The Week On Wall Street: Glass Half Full; Glass Half Empty

wakila/E+ via Getty Images

« It is a way to take people’s wealth from them without having to openly raise taxes. Inflation is the most universal tax of all. » – Thomas Sowell

Glass Half Empty

It’s a new year, investors have changed the page on the calendar, and they have also changed their mindset when it comes to the equity market. Needless to say, while it’s still early, 2022 is not following the same playbook that was used last year. This reinforces the point that market participants have to remain flexible to survive the mind games of the equity market.

Sentiment and trends have shifted because the backdrop changed. Last year the parade of new highs was never-ending and the leader board was filled with mega caps. The Fed was a non-participant. Not so at the start of this year. A sector that was thought written off and proclaimed « uninvestable » by some, Energy, is maintaining its strength from last year.

Add in the other value and cyclicals that have performed so far and this equity market is far different than what some have become accustomed to. As we start the year, the value trade has both valuation and momentum going for it, so this new momentum trade may have room to run. This quick change in sentiment seems to have caught many investors offsides.

Investors have recognized the « issues » they have to face this year and the thought of higher interest rates is at the forefront of their collective minds now. When we start poking around at historical results during rate cycles and « midterm election year the situation becomes at the very least « volatile » keeping investors on edge.

Glass Half Full

However, there are plenty of things that could go right. Starting with the notion of rising interest rates. I note that while this brings knee-jerk market reactions, history tells us they usually don’t usher in market debacles. Returns can be muted and once the emotional situation settles down, the stock market performs pretty well after rates have risen. That is because rates usually rise while the economy remains strong.

Herein lies a KEY for ’22, as the outcome regarding inflation could go either way. The economy has to remain resilient because in this rate cycle the Fed has embarked on this mission for the sole purpose of fighting inflation. Of course, we could see inflation start to peak, which will take some of the pressure off the Fed and reduce the chances the Fed tightens too quickly. In that regard, the Fed is going to need help, and to date, the cavalry is asleep in the barn. If we see a 1% Fed funds rate at the end of the year, it won’t do much to an inflation rate that is running at 7%.

As Fed Chair Powell testified this week, there has been little progress on the supply chain issues (many see this as the culprit) that continue unabated and have lasted far longer than many anticipated. A key area to watch going forward.

There is also an issue the stock market will be paying attention to and that is corporate earnings. There is little to support an argument that we won’t see more positive surprises, although we can expect them to moderate. I doubt the extraordinarily high « beat » rate matches previous quarters, but it should be high enough to generate positive sentiment.

Finally, we may see an end or at the very least diminished impact from Covid. The Omicron variant spread through the U.S. at the fastest pace since the start of the pandemic. Despite this variant being milder, draconian measures that disrupted school openings, return to work, and leisure activities were back in force in some areas of the country.

The good news is it’s expected to pass just as quickly as it came. The consensus view from the « experts » noted from the beginning that each successive variant will become less and less impactful on the health of society. That is the case with Omicron and it just might be the last gasp. If nothing else, the message that we all have to learn to live with the disease will eventually sink in. We’ve already seen plenty of pushback and at some point will effectively overrun the minority (numbers not race) views that handcuff the economy. Normalcy slowly returns.

Now, plenty of things will have to go just right for ’22 to have a chance of keeping the recovery going. We might not get the desired result on every issue, but it is possible, and if we use an « open mind » we should at the very least keep « glass half full » on the table.

The Week On Wall Street

The negative sentiment that has been evident in the HIGH PE sector of the market spread to the general market on Monday. All of the major indices sold off hard finally found support levels that held then staged a solid rebound rally to close the day well off the lows. The NASDAQ reversed a 400+ point loss and closed with a modest gain on the day. At the intraday lows, the S&P was 2.6% off the latest high set 5 trading days earlier.

It took a while, but Turnaround Tuesday finally arrived. Once the downside probing ended the indices staged another reversal. It was more of the same on Wednesday, fits of starts and stops as indecision became the short-term trend.

Indecision turned into outright selling when the S&P had trouble building on the 2-day rally. Stocks were sold across the board on Thursday and week into the session on Friday before bargain hunters showed up before the 3-day weekend.

The S&P made it back-to-back weeks with a loss leaving the index less than 3% from the all-time high as investors will now ponder what comes next over the holiday weekend.

The Economy

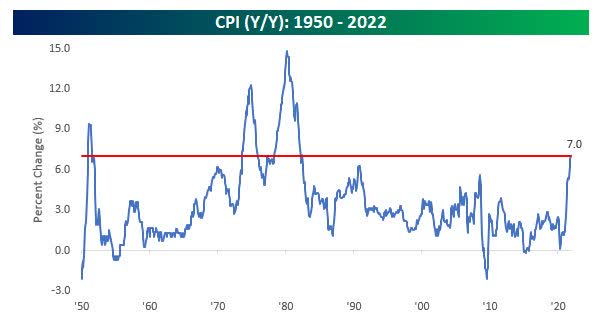

The CPI report beat analyst estimates again in December, with gains of 0.5% for the headline and 0.6% for the core. On a year-over-year basis, headline CPI increased 7.0%, and as shown in the chart below, that’s the highest rate of change since 1982.

CPI Bespoke

Not only are consumer prices up significantly over the last year, but the pace at which we have reached these levels is also nearly unprecedented. A year ago at this time, CPI was only rising at a year-over-year rate of 1.4%. That rate of increase has now accelerated by a full 5.6 percentage points. Going back to 1951, the only other times that the rate of change in Y/Y CPI increased at a similar or higher rate were in 1951 and 1974.

Headline PPI rose 0.2% and the core increased 0.5% in December, near expectations, following respective gains of 0.8% and 0.7% in November. This is the smallest monthly gain since an unchanged print from November 2020. But the annual rates of growth accelerated to 9.7% year over year from 9.6% on the headline and to 8.3% year over year versus 7.7% y/y previously.

For the year over year data, these are both fresh record highs, extending the streak of monthly peaks going back to last spring.

The NFIB Small Business Optimism Index increased slightly in December to 98.9, up 0.5 points from November. Twenty-two percent of small business owners reported that inflation was their single most important problem encountered in operating their business. Price raising activities have reached levels not seen since the early 1980s when prices were rising at double-digit rates. NFIB Chief Economist Bill Dunkelberg:

« Small businesses, unfortunately, saw a disappointing December jobs report, with staffing issues continuing to impact their ability to be fully productive. Inflation is at the highest level since the 1980s and is having an overwhelming impact on owners’ ability to manage their businesses. »

Consumer

While retail sales closed last year with a whimper, overall sales for 2021 were robust. December sales plunged 1.9% in December and dropped 2.3% excluding autos, much weaker than expected. December sales were restrained by both a pull-ahead of holiday sales into early-Q4 due to feared supply shortages, and a headwind to holiday activity from the Omicron variant.

Year-over-year, retail sales increased 16.9%

Consumer sentiment dropped to 68.8 in the preliminary January print from the University of Michigan survey, down 1.8 points, basically halving the 3.2 point rebound to 70.6 in December. This is marginally above the 10-year low of 67.4 from November. Much of the weakness was in the expectations component that fell to 65.9 after rising to 68.3 previously.

The current conditions slipped to 73.2 following the pick-up to 74.2 last month. The 12-month inflation gauge rose back to 4.9% from the 4.8% in December but is again on par with November’s 4.9% that is the highest since mid-2008.

Consumers are responding to the environment that is in place now in the economy. At some point, this seeps into consumer spending.

The Global Scene

Eurozone

European consumers have been slower than their U.S. counterparts to bounce back, but economists now anticipate a revival in Europe this year, perhaps exceeding 5% growth in real terms. One reason: excess savings in the euro area amount to roughly 12% of a year’s worth of pre-pandemic spending.

China

China’s politically volatile global trade surplus surged to $676.4 billion in 2021, likely the highest ever for any country, as exports jumped 29.9% over a year earlier despite semiconductor shortages that disrupted manufacturing. Exports rose to $3.3 trillion in 2021 despite shortages of processor chips for smartphones and other goods as global demand rebounded from the coronavirus pandemic. Quite an accomplishment considering manufacturers were hampered by power rationing in some areas to meet government efficiency targets.

Inflation – Public Enemy Number One

Inflation is a growing problem that requires effective solutions. What is so concerning these days; the underlying causes haven’t been addressed. Instead, market participants have witnessed a search for « scapegoats ».

It’s been said that Corporate America is responsible with consortiums to fix prices, price gouging by these greedy corporations in certain segments of the economy. This time around it’s the meat industry. The administration is now blaming the meatpackers, who handle the processing, packaging, and distribution of meat raised by farmers and ranchers of price-gouging all in an attempt to drive prices higher for beef, chicken, and pork.

Unable or unwilling to acknowledge the problems driving inflation, what investors are hearing is a repeat of the same failed policies that got us into this inflationary mess in the first place.

Meat prices are surging because the meat industry, like virtually every other industry, is facing dramatically higher input and labor costs. This isn’t a secret. Start with feed costs, which are at historic highs. As the Wall Street Journal reported on Dec. 27, feed costs skyrocketed in 2021 and are expected to be volatile this year. This makes it more expensive to raise livestock, which in turn creates higher costs for meat.

Feed costs are higher in part because fertilizer costs are higher. American Farm Bureau Federation data show costs for anhydrous ammonia, used in nitrogen fertilizer, were up 210% in September 2021 compared with a year earlier.

Fuel costs have soared, with gasoline prices up 58% in November compared with the previous year, according to the Bureau of Labor Statistics. That increases the cost of transporting livestock to processing plants and finished products from processing plants to your local grocery store.

Labor costs are also higher-a lot higher. The Washington Post reports that meat processors were paying a starting wage of $14.50 an hour before the pandemic – a figure that has jumped to $22. Tyson Foods (NYSE:TSN) recently announced it spent $500 million last year on wage increases and bonuses, including $50 million on employee bonuses. When the next spokesperson steps us to the microphone and cries that greedy corporations need to pay their employees more they should be aware of the facts, and secondly, be careful what they are wishing for.

But with 10.6 million job openings in November, only 6.8 million people unemployed and 4.5 million people that have quit their jobs, meat processors, like most businesses, had trouble finding and retaining workers despite significant wage increases. This labor shortage creates supply bottlenecks.

With the demand for meat up worldwide, higher costs plus labor-induced supply shortages are driving dramatic price increases. For the average person that isn’t trying to manufacture « excuses », supply and demand aren’t hard to understand. Common sense goes out the window when politicians play the blame game.

It doesn’t stop there. This goes one step further and sets up a frightening scenario on the inflation front. The administration wants to increase federal scrutiny of meatpackers on antitrust grounds as a means to get prices down. Four packing companies account for about 80% of beef processing, 70% of pork processing, and a little over half of the poultry processing. But the « big four » companies the president identified compete with each other, much like big companies in other industries. About half the chicken market is controlled by competitive regional companies, not the big guys.

Bottom line; meat prices have surged because of skyrocketing costs and labor shortages, not a lack of competition. This industry isn’t unique, these and other issues are pervasive throughout the economy. Acknowledging and addressing these problems could actually help reduce inflation.

Why is that so important? It will take more than the Fed to fight inflation. Staying with the pervasive anti-business approach to every issue will eventually kill growth. Entertaining the notion that everyone and everything is responsible except the unnecessary government spending that’s actually fueling it is a recipe for further inflationary issues. By the way, this is the SAME rhetoric that was bandied about in the ’70s, the last time inflation roared out of control.

The Fed’s proposed increases will raise the Fed funds rate to 1%. That won’t come close to quelling 7% inflation.

The last time we had 7% inflation the Fed funds rate was 11.5%.

Investors are going to have to see results on this issue very soon. The knee-jerk reactions we have seen to a « headline » will look like a walk in Disney World compared to what unchecked and entrenched inflation will rain down on the economy and investor portfolios.

Facts and Truth are unpopular subjects because they are unquestionably correct.

Earnings

Elevated new orders in Q4 economic surveys bode well for positive surprises in the Q4 earnings season, which began this week. It is also likely that the level of surprise continues to moderate, following extraordinarily high beats for the vast majority of this recovery. A look at the « early Q4 reporters » is consistent with this thinking, as 81% of the companies are beating earnings estimates by 6% (above 15-year averages of 69.5% and 5.3% respectively).

I’ve also noted a decent number of companies offering interim reports raising their outlook. Demand is likely to remain elevated as inventories get replenished from very low levels should support upside to earnings estimates.

The Financials started the earnings parade with JPMorgan (NYSE:JPM), Wells Fargo (NYSE:WFC), and BlackRock (NYSE:BLK) reporting Friday. All three reported solid results but the market reactions were mixed.

If I received one message on Friday, I received five from investors wondering what is wrong with the banks. Specifically JPMorgan. Ladies and gentlemen stocks do pause. The recent high for JPM is 171, the stock traded at 168 before the announcement. Shares sold for $150 in September. The pullback after EPS is well within reason. Stocks do retreat – they do go down – they don’t go up without pause. There is no message from the banks, and it isn’t a precursor of what to expect in the rest of this earnings season.

The Daily chart of the S&P 500 (SPY)

A topsy-turvy week with a rally that looked like it was headed back to the highs, only to be cut short sending the S&P back down to test support levels. While the volatility index might not be spiking, investors’ blood pressure readings may be doing just that.

S&P 1-14 FreeStockCharts.com

The BULLS take the microphone as an intro, only to be followed by a song from the BEARS, that is followed by a closing dialogue from the « NEUTRALS ». This week was a head-scratcher for sure, leaving all options open for what comes next.

The 2022 Playbook Is Full Of Opportunities

This year more than ever, it comes down to selectivity and diversification. While the S&P is down 1.6% YTD, my SAVVY 2022 HIGH conviction stocks have recorded a 6% gain.

Two weeks into the New year and it has already been a topsy-turvy experience for investors. It’s been a tale of two markets, and it has been a tough one for growth stocks as the Nasdaq is down approximately twice as much YTD versus the S&P 500 (-4.8% vs -2.1%). More importantly, investors have witnessed a stealth BEAR market occurring under the surface of the major indices.

We’ve seen the « bubbles » that so many were concerned about « pop ». IPOs as measured by the Renaissance ETF (NYSEARCA:IPO) is down ~30% since they saw a peak in February of last year. SPACS, the « meme » stocks, and Alternative Energy have been punished. Other speculative areas like HIGH growth PE stocks and Cryptocurrency have been clobbered since the start of the year. In short, this market is rapidly unwinding many of the most speculative excesses of the past two years to start 2022, and the trend hasn’t slowed yet.

When a bubble bursts, it’s not often that we see the asset pick back up and immediately start making the same kind of outsized moves again. Usually, it takes a long time to rebuild and I think that could be the case with these areas of the market.

Stealth Bear Market?

Looking back in December when the major averages were anywhere from 0.5% to 6.1% away from their 52-week highs, in every case, the average stock in the index was much, much weaker. Depending on what index we look at the average stock was down between 11% and 28%. Most egregiously, the NASDAQ Composite (3,605 stocks) was only 3.6% away from its 52-week high as of December 13, but its average stock was down almost 40%. I’ve shared a few stats over the past month that show that we may have already lived through a stealth correction or bear market, and it’s hard to argue against it when we see more statistics like this.

The Bifurcated Market

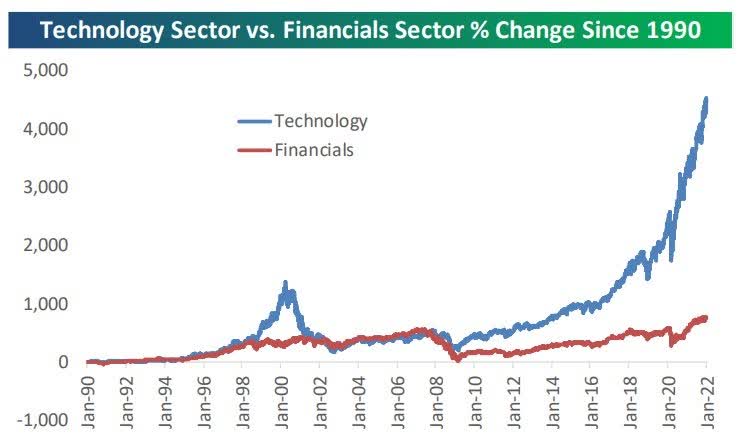

The move to value has been swift, it decimated HIGH PE growth and sent growth in general into a pullback. This price action is leaving many investors questioning whether this move will have any lasting power. Looking at how the two areas of the market have separated, it’s easy to make a case that over a while this will be rectified.

Tech Vs. Banks Bespoke

Investors already have a lot to think about and can now wonder if this morphs into another crash scene for tech or a combination of a strong rally in value combined with a very decent pullback in tech.

Small Caps

A different month, a different year, but it’s the same story. The Russell small caps (NYSEARCA:IWM) remain in a well-defined trading range. At the recent low, it was 10.7% off its high. The ping pong match in the Russell continued this week as the small caps rallied 1% off of what is seemingly a never-ending test of support.

However, similar to the overall market scene it’s a tale of two markets. Small-cap Value (NYSEARCA:VBR) buoys the sector, while small-cap growth (NYSEARCA:VBK) is adding downside pressure.

Growth vs. Value

When we start to look around for strength in the market, it is pretty clear investors are looking for « value » and more often than not, dividend-paying companies fall into that category.

DVY 1-14 FeeStockCharts.com

After building a nice base in the second half of 2021, DVY is making another leg higher at the moment. Perhaps the beginning of what will turn into a long-term move higher.

« FINERGY » (Financials/Energy) on Fire

This trade has been somewhat overlooked by the talking heads but as we have discussed week after week it’s been going on for a while now. Over the last 12 months, Financials are now up 35%, while Energy is up nearly 55%. This « trade » has been highlighted here for over a year now.

Energy

After testing intermediate support in December, the energy complex (NYSEARCA:XLE) has taken off on another leg higher. A close above $83 on WTI was a catalyst, and with Energy representing « value », the sector is in demand. While the ETF is extended now, there will be entry points presented and any pullback is a buying opportunity.

The Oil Exploration ETF (NYSEARCA:XOP) is up around 13+% in the past two weeks. If the bigger picture pattern continues to play out, it could only be getting started. The « technicals » support a move higher and there doesn’t appear to be any change in the fundamental scene regarding energy policy in the U.S.

Financials

Interest rates move higher and the Financial ETF (NYSEARCA:XLF) follows along with a new high. Similar to the prices of bank stocks, rates were extended and both pulled back from extended levels. Strength begets strength and breakouts are not something any investor should fear. The regional banks look more attractive now.

Homebuilders

As mortgage rates have risen, the homebuilder stocks have begun to get hit. They’re not down too much from highs, but the homebuilder ETF (NYSEARCA:XHB) recently made a series of lower highs. After testing support on Monday the group staged a nice rebound before selling wiped out some of the gains. Whether any rally has staying power is yet to be seen. Longer-term any increase in rates shouldn’t be enough to tamper down demand.

Savvy favorite D.R. Horton (NYSE:DHI) is up a nifty 53% since purchase in Q4 ’20. Shares moved 7+% off the lows this week, before pulling back on Friday, and remains a top selection for ’22.

KB Home (NYSE:KBH) (another savvy pick) and Lennar (NYSE:LEN) posted outstanding EPS results with favorable guidance. The latter just raised its dividend by 50%.

Technology

We just witnessed a bloodbath in the HIGH PE stocks, but the larger mega-cap names in Technology also took a hit. With sentiment changing, it is time to put this group in perspective and investors may have to tread carefully here as well over the near term. At some point « everything » reverts to the mean and enters consolidation phases. « Value-Tech » is not immune. They have been market leaders for a very long time.

I’m not suggesting a blood bath in technology, but I am seeing signs that it won’t be so easy to navigate this area of the market as it has in the past. AAPL, MSFT, GOOG, TSLA, etc. are examples of big-names that have recently broken their short-term support. By no means is that a dire warning but it is something investors should keep an eye on.

Extended weakness in mega-cap tech could add pressure to the indices, BUT there is the possibility of a « softer landing » when the top stocks pull back if others emerge to take their place. Another reason to be vigilant. That doesn’t mean I’m running from these names. I continue to HOLD them as a CORE of my portfolio. Eventually, investors will come back to why they are the « darlings » of the market.

While valuations for tech-oriented firms are elevated, they are justified by the continued strength in earnings and the fact that business plans for future tech spending are at record highs.

However, in the short term, NONE of that matters to those that have a myopic view of the markets. There comes a time when the FEAR of others becomes the friend of Savvy investors.

Semiconductors

Even though many of the semiconductor stocks do not fall into the HIGHLY speculative, little to no earnings category, this group also sold off. The semiconductor ETF (NASDAQ:SOXX) has rebounded and it remains to be seen if this leading group gets back in stride. This group has been a leader for so long that wouldn’t be shocking if we see back and forth action that eventually leads to more price weakness. Any pause is well overdue.

Another case where I am maintaining my positioning in this group as the secular tailwinds are secure and in place.

ARK Innovation ETF (ARKK)

Of course, when things were going well Cathy Wood, the manager of the ETF was genius, and now that there is a reversal of fortune there is plenty of criticism to be found.

Her objective is to find stocks that can change the landscape. In doing so the ARK family of funds is dealing with some of the most speculative and unproven stocks in the market. Investors have to start realizing that returns are going to be highly variable. When the underlying environment is favorable to these strategies, huge outperformance is the norm. However, when the winds change, the declines can be very difficult to watch.

Many are writing off the entire ARK family of funds, I’m not one of them. I am always aware of what sentiment can, and will do when it comes to investing in ANY sector. It wasn’t too long ago where I heard commentary stating anyone that held energy stocks was a fool because that sector was DEAD forever.

However, an investor has to use the tools available and take a more nimble approach now. Of course, if you are a true long-term investor who believes ARK will grow returns over 5-10+ years, you also understand there will be these periods of poor performance that have to be endured.

Cryptocurrency

BTC extended its losing streak to 7 days with another losing session on Monday the longest losing skein since 2018. That was the lowest point since last September. That came to an end with a rebound rally that would be described as modest at best.

Final Thoughts

The market backdrop is set up for plenty of « starts » and « stops ». The Fed takes center stage, but they will need a lot of luck and plenty of assistance to thread the needle in fighting inflation while trying to keep the economy afloat. Hope is not a strategy. Anyone hoping that we see a change to policies that help the situation may want to rethink that strategy.

There is any number of signals that can turn Green or start flashing Red. Whether you see a glass half full or a glass half empty, your glass needs to be filled with facts.

Postscript

Please allow me to take a moment and remind all of the readers of an important issue. I provide investment advice to clients and members of my marketplace service. Each week I strive to provide an investment backdrop that helps investors make their own decisions. In these types of forums, readers bring a host of situations and variables to the table when visiting these articles. Therefore it is impossible to pinpoint what may be right for each situation.

In different circumstances, I can determine each client’s situation/requirements and discuss issues with them when needed. That is impossible with readers of these articles. Therefore I will attempt to help form an opinion without crossing the line into specific advice. Please keep that in mind when forming your investment strategy.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!