Five tax threats to your pension

In principle, the government likes to give us tax breaks on pension savings so we have enough money when we retire and don’t end up dependent on the state.

In practice, tax relief on pensions has constantly been in the chancellor’s crosshairs.

And the strain on the nation’s finances from the Covid-19 crisis has increased the chances of pension tax perks for wealthier retirement savers being raided to help pay the nation’s pandemic bill.

Having spent about £400bn propping up the economy during the Covid-19 crisis, chancellor Rishi Sunak is looking for ways to rebalance the finances.

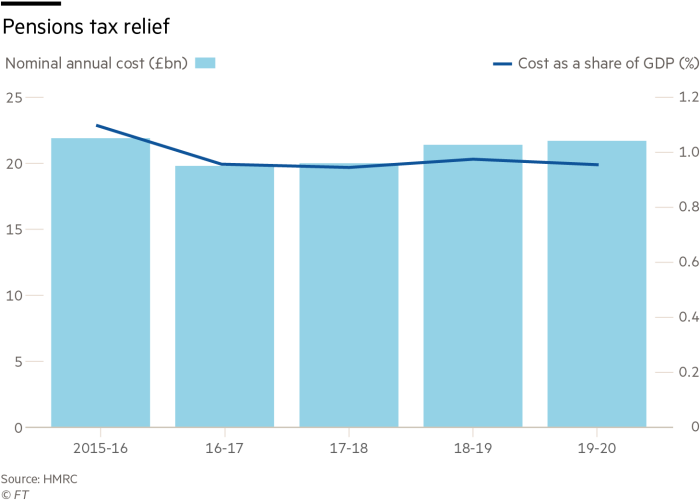

At an estimated cost to the exchequer of £21bn a year, pensions tax relief looks ripe for further cuts.

“Pensions are such an obvious low-hanging fruit, it seems likely that they will be targeted at some point,” says Holly Mackay, founder and chief executive of Boring Money, a financial website for consumers.

“No one knows when the changes will come but I think we can agree that they will.”

FT money assesses what the chancellor might target and gives you tips on how to mitigate the impact of any further cuts to tax relief.

1. Lifetime allowance — further cuts

Likelihood of changes: medium to high

The lifetime allowance (LTA) governs how much can be saved, or grow, in a defined contribution or defined benefit pension cumulatively before tax charges apply. Successive chancellors have chipped away at the generosity of the LTA, which has shrunk from a peak of £1.8m in 2010-11 to £1.073m today.

This year, the chancellor froze the LTA at its current level for the remainder of this parliament. Pension funds in excess of the LTA are currently taxed at a rate of 55 per cent if taken as a lump sum and 25 per cent if taken as an income.

Most workers will not be troubled by the threat of breaching the LTA, however successive cuts to this allowance, particularly in recent years, have meant it is no longer just an issue for the very highest earners. Long-serving teachers, nurses and police officers — who have risen up the career ranks — are among those at risk of breaching the LTA due to the way pension growth is calculated in public sector retirement schemes.

Rebecca O’Connor, head of pensions and savings with Interactive Investor, the investment platform, thinks the chances of further cuts to the LTA are high.

“Reducing the lifetime allowance would be an extremely canny way of raising revenue from people’s pension pots over the long term because it is less visible and therefore less politically controversial than taxing property wealth,” she says.

“If it was reduced to £800,000 or £900,000, as has been reported, then it actually becomes more of a middle-class tax, because although such amounts sound very large and are indeed significantly higher than the average defined contribution pension pot is currently, the pot size somebody will need in 10 or 20 years to generate a decent income is going to be higher than it is now because of inflation.”

ACTION: Boost savings before protecting your pot

If there were to be another cut to the LTA, this would probably be accompanied by another opportunity to “protect” your current allowance level, but in exchange for making no further contributions to your pension plan. This means the pension can increase but only through investment growth.

Christine Ross, client director and head of private office — north with Handelsbanken Wealth & Asset Management, says that if you still have a reasonable amount of headroom between your fund value and the current LTA it may be prudent to maximise contributions now and apply for any transitional protection that is offered.

“Employees benefiting from employer pension contributions whose funds are nearing the lifetime allowance will need to weigh up the benefit of remaining an active scheme member against the potential additional tax liability,” says Ross. “Some employers offer a cash alternative to pension contributions for those affected. This could be used to fund other savings such as Isas but unlike pension contributions, the cash alternative payments will be subject to tax and national insurance deductions.”

2. Annual allowance — further cut to £35,000-£30,000

Likelihood: medium

The standard annual allowance (AA) — the maximum you can pay yearly into a pension fund before tax charges apply — has been slashed from £255,000 in 2010-11 to £40,000 today. The last time this allowance was trimmed, from £50,000 to £40,000 was 2014-15. Chancellors have since used other methods to reduce the generosity of the allowance for the very highest earners. For example, a “tapered” annual allowance, which sees the AA shrink to as low as £4000 was introduced for those with threshold incomes of more than £200,000.

Experts say Rishi Sunak will be reluctant to tamper with the tapered allowance again, following an outcry from public sector workers who were most impacted by the measure. Instead, he may be more likely to tinker with the standard annual allowance.

“The government effectively tried to cut the annual allowance through the introduction of the tapered annual allowance,” says Andrew Tully, technical director with Canada Life.

“It admitted defeat by increasing the taper threshold significantly in 2020 due to the outcry from public sector workers, in particular doctors. At a time when the NHS will continue to be under great strain the government needs to keep doctors onside.”

Given the outcry over the taper, Tully says a general reduction in the AA (for example to £30,000 or £35,000) could be considered, but the chancellor would risk another public sector backlash.

ACTION: Make the most of “carry forward” allowances

If you haven’t made full use of previous years’ pension allowances, doing so now would be a smart move, experts say. Current rules allow savers, under certain circumstances, to “carry forward” any unused annual allowances from the three previous tax years, starting with the earliest, subject to conditions (see box).

3. Tax relief scrapped for high earners

Likelihood: Low to medium

A chancellor looking to make serious savings could take the drastic step of scrapping tax perks for wealthier pension savers and replace them with a system where tax relief on contributions was the same for all earners. Under the current system, those contributing to a pension can get tax relief on what they pay in at their marginal rate. This means a higher-rate taxpayer gets the same level of tax relief on their pension contributions.

“A move to a simple rate of 33 per cent, for example, would help people to understand (tax relief) and provide more benefit for lower earners and reduce the benefit for higher earners,” says Claire Walsh, an independent chartered financial planner and personal finance expert. “The net effect would save the government money and hopefully encourage people to save more for their retirements reducing the burden on the state.”

However, Walsh noted a shake up of rates would be hugely complicated to implement, including for members of defined benefit schemes. Tully of Canada Life agrees: “Changes are also not likely to be quick to implement, with various consultations and legislation required.”

ACTION: Maximise your contributions

If you are a higher- or additional-rate taxpayer, you may wish to maximise your pension contributions prior to the Budget, providing you have the scope to do so says Ross. “Those with a total income in excess of £240,000 a year (which takes into account all sources of income as well as employer and employee pension contributions) will have a scaled back annual contribution allowance which needs to be taken into account,” she adds.

For younger retirement savers, Lifetime Isas would almost certainly be a lucrative way to top up retirement savings if Sunak plumped for a flat rate relief, says Nathan Long of Hargreaves Lansdown. Savers aged 18 but under 40 can use a Lisa to save for their first home or retirement, with the government paying a 25 per cent bonus on savings of up to £4,000 per year. “The fairly unusual Lisa rules allow people to pay into their account and benefit from a government top-up until 50, but only if they’ve set one up before 40,” adds Long.

4. Cut to the tax-free lump sum

Likelihood of changes: Medium to low

If the chancellor was looking for a relatively simple change, he could cut or scrap the tax-free cash limit on pension savings, or the pension commencement lump sum (PCLS) as it is technically known.

Currently, a quarter of a pension pot can be taken tax free, with the remainder taxable. The PCLS is a very popular feature of pensions with many relying on this tax free cash to pay off a mortgage, help the children with a house deposit or do renovations. Because of this reliance, Tully says scrapping tax free cash would be “deeply unpopular” and the government would think hard before scrapping or changing it.

Ross says she would also be very surprised if there were to be a change to the PCLS that would be imposed retrospectively although she thinks it is “highly possible” that PCLS could be limited to benefits already earned.

“This might mean that all future contributions, or even fund growth, did not attract a tax free element at retirement,” she said.

ACTION: Don’t rush to access a tax-free lump sum now

Those aged over 55 who are worried might be tempted to withdraw their tax-free cash now. However, unless you need the money, or were planning to take your cash anyway, experts do not advocate rushing to tap into your lump sum before the Budget.

“The money grows tax free within a pension and unless you’ve plans for the money you may find you end up spending it sooner than you would otherwise,” says Walsh. “Trying to guess potential changes is foolish; other potential tax changes such as the much-mooted wealth tax could mean that you end up worse off by taking money from a pension.

“If they did make changes to tax-free cash, I would expect we’d be given a degree of notice — as has happened when changes to the

lifetime allowance have been introduced, which would then be the time for people to consider whether to take action.”

5 Squeeze on death benefits

Likelihood: Medium to high

Experts say the chancellor may look to reverse 2015 changes which made pensions more attractive for individuals who want to keep their savings out of the inheritance tax net.

Since 2015, unused funds in a defined contribution pension can be passed tax free to beneficiaries if the investor dies before the age of 75.

By contrast, if the investor dies aged 75 or over, beneficiaries are liable for tax on any residual inherited. Sir Steve Webb, former pensions minister and now partner with Lane, Clark & Peacock, an actuarial firm, says this death benefit perk could be reversed.

“Bringing pensions back into inheritance tax net (reversing a George Osborne change) — doesn’t feel very ‘Tory’,” says Webb. “But most people think it’s hard to justify giving special tax treatment to unspent pensions on death.”

Walsh says that death benefits for DC pensions look generous and an option would be to include these payments in an estate, making them liable to IHT. While this would be lucrative it would be complicated to legislate, adds Walsh.

“As an alternative, Sunak could harmonise the tax treatment of pensions across all ages — income taxed as beneficiaries or 55 per cent if taken as a lump sum,” adds Walsh.

Andrew Tully of Canada Life agrees this may look attractive to the chancellor, but says pushing pensions into the inheritance tax net pre age 75 “would be a serious step backwards for a progressive government and would send completely the wrong signals to savers.”

ACTION: Be prepared to juggle your assets

If the government moves to reduce pension benefits for those dying before they are 75, people may then want to reorganise their affairs — and consider which assets are to be used to generate retirement income and which are best diverted to estate planning.

Who can use pension carry forward?

In the current tax year you can contribute up to £40,000 to your pension and can carry forward any unused allowance from the previous three years, potentially up to £120,000.

Carry forward is allowed if:

-

You had a pension in each year you wish to carry forward from, whether or not you made a contribution (the state pension doesn’t count).

-

You have earnings of at least the total amount you are contributing this tax year. Alternatively, your employer could contribute to your pension.

“I would encourage higher-rate taxpayers to consider whether they should be taking advantage of unused carry forward and putting more into pension now,” says Claire Walsh.

“Even if the lifetime allowance is slashed the tax relief on the way in and the tax-free growth that money receives within the pension mean it will be the most tax advantaged place for many people to save.

Although the standard annual allowance has been £40,000 since 2014-15, if an individual is subject to the much-reduced money purchase annual allowance (MPAA) of £4,000 and/or the tapered annual allowance (TAA), the amount or even the possibility of carry forward may be affected.

The MPAA is typically triggered when an investor aged over 55 takes more than a certain amount of cash from a defined contribution pension.

“Those with high incomes or bonuses, who haven’t paid in much to a pension over the previous three years, are those I suggest should prioritise investigation before anything is diluted or removed,” says Holly Mackay, founder and chief executive of Boring Money, a financial website.