped up plans to explore digital currencies to offer people an secure alternative to cryptocurrencies, which are out of their control. On Monday, the Bank of England was the latest to announce it was looking into a central bank digital currency.

On Tuesday morning, prices of cryptocurrencies and related stocks slipped lower. Bitcoin’s fell 1 percent, trading just above $55,000. Shares in Coinbase and Riot Blockchain were slightly lower in premarket trading.

Elsewhere in markets

-

U.S. stocks are expected to follow European and Asian stock indexes lower. The S&P 500 index is set to open 0.4 percent lower but it’s still less than a percentage point away from the record high reached on Friday. The Stoxx Europe 600 index dropped 1.1 percent.

-

Oil prices rose. Futures on West Texas Intermediate, the U.S. crude benchmark, rose 0.9 percent to about $64 a barrel.

-

Shares in British American Tobacco dropped nearly 7 percent on Tuesday, the worst performance in the FTSE 100, after The Wall Street Journal reported on Monday that the Biden administration is considering making tobacco companies cut the nicotine in cigarettes so they aren’t addictive. American tobacco companies saw their shares fall on Monday.

HOUSTON — Under growing pressure from investors to address climate change, Exxon Mobil on Monday proposed a $100 billion project to capture the carbon emissions of big industrial plants in the Houston area and bury them deep beneath the Gulf of Mexico.

Exxon, the largest U.S. oil company, wants to create a profit-making business out of the capture of carbon emitted by petrochemical plants and other industries. But its plan would require significant government support and intervention, including the introduction of a price or tax on carbon dioxide emissions, an idea that has failed to attract enough support in Congress in the past.

The company already captures carbon, which it injects into older fields to produce more oil. Exxon now wants to use its expertise to store the carbon dioxide generated by other industries. But without a price on emitting carbon, many businesses would have little financial incentive to pay Exxon to capture and store their carbon.

The Obama administration failed to enact a cap-and-trade system, which raises costs for polluting companies by forcing them to buy tradable permits to release greenhouse gases into the atmosphere. California, the European Union and 11 states in the Northeast use versions of cap-and-trade. Other governments, including British Columbia and Britain, have imposed a per-ton tax on emissions.

Exxon wants to capture carbon from industrial plants along the Houston Ship Channel and pipe it offshore where it would stored up to 6,000 feet below the Gulf of Mexico. The effort would be paid for by industry and the government, and would eventually store 100 million tons of carbon annually — equivalent to the emissions of 20 million cars, according to Exxon.

The company has discussed its idea with national and Texas policymakers and Republicans and Democrats in Congress, Exxon’s chief executive, Darren Woods, said in an interview. “They see the opportunity and appeal of this idea,” he said. “The question is, how do you translate the concept into practice?”

Exxon said its proposal complements President Biden’s climate efforts, but it would require the administration to embrace a price on carbon, something it has not done.

“The concept of a price on carbon is critical,” Mr. Woods said. “There has to be a way to incentivize the investment.”

Offshore storage has already gained traction in Europe, where governments have put carbon prices in place and lawmakers are more willing to spend taxpayer money to address climate change.

Mr. Woods said that, given the right policies, carbon capture projects could be a major business for Exxon around the world. “The potential for these markets is very, very large to the extent that demand continues to increase to decarbonize society,” he said.

Last year’s pandemic-induced production delays, combined with a continued shortage of computer chips and other automotive components, have tightened the supply of new models — especially popular sport utility vehicles and pickup trucks.

That means it may be challenging to find a new ride with the colors and features you want at a price you can afford, Ann Carrns reports for The New York Times. “It’s harder to get exactly what you want,” said Ivan Drury, senior manager of insights at Edmunds. “Don’t expect heavy discounts.”

So if new cars are too expensive, you can just buy a used car, right?

Yes, but deals may be elusive there as well. Fewer people bought new cars last year, so fewer used cars were traded in. And the short supply of new cars is pushing more buyers to consider used cars, raising those prices, analysts say. The average price paid for a used car is well above $20,000, Edmunds says.

On the plus side, if you have a car to trade in, its value is probably higher, especially if it’s a popular model. The average value for trade-ins, including leased cars turned in early, was about $17,000 in March, up from about $14,000 a year earlier, according to Edmunds. The average age of trade-ins was five and a half years.

Various online services, like Kelly Blue Book, TrueCar and Carvana, will supply a trade-in estimate based on your location and your car’s age, mileage and general condition, and offer more tailored appraisals if you provide details like the vehicle identification number. Some even offer to buy your car outright.

-

United Airlines said Monday that it lost nearly $1.4 billion in the first three months of the year, but added that a turnaround was close as bookings picked up. The airline said it had stopped spending more money than it collected in March from operations, investing and financing activities — losses known as its “cash burn.” United also said it expected to turn a profit sometime this year.

-

JPMorgan Chase’s role as the financial backer of the so-called Super League, a breakaway soccer league made up of top clubs from England, Italy and Spain, has made it a target for a storm of criticism. Soccer’s organizing bodies and domestic leagues, European heads of state, former players and supporter groups of the clubs involved were among those speaking out against the plan.

-

Tribune Publishing said Monday that it had ended talks to sell itself to Newslight, the company set up last month by the Maryland hotel executive Stewart W. Bainum Jr. and the Swiss billionaire Hansjörg Wyss, after Mr. Wyss withdrew from a planned offer on Friday. Tribune Publishing’s special committee, which evaluates the bids, said in a news release on Monday that the Newslight bid could no longer “reasonably be expected to lead to a ‘superior proposal’” than the nonbinding agreement the company had reached in February with Alden Global Capital.

Around the world, governments are moving simultaneously to limit the power of tech companies with an urgency and breadth that no single industry had experienced before.

Their motivation varies. In the United States and Europe, it is concern that tech companies are stifling competition, spreading misinformation and eroding privacy; in Russia and elsewhere, it is to silence protest movements and tighten political control; in China, it is some of both.

Nations and tech firms have jockeyed for primacy for years, but the latest actions have pushed the industry to a tipping point that could reshape how the global internet works and change the flows of digital data, Paul Mozur, Cecilia Kang, Adam Satariano and David McCabe report for The New York Times.

“It is unprecedented to see this kind of parallel struggle globally,” said Daniel Crane, a law professor at the University of Michigan and an antitrust expert. Now, Mr. Crane said, “the same fundamental question is being asked globally: Are we comfortable with companies like Google having this much power?”

Underlying all of the disputes is a common thread: power. The 10 largest tech firms, which have become gatekeepers in commerce, finance, entertainment and communications, now have a combined market capitalization of more than $10 trillion. In gross domestic product terms, that would rank them as the world’s third-largest economy.

Governments agree that tech clout has grown too expansive, but there has been little coordination on solutions. Competing policies have led to geopolitical friction. Last month, the Biden administration said it could put tariffs on countries that imposed new taxes on American tech companies.

Tech companies are fighting back. Amazon and Facebook have created their own entities to adjudicate conflicts over speech and to police their sites. In the United States and in the European Union, the companies have spent heavily on lobbying.