Libor’s US replacements: no one rate to rule them all

A while back, FT Alphaville wrote about how sterling Libor’s demise was causing all sorts of headaches for the UK’s financial services industry. But the problems we’ve had on this side of the pond are nothing compared with the situation we’re seeing play out in the US right now.

There are many reasons why the attempts to ditch dollar Libor are proving more difficult on the other side of the Atlantic. One of them is that there are multiple candidates vying to replace the doomed benchmark.

The UK’s Libor transition is not without its issues. But what’s helped is that a consensus has formed around the Sterling Overnight Interbank Rate, or SONIA, as the agreed-upon alternative.

The situation in the US is more complex, with several benchmarks all competing for the title of Libor successor. In turn, this is leading many market players to put off replacing Libor in their financial contracts as well as slowing the process to a widely approved alternative.

How the ARRC’s built

In theory, the winner has been picked by The Alternative Reference Rates Committee, or ARRC. The group, which is made up of the banks but convened by the Federal Reserve Board and the New York Fed, has led the transition effort. After a lengthy consultation, the AARC eventually settled on SOFR, or the Secured Overnight Financing Rate, as its recommended alternative to replace Libor. The New York Fed publishes the measure daily.

Yet, while SOFR has — like SONIA — garnered official endorsement, there’s a fundamental difference between the two (and it’s not just that the former is rather trickier to pronounce). Unlike SONIA, which is based on unsecured borrowing rates, the US rate is based on overnight borrowing in the repo market, where US Treasuries are used as collateral.

SOFR, so good?

It’s easy to see the attraction of choosing a rate based on the repo market. For starters, it’s massive, with more than $1tn-worth of transactions daily. So there’s far less chance of SOFR proving tricky to measure due to a paucity of activity — the deciding factor in Libor’s downfall.

That SOFR is produced by the New York Fed, as opposed to the British Bankers’ Association, which recorded Libor in its pre-scandal glory years, also lends it an air of kudos. When it comes to fixing, no financial metric in the world is watertight, but we’d trust a central bank a lot more than we would a trade body.

However, there are a couple of concerns. Critics argue that, while the repo market is where the likes of J.P. Morgan might fund themselves, there are thousands of banks in the US that rely on other sources of funding.

Readers with decent memories might recall that, during the autumn of 2019, the repo market became extremely volatile, with the rate soaring several hundred basis points above the federal funds rate. (For those who haven’t, or who don’t, see here.)

That bout of volatility led the Bank for International Settlements to claim that the repo market was dominated by four banks, with holdings of Treasuries overwhelmingly concentrated in the largest financial institutions. The New York Fed hit back via its Liberty Street Economics blog, where it argued that, by focusing on only one portion of the repo market, the BIS’s concerns were overplayed. If you look at the repo market in its totality, then it is not nearly as concentrated as the BIS makes out.

You can go back and forth on whether the repo market is too concentrated, but what’s indisputable is that, unlike in the UK, where banking is dominated by a few large players, the US financial landscape is far more diverse, with about 5,000 retail banks scattered around the country. All of the major players in the UK use the overnight money markets, so it makes sense to rely on SONIA. In contrast, in the US many banks rely more heavily on commercial paper or certificates of deposit than Treasuries for short-term funding.

So SOFR isn’t exactly representative of many institutions’ cost of funds. In a time of crisis, like last March, that might be an issue.

We know that Treasuries aren’t a perfect replacement for cash, but secured overnight borrowing based on US government paper is likely to be far cheaper when there’s a flight to safety. As we saw in 2008, access to unsecured borrowing at longer maturities can even slam shut in times of crisis.

And whether you think ARRC was right or wrong to plump for SOFR is, is in some respects, a moot point. That many do not think it represents their cost of funding has meant that other alternative rates have grown in strength.

Ameribor and more

There’s one alternative in particular that’s garnered a lot of attention: Ameribor. This, the brainchild of a panama-hat-sporting mid-Westerner by the name of Richard Sandor, has been around for longer than SOFR.

It was conceived of 10 years ago and, according to its creator, was set up to better reflect the actual borrowing costs of America’s smaller lenders than a rate fixed an ocean away in the City of London. The rate is calculated using borrowing that takes place on Sandor’s American Financial Exchange — dreamt up at the same time as Ameribor, with a view to creating a deeper market for funding smaller lenders — and began electronic trading in 2015 with just four banks.

Here’s Sandor talking to us about the AFX’s genesis:

We wanted to create a market that would be more reflective of what funding costs ought to be for smaller banks than the current bilateral arrangements. So we got on a plane and, instead of going to London, we went to Tupelo, Mississippi, to Bentonville, Arkansas. We’ve visited banks in 125 small cities in total. At first we were laughed at. But, as Schopenhauer says, the truth grows in three stages: first, it’s ridiculed; the second, it is violently opposed; the third, it’s accepted as self-evident. The ridicule abated in 2014, when the Fed said it would build an alternative to Libor.

The transactions on the exchange are then used as a basis to calculate Ameribor which, along with an overnight rate, also has a one-month forward-looking, or term, rate. That makes it more handy to use in loans than backward-looking ones, like SOFR averages. In the process, Sandor thinks that he’s helped create a national interest rate market:

We are in 50 states. We’ve got Appalachian banks lending to Brooklyn banks. We’ve got 1,700 bilateral credit lines, among banks that never knew each other. We’ve given lenders and borrowers choices that they didn’t have before.

Bloomberg’s Short-Term Bank Yield Index, or BSBY, attempts to do a similar thing, using, according to this marketing blurb, “aggregated and anonymized data that is anchored in transactions of Commercial Paper, Certificates of Deposit, USD bank deposits, and short term bank bond trades”. BSBY is garnering some attention right now, with banks issuing multiyear paper linked to the benchmark. It has the advantage of five tenors, going up to 12 months. ICE Benchmark Administration, which records the Libor settings right now, also plans to offer the US Dollar ICE Bank Yield Index as a credit-sensitive replacement. (Tracy Alloway mentions some other candidates here.) In response, ARRC is pressing ahead with plans to create its own term structure, with multiple tenors. Last week, it announced that CME Group would administer its term rate.

Nevertheless, these alternatives are gaining momentum. In late April, the Loan Syndications & Trading Association, a trade body for the US syndicated loans market, advised parties about how to use credit sensitive rates such as BSBY and Ameribor, among others, as fallbacks in financial contracts that are currently underpinned by Libor.

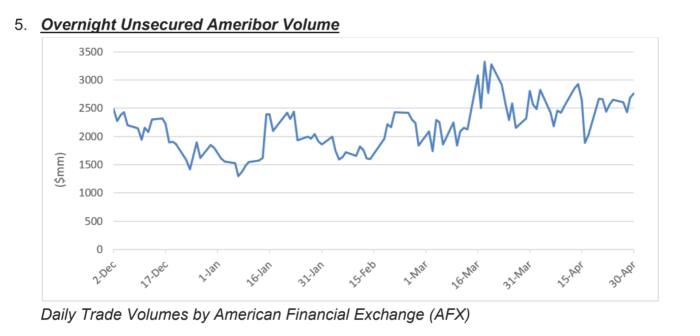

All are clear improvements on Libor in the sense that they are based on actual transactions. Yet the volumes upon which they are based are far shallower than those of SOFR. For Ameribor, the average value of transactions during the first half of 2020 was just $2bn. The BSBY median traded volume from December 2017 to October 2020 was just under four times that, at $7.4bn. Those are not very big numbers.

This has provoked concerns that the markets in which the transactions supporting the alternatives take place will prove far less liquid, and borrowing against the alternative benchmarks more expensive, in times of stress. For BSBY, volumes shrank to a low of $3.5bn during the early months of the pandemic in March and April 2020. Though surprisingly, the American Financial Exchange transactions underlying Ameribor actually rose during the period, according to a note from the Berkeley Research Group.

The official view on these alternatives, meanwhile, is confusing. US authorities are, on the face of it, far less fussed about there being a number of competing alternatives than their counterparts on this side of the Atlantic. As Philip Lee, counsel at Linklaters in New York, puts it:

The Federal Reserve Board, New York Fed, the ARRC, they’re very clear in saying they’re not mandating the use of SOFR, just recommending it. The view is that this really is a commercial decision, that it is for the parties to choose.

Lee says this lack of clear support may be creating “a chicken and egg problem”, with no one want to stick their neck out and move to an alternative that one day proves unpopular.

We think that’s right. The case of the UK illustrates that transition is sluggish enough even when there is a regulatory push to stick SONIA in as many contracts as possible. There’s a clear first-mover disadvantage at play, where parties — fearing conduct risk, or losing customers — are scared to make the leap beyond Libor until they have a fair idea whether US institutions will switch to SOFR, or multiple benchmarks.

Indeed, the AARC thinks the amount of US dollar Libor-linked contracts has actually risen to $223tn, as of March, up from $199tn at the end of 2016. The bulk of this is in derivatives, but the outstanding volume of cash products linked to Libor have also risen. As a reminder, we’ve known Libor was going to die since the summer of 2017. While the transition in the UK is far from complete, in markets such as fixed-income, Libor-linked issuance is non-existent. Catherine Wade, a London-based counsel at Linklaters, told us:

We haven’t seen any new sterling Libor contracts in the public bond markets for a while now. The Sonia bond market has become incredibly well established in quite a short period of time.

Just to make things even murkier, while the US authorities will not explicitly say parties ought to use SOFR, they do draw attention to the alternatives’ flaws. Here’s John Williams, chair of the New York Fed, in May:

No other rate has the depth of transactions of the repo market that underlines SOFR . ..

As we move towards the post-Libor world, we must make sure that we are building a house with a sturdy foundation with the most robust reference rates available.

Williams added that once those “foundations” were in place, a house “with an assortment of reference rates’‘ could follow. This strikes us as disingenuous. If SOFR becomes entrenched, then that would likely weaken the alternatives by discouraging the creation of a market with the strength in depth that officials seem to desire.

There is no choice but choice

Let’s not be myopic here. That there are multiple alternatives for an alternative reference rate is not all-important in explaining why the US transition is taking longer than in the UK. But it is a factor.

Take the attempts to create an officially endorsed replacement for term Libor. As we wrote in May, the ARRC wants to see a lot more liquidity in SOFR-linked derivatives markets and a lot more cash products, such as loans, linked to SOFR before it backs a term rate. But the more the market is split into different camps, the longer that will take to reach a level the ARRC deems acceptable.

Yet given the breadth, diversity and depth of the US financial market, we’re not sure it makes sense to ape the UK and just have one replacement rate. Sandor put it best:

The genius of the US model of financial governance is that it lets the market sort it out. That’s partly because it’s such a big country, because it’s so decentralised. What that means when it comes to Libor transition is that officials here can’t be like the UK and say there’s one replacement rate. There are different structural needs here. I’ve been to Oklahoma City, to Tulsa, to San Antonio. I’ve spoken to people in these places, it’s not just an academic point of view that their cost of funds isn’t the same as for the big Wall Street banks.

While that means the US transition is going to drag out for a while, Meredith Coffey of LSTA thinks that could be for the best:

Markets compete, we might be in a multi-rate environment for a while. The discussion on which alternative rate to use — if not SOFR — does slow things down a little. But I don’t think that’s a terrible thing. We’re in a period where people need to figure out what works for them.

When you think about it as much as we have had to, it begins to strike you as bizarre that pretty much all the floating rate contracts all over the world were underpinned by one rate put together on the back of guesswork by a dozen or so people every morning in skyscrapers in the Square Mile and Canary Wharf. It’s a bit like having one stock index for the world. Or one oil price. With neither based on actual transactions.

Having one rate to rule them all made life simpler. It made markets more efficient too. What we are confronted with now is more complex, but also more reflective of how finance actually works. If we want to avoid ending up here again decades from now, it may well be that there is no choice but choice.