Valneva Stock: Vaccine Business, Catalysts Ahead, And Pfizer’s Lyme Love (NASDAQ:VALN)

VioletaStoimenova

Thesis

Valneva (NASDAQ:VALN) is a French specialty vaccines company which has not been covered on Seeking Alpha after its Nasdaq IPO, even though it sports a market cap of $1.1 billion.

It has operating sites all over the world, four of which in Europe and one in both Canada and the US, and has +750 employees worldwide. It has an ongoing travelers health business which I believe may report good results in the coming quarter, probably also with R&D expenses for the quarter reduced.

VLA2001, Valneva’s inactivated Covid-vaccine which has strong efficacy across different variants, a good safety profile and booster potential, is currently suffering from an oversupply of Covid-vaccines, at least in the Western world. There may be an occasion here in the longer term, as a shift towards better vaccines than those currently used occurs.

In the second half of 2022, Valneva will file for a biologics license application (BLA) for VLA1553, its Chikungunya vaccine candidate. This vaccine candidate has fast-track designation in the US, prime designation in the EU, and is eligible for a priority review voucher. VLA1553 has shown excellent safety and immunogenicity results and seems best placed to become the go-to vaccine for this disease.

In the third quarter of 2022, Valneva will initiate a Phase 3 trial for VLA15, the world’s only Lyme vaccine candidate, which is again shown to be safe and efficacious. Pfizer (PFE) co-develops this vaccine, has provided serious funding, will pay more as milestones progress, and has just recently taken an 8.1% stake in Valneva.

I see a buying opportunity here, with two important catalysts ahead, i.e. the BLA for the chikungunya vaccine and the Phase 3 trial initiation for the Lyme vaccine candidate. The fact that Pfizer saw the interest in the Lyme vaccine adds to my conviction.

With about €300 million in the bank, I believe the market’s current valuation of Valneva is too low. I do see one caveat, and that would be that the market hasn’t fully discounted poor revenue coming from Valneva’s Covid vaccine.

The current share price

The company trades both on Euronext and on the Nasdaq, with much less liquidity on the latter.

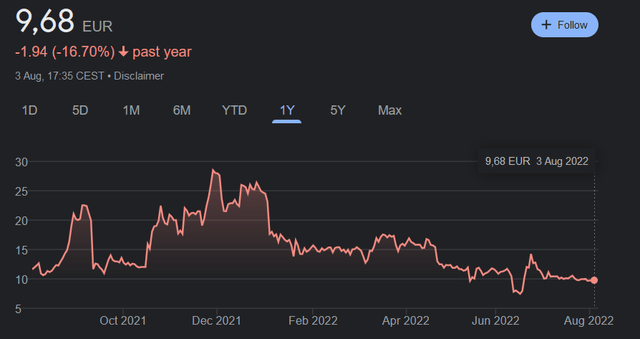

On Euronext, it trades under the ticker ‘VLA’, with a year-high of €29.7 and a year-low of €7.26. Its one-year chart is as follows. Trading on Euronext is more liquid.

Valneva stock price chart Euronext (Google)

On the Nasdaq, where the company trades under the ticker ‘VALN’, its yearly trading range is in between $67.84 and $13.71, with the company now trading around $20. Contrary to Euronext, there is little liquidity on the Nasdaq.

There has been volatility in the stock price lately due to negative sentiment surrounding the commercial viability of the Covid vaccine program on the one hand, and positive sentiment relating to the recent €90.5 million stake of Pfizer in Valneva on the other.

I will cover Valneva’s portfolio below as a function of each asset’s maturity in the business. I see most potential in both the chikungunya and Lyme disease candidates. Contrary to its Covid-vaccine, I believe those vaccines will not face serious competition, if any, once approved. Hence, I am looking at this company in part as a biotech company with a high-value late-stage pipeline, a fully operational manufacturing and commercial team, and a recovering ongoing business.

Valneva’s ongoing business: traveler health portfolio and third-party distribution

Valneva’s Traveler Health portfolio includes two vaccines, Ixiaro/Jespect and Dukoral, and encompasses vaccines for those traveling to other countries. Ixiaro, commercialized under the name Jespect, is a vaccine for Japanese encephalitis. Dukoral is a vaccine for the cholera and prevention of diarrhea resulting from an enterotoxigenic E. Coli bacteria.

This business, covering approvals in most countries in the Western world, had been heavily impacted by travel restrictions and Covid-related lockdowns, mostly in 2020. Revenues declined from $130 million in 2019 to $66 million in 2020 and $63 million 2021, which still saw an impact from the pandemic. US soldiers travel too, and Valneva in fact derives quite some revenue from its long-standing relationship with the US government. The US military has an ongoing 3-year supply contract with Valneva for Ixiaro, and has been using that vaccine for more than 10 years already. The total minimum value of this contract is $118 million.

I expect Valneva to report good numbers here for the second and third quarter of 2022.

Valneva also commercializes third-party products such as Moskito Guard, Encepur, Flucelvax Tetra, Fluad, Kamrab and Rabipur, amounting to $15.4 million in 2021. It also has some minor other revenues.

VLA2001, an inactivated COVID-19 vaccine

VLA2001 is an inactivated virus vaccine which has shown robust efficacy and safety against different variants. It applies the same technology as Ixiaro’s, and consists of inactivated Covid-19 particles with preservation of the native structure of Covid-19’s spike-protein. It can be stored at cold chain temperatures (2-8° Celsius), can be used as primary vaccination or as a booster, and is suitable for routine immunization in the longer term. The Phase 3 trial results showed superiority in neutralizing antibody levels and a better safety profile compared to AZD1222, another EMA-approved vaccine. It has received standard marketing authorization in the EU, conditional marketing authorization in the UK, and emergency use authorization in Bahrain and the UAE. Q3 2022 should see Valneva readout its booster data, which I do not expect the market to react to.

Here comes the catch though. Due to oversupply of vaccines in the Western world at this, this vaccine has yet to turn into a commercial success.

The UK government had terminated its contract to order several million doses in 2021, which has led to a +$200 million settlement agreement in that year, which led the company to report total revenue of €348.1 for that year, compared to €110.3 million in 2021. I do add that 2020 and 2021 were weak years as the company’s travelers health portfolio revenue was seriously impacted by Covid. In 2019, revenue from the travelers health portfolio had been €129.5 million.

The EU has recently expressed its wish to terminate its supply agreement with Valneva to supply up to 60 million doses over a period of two years, which led the stock to sell-off to its year-low in June 2022. The company is in talks with the EU about a remediation plan, as several EU countries have expressed their wish to receive the vaccine. I have seen an analyst write that Valneva may accept a ‘best-we-can-do’ offer to reduce stock inventories. Valneva has nonetheless clearly stated that, if volume indications would be too low, commercialization would not be sustainable. In that sense, I believe the company will have to revise its sales guidance expressed for 2022, but I believe the market has taken that into account.

In the longer run, as the world may be ready for better and longer-lasting vaccines than the ones that are currently mainstream, this vaccine may attract business.

VLA1553, the chikungunya vaccine candidate

VLA1553 is one of three chikungunya vaccine candidates in development, probably best-in-class and furthest-progressed.

Chikungunya is carried by mosquitoes in tropical and sub-tropical environments such as the Americas, India, and Thailand. It is prone to cause outbreaks among the population with a severe economic impact. Morbidity is low, but the inflammatory burden and persistent joint pain have a debilitating impact.

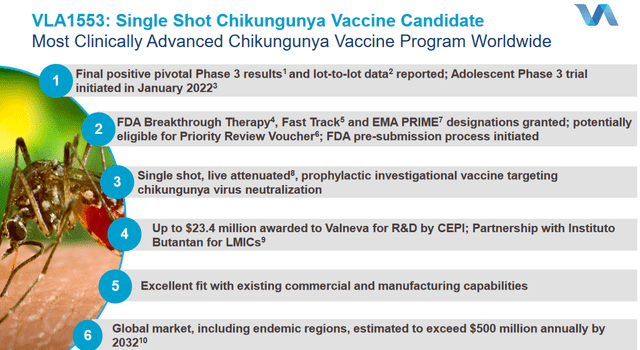

VLA1553 overview slide (Valneva corporate presentation)

The Phase 3 trial results showed outstanding immunogenicity and led to protective chikungunya neutralizing antibody titers in 98.5% of participants 28 days after single-dose administration. That 98.5% seroprotection rate exceeded the bar of 70% that had been agreed with the FDA. VLA1553 has basically been racking up regulator’s favoritism, with fast-track and prime designation respectively by the FDA and the EMA, and breakthrough therapy designation by the FDA in July 2021. Valneva is now likely to receive a priority review voucher, as sponsor of the first chikungunya vaccine to be approved in the US.

Valneva would include VLA1553 in its travelers health portfolio with approval in the US and the EU underway. It has also entered into an agreement with the Brazilian ‘instituto butantan’ to commercialize this vaccine for less developed countries.

Valneva is about to file for a BLA any time now, as it had been announced for mid-2022. I believe this could be a substantial catalyst for this drug candidate. Upon approval, launch can be expected soon after, with the plus here that Valneva has its commercial network set up already.

In a global market which is to exceed $500 million by 2032, it can capture that market upon approval and establish its go-to position for years to come. I have read an analyst forecast risk-adjusted peak sales of €260 million by 2028. The above means that upon approval, this business has the potential of tripling the current sales revenue over time.

VLA15, the Lyme disease vaccine candidate

VLA15 is the biggest horse in the stable in my eyes, as the only Lyme vaccine candidate in the world, with outstanding Phase 2 data, which came in different sets of data over different studies, and huge Pfizer backing/involvement. Lyme disease is commonly known to most people. It is caused by the Borrelia burgdorferi bacteria, is transmitted by ticks and highly present in several regions of the Western world, where it expands more and more due to climate change.

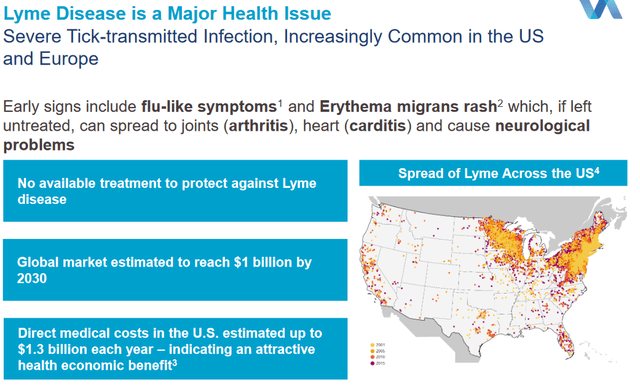

Lyme disease incidence slide (Valneva corporate presentation)

Most patients recover, but 10-20% have persistent and sometimes disabling issues such as ongoing fatigue. There is currently no vaccine for Lyme disease available in the world, and although antibiotic treatments may provide relief, these generally come too late because detection of the disease is slow, and the therapeutic window passes.

VLA15 has shown strong immune responses across 6 different serotypes. In April 2022, Valneva has reported results of its phase 2 pediatric study showing strong immunogenicity and an outstanding safety profile. These results build on earlier successful Phase 2 results, which is perhaps why the market has not given them much attention, if any.

The upcoming catalyst here is the initiation of a phase 3 trial the second half of 2022, the results of which could be expected by year-end 2023.

In the US and Europe combined, about 700,000 people each year are diagnosed with Lyme disease, with this number on the rise due to climate change.

Pfizer and Valneva have a co-development and co-commercialization partnership here, with development-costs being split 60/40 for Pfizer and Valneva, respectively, and Valneva eligible for milestone payments. Of these milestone payment, $168 million are still to be paid. Initiation of the Phase 3 study, which is for any time now, will lead to a $25 million payment.

The Pfizer involvement should ensure perfect marketing and commercialization potential. The most recent terms of the royalty agreement, as recently revised, are tiered royalties ranging from 14% to 22%. Add to that, Valneva is eligible for up to $100 million in milestone payment from Pfizer based on cumulative sales. I will also add to that, Pfizer is flush with cash and apparently on a buying spree. Latest rumors, as reiterated in this Seeking Alpha editor coverage on prognosis for the biotech sector in the current quarter, include rumors of Pfizer being in talks to buy Global Blood Therapeutics (GBT) in a $5 billion deal. In my earlier Cardiff Oncology (CRDF) coverage, I had recalled how earlier Pfizer equity investments led to buyouts. An 8.1% stake of Pfizer may bode well here, but I have difficulties to believe that would be a short-term scenario as parties have just revised their deal. I’ll add that Pfizer seems most interested in Valneva’s Lyme business, which I assume could not be included in Valneva’s travelers health portfolio.

If one would assume a 400-million-person worldwide market with 3% penetration (i.e. 12 million), and pricing of $100 in the US and €50 in the EU which would be equally split between the two main markets, one arrives at sales numbers of $1.2 billion and €600 million, respectively. Assuming royalties to be around 18% (the middle of 14% and 22%), revenues would be $216 million for the US and €108 million for the EU. These are only vague estimates at this stage, as pricing is unknown and the concrete markets are unexplored, but they do give an idea of the value-driving potential here. Pfizer is seeing it, and again, there is no competition for this vaccine in the pipeline.

First quarter 2022 results and second quarter expectations

The results reported by Valneva for Q1 2022 were about the same as those reported for the year before. Total revenue was €21.8 million compared to €23.2 million in 2021, with product sales of €16.2 million compared to €16.1 million in 2021, and with first COVID-19 vaccine sales of €3.8 million. A total of €5.6 million were derived from other revenues, compared to €7.1 million in 2021.

As Valneva’s business had been severely impacted by Covid-measures, I expect to see an uptick in business results for the coming quarter, as people are resuming travel again similar to pre-pandemic times to countries where the vaccines in the traveler’s health portfolio are of use. Valneva highlights in its corporate presentation that this business represented $130 million in 2019 when it was growing strongly (slide 18), and is a key asset for the future.

Guidance in the Q1 results on May 5, 2022, was that Valneva expected its 2022 revenues to be within the range announced in February, namely €430 million to €590 million. I expect this guidance is no longer applicable in light of the recent termination or termination discussions with regards to the Covid vaccine, both in the UK and in the EU. I do believe the market has already discounted the future revision of that guidance, which one can see in the share price dip right after the Covid-update the company issued on June 10, 2022.

Already for the first quarter of 2022, R&D costs were reduced to €20.7 million, where they were still €27.7 the year before. This was mainly attributable to ending of the Phase 3 trial for chikungunya and lower investments for the Covid-vaccine. I don’t expect to see any major R&D costs for the second quarter of 2022, as the Phase 2 trials for Lyme disease have now also ended.

The reduction of R&D expenses for Q2 2022 that I expect may also have a considerable impact on operating and EBITDA loss compared to previous quarters. For Q1 2022, Valneva’s operating loss was €18.4 million versus €31.1 million in Q1 2021. Q1 2022 adjusted EBITDA loss was €12.7 million compared to €28.3 million in Q1 2021.

Financials

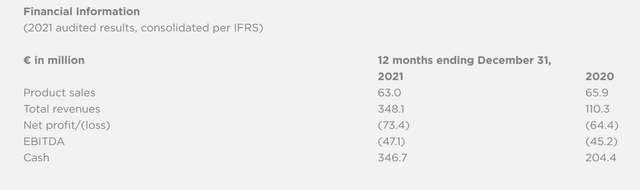

These were Valneva’s 2021 financial results as reported on March 24, 2022.

Valneva 2021 financial results (Valneva Full Year 2021 reporting)

Total revenues in 2021 were €348.1 million, compared to €110.3 million in 2020, but of that €348.1 million, €253.3 million was attributable to a settlement under the terminated UK agreement. Revenues from normal business, affected by Covid, were €94.8 million. As these were $130 million in 2019 and were apparently on the rise, I expect Valneva to do better here in Q2 2022 than compared to last quarter or last year’s second quarter.

Valneva is flush with cash and will be so for the foreseeable future. Its cash position end of March 2022 €311.3 million. In April 2020, Valneva entering into an R&D agreement with Pfizer for the Lyme vaccine candidate, which led to an upfront payment of $130 million in June 2020. Pfizer is due to pay an additional $178 in development milestones, among which $25 million when the vaccine candidate enters Phase 3 trials. In May 2021, Valneva picked up $107.6 million as a result of a global Offering and Nasdaq listing, which was followed by an additional global offering worth $102 million. The collaboration agreement with Pfizer has been adapted in June 2022, with Pfizer taking an equity investment in Valneva of 8.4% for a total of $90.5 million, and with parties agreeing a slightly different royalty split. Finally, a financing arrangement with US healthcare funds Deerfield and Orbimed led to the availability of an additional $40 million in April 2022.

A fair value for Valneva’s business potential

As mentioned above, given its pipeline, I am looking at Valneva as an ongoing business with an even bigger pipeline.

With a €1.15 billion market cap and about €300 million in cash, its enterprise value would be €850 million. I would expect yearly revenues from the currently travelers health portfolio to pick to where they were in pre-Covid levels, i.e. at around €120 million or more.

For me, Covid sales are unclear at this stage. With the company being in remediation talks with the EU, I can’t expect it to sit on the sidelines with such a perfect vaccine once routine immunization will become more normal. The vaccine, the only of its kind in Europe, can be used as a booster shot leading to hybrid immunity, with persistent efficacy across different variants. The company’s €430 million to €590 million total revenue for the year was largely based on Covid-sales, and that number will have to be revised downward. But I believe the market has discounted that.

The company’s R&D expenses should go down as they soon won’t be related from the chikungunya vaccine candidate anymore. Pfizer is in part providing funding for the Lyme disease candidate.

Approval of the chikungunya vaccine may be on the company’s doorstep, with risk-adjusted peak sales of €260 million being possible in some years’ time, which means this vaccine candidate has the potential of tripling the current sales revenue of around $100 million over time. This vaccine would be included in the travelers health portfolio, for which Valneva already has a commercial team in operation, so I assume that will not lead to disproportionate additional costs.

Finally, I have made an estimate above of revenues that could be derived from the world’s only Lyme vaccine backed by Pfizer at $216 million for the US and €108 million for the EU. This asset, too, is largely de-risked in my eyes, as there is no other vaccine candidate in clinical trials.

One sees that the company holds the biggest potential in its two late-stage assets, with immediate catalysts around the corner.

Risks

The major short-term risk I see is the market’s interpretation of possibly revised sales guidance for the year 2022. I believe Valneva has communicated well about the EU’s wish to terminate the contract for the Covid-vaccine. The company is in remediation talks, as mentioned above, but it is impossible to say at this time what will come out of that. I am, for the short-term future, not giving the Covid vaccine much value.

Furthermore, if either the chikungunya vaccine candidate does not get approved, or the Lyme disease candidate would for some reason yield less positive results or show side effects in a Phase 3 trial, then the narrative here would need to be changed. I consider both risks to be low, as we are dealing with far-advanced assets which have been tested abundantly in large-scale trials.

A further risk includes delayed uptake of the traveler’s health portfolio, despite a Covid-unwinding world.

Conclusion

Valneva has an ongoing travelers health business which I assume will have done well for the past quarter, with possibly reduced R&D costs. Quarterly earnings will be reported on August 11, 2022, so we will know at that time whether that’s correct. On the other hand, I assume the company’s guidance on its Covid-vaccine is off the table in light of an oversupply of Covid-vaccines and the company being in contract remediation talks with the EU.

More importantly, two major catalysts are around the corner: a biologics license application for chikungunya vaccine and a Phase 3 trial for the world’s only Lyme vaccine candidate. I explain above why I see both as possibly strong catalysts for the company. Valneva, apparently still quite unknown to the greater public although it has a market cap of more than 1 billion, is trading near the low end of its 52-week range.

Looking at the price volatility in June, I assume that the market has taken into account the company’s recent guidance on contract remediation talks with the EU. The caveat is that the market has not fully discounted this yet. I am rating this company as a buy in light of the upcoming catalysts, and in light of the tremendous potential coming from both the chikungunya and Lyme vaccine business as set out above. Pfizer recently took an equity investment of 8.1% and has shown repeated and ever stronger interest in the company’s Lyme vaccine candidate.